Apple vs. Microsoft

Let's brawl

Recently, I’ve done a bunch of posts showing grades for different stocks and various metrics. Those posts have mostly been to showcase incremental progress toward the eventual goal of building something more meaningful. Today, I get to show that off:

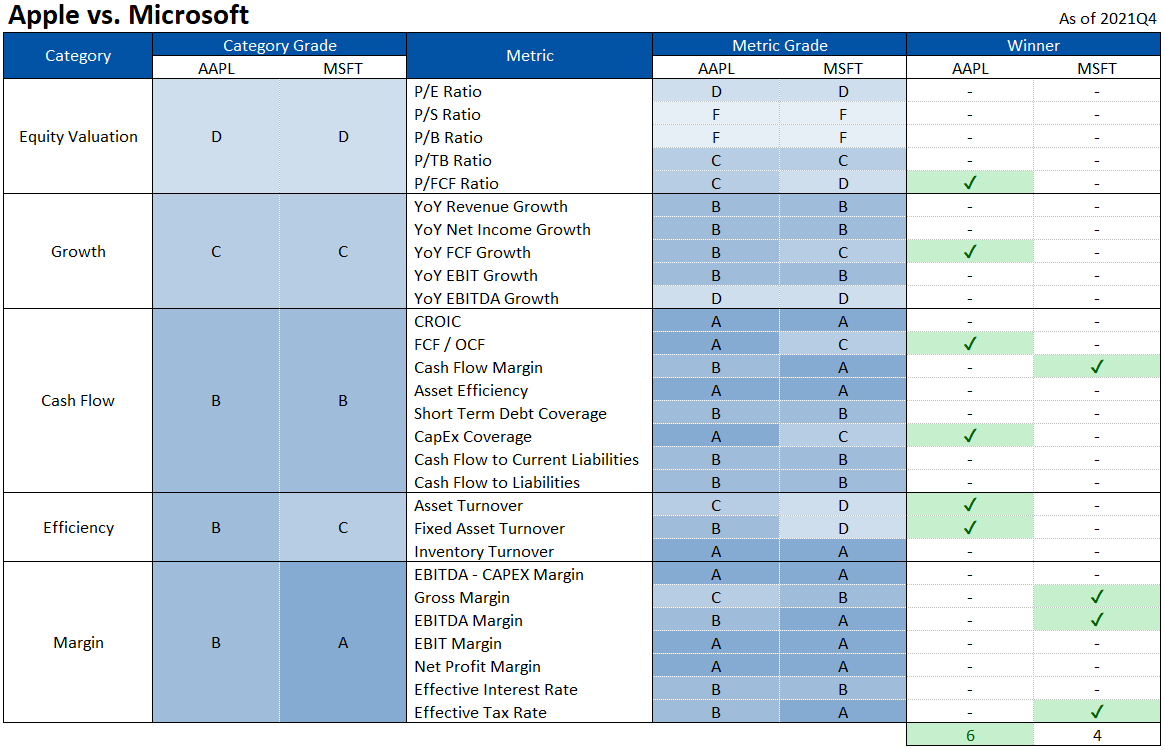

What we have here is a comparative scorecard with grades for five major categories of company analysis with additional grades for the underlying components that make up those categories. In short, a lot of information.

That information is distilled into an even simpler format on the right, whereby the two companies are compared for each of the 28 subcomponent metrics to identify which stock has an edge. In the case of Apple and Microsoft, these are two pretty evenly matched foes, so it’s not surprising that there is only a slight edge (just barely) to one of the two challengers.

The idea of this scorecard approach is to condense a massive amount of fundamental information into something that can be quickly analyzed for decision making. Obviously the nature of investing (especially for larger stakes, complex portfolios, unique investment criteria, etc.) cannot be boiled down into one simple yes or no for any given situation but a tool like this is definitely helpful to get a quick cheat sheet on a given stock or set of stocks.

So, the next question I have for you is, what companies should we compare next?