Checking in on the big caps

S&P 500 Market Cap Leader Performance

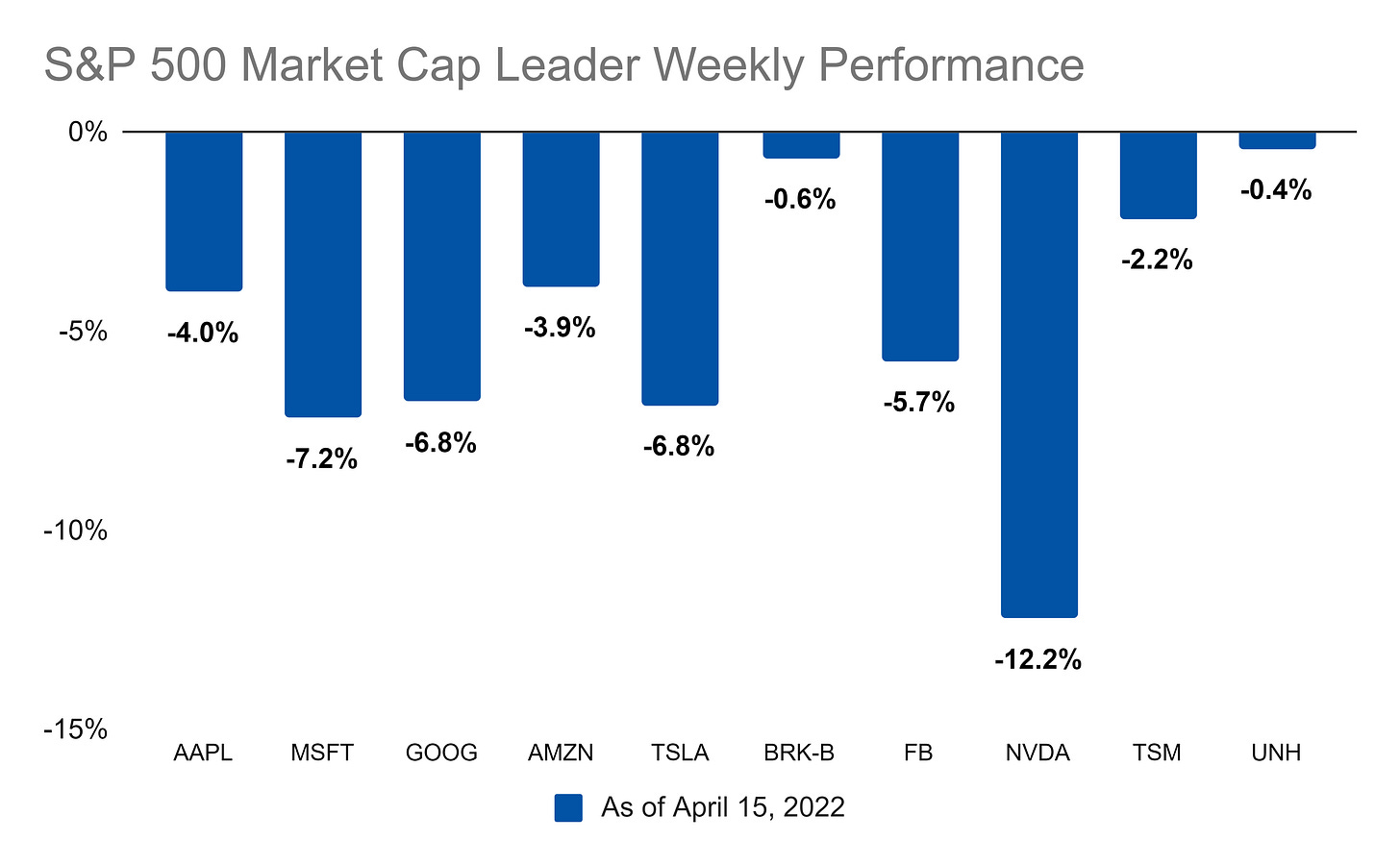

Last week, all of the ten largest stocks in the S&P 500 saw sizeable losses:

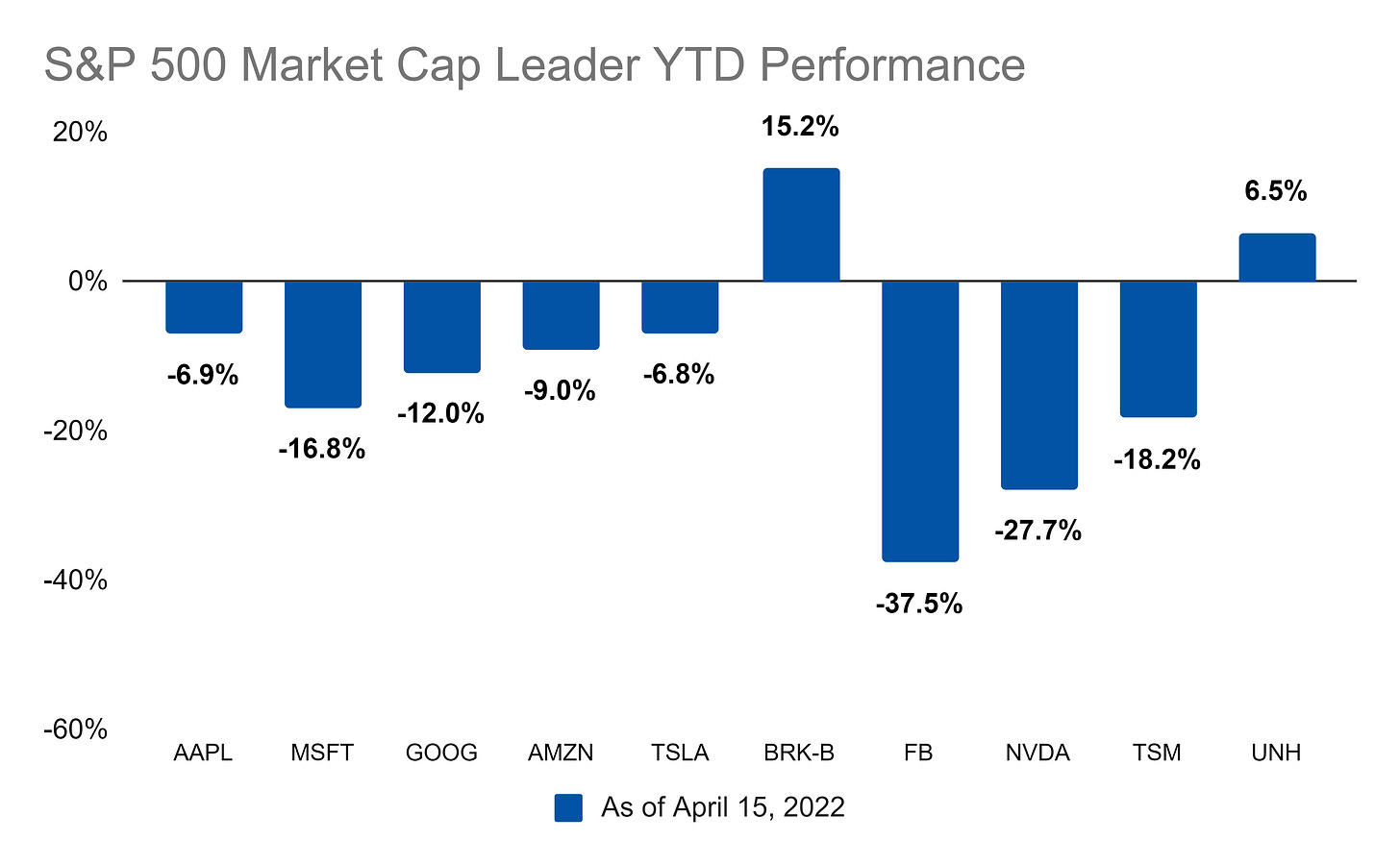

Year to date, only two of the top ten stocks are in the green:

It wasn’t a great week for the market and seeing widespread losses across the board is a bit worrying. After all, with stocks like BRK-B and UNH showing recent resilience against inflationary pressures, you might expect something even a little positive. It almost was but not quite.

However, two stocks can’t hold the weight of eight others that have an outsized market cap and exposure to rising rates. We’re going to need to see some resolution to the swift climb in things like the ten-year treasury rate if we want a serious rally.

Problem is, with inflation going nuts, the Fed can’t really step off the gas like they did in 2018 when their pace of rate increases got to be too much. To buck inflation, we may even need a recession. But…history shows us that even a recession doesn’t always break an inflationary spell. That’s why inflation is so bad - it’s a tough nut to crack.

This predicament is why the Fed is rightly being criticized for being so flippant about the potential for inflation to happen, downplaying it when it started, and now looking completely out of their element and behind the ball with it at its worst level in forty years. Unfortunately, it’s a lot for the market to look past and it’s hard to know whether a new all time high for the market is going to be a few months away or many many months away. As always, time will have to tell!