Over the last two days, we have introduced four new metrics for assessing a stock. Here is an important fifth one, which compares net working capital to assets:

This result surprised me, as I would expect more working capital to be a good thing. That’s why we do the analysis versus making assumptions - it turns out in this case the opposite is true. That’s good to know!

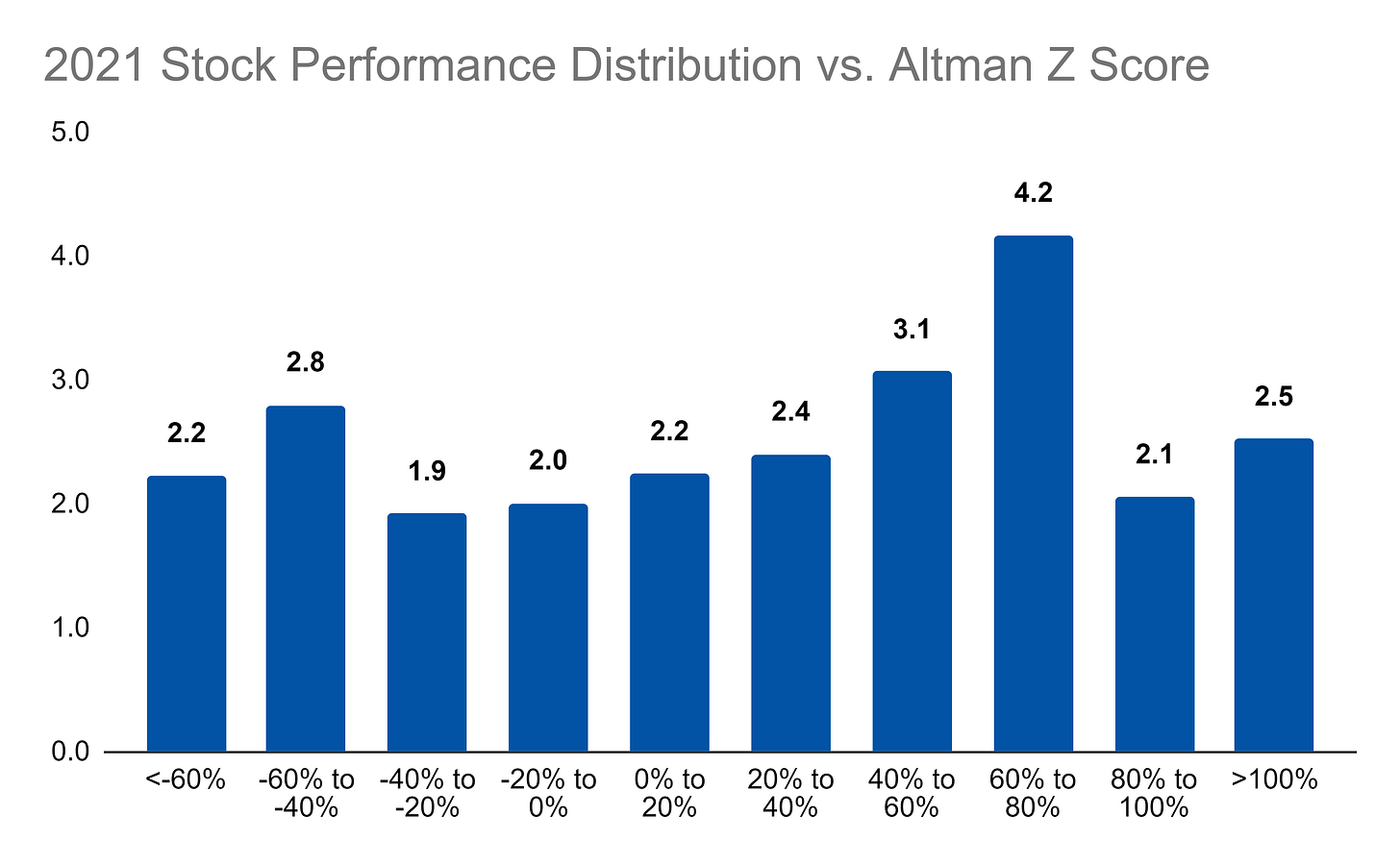

If we take the four metrics from the last two days and the metric above and combine them using a particular weighting, we get what is known as the Altman Z score. This metric assesses whether a company may be on its way toward bankruptcy. A higher score is better, meaning a company is less likely to go bankrupt:

What we see is a general increasing trend of bankruptcy security as performance increases up to a point. On the high end, those companies have indicators that suggest they are more likely to be heading toward bankruptcy.

This is another important result because it shows us that companies that do really bad or really good can be similar in certain ways. For companies that are on the extremes, they could be volatile in terms of fundamentals, teetering on the verge of problems or not. As such, there are either big losses or big gains. It’s risky. You may try to get the crazy outperformers but choose companies that will do the worst.

It seems then that there may be a sweet spot we can discover of stocks that will do better than average but not expose us to potential outliers that could do really good or could do really bad. That’s just an idea for now and part of a longer-term investigation but we will certainly continue to head in that direction of finding characteristics that make a better-than-average stock!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000