Interest rates can tell us a lot of information about where we are at in an economic cycle or if there is stress in the market. For example, consider the difference in rates between riskier BAA bonds and less risky AAA bonds, where we can see just how bad the 2008 financial crisis was:

Instead of AAA bonds, we can also use other rates, like the federal funds rate, and see that the spread here tends to rise during recessions and fall during recoveries:

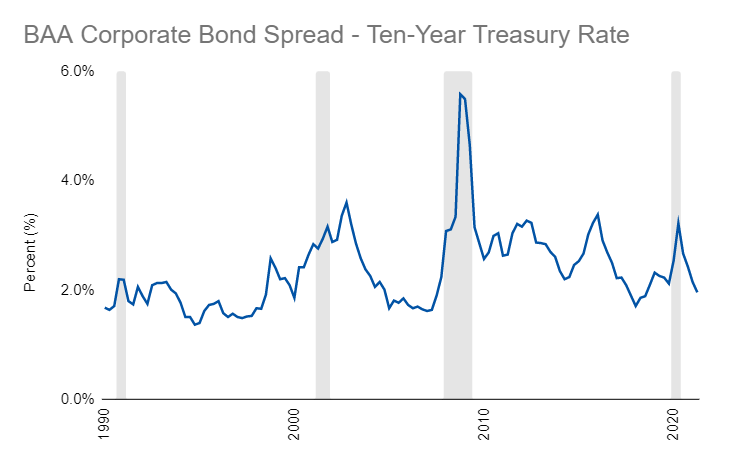

Since AAA bonds are considered super safe, replacing them with another safe instrument (like the ten-year treasury), gives us a similar but slightly different interpretation of stress:

Though, none of these spreads are as popular as the VIX for assessing stress:

I also like the TED spread for stress as well but LIBOR will soon be going away soon, so the lifespan of this metric is nearing the end:

In terms of where we are right now then, well, looking at the five charts above it’s all pretty typical to long-term trends!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000 | Contact