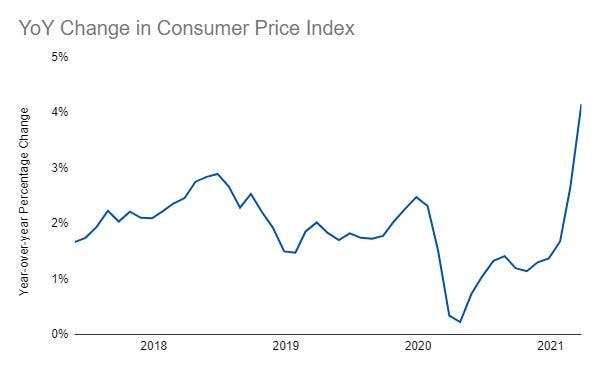

One of the big topics right now is inflation, which isn’t surprising since we just saw a big increase on a year-over-year basis:

But what is going to happen to inflation over the coming years? For that, we can look at the inflation rate implied by interest rates. Here is how the ten-year expectation for inflation has changed over time:

While there was a steep drop in inflation expectations at the bottom of the COVID crash, inflation expectations have risen ever since. Right now, interest rates imply a 2.5% average inflation rate over the next ten years.

However, that estimate is clearly changing at a rapid clip. That’s one reason people think the Federal Reserve may have to raise rates sooner than they have communicated previously.

A lot hinges on the next few months though. We are at in a strange period for economic data, as aftershocks from the COVID crash continue to reverberate and impact the numbers. Basically, expect some volatility. Once this passes, we will get a better handle on the ten-year forward inflation expectation - and look out if it keeps climbing sharply.

Links

Yesterday’s Post | Most Popular Posts | All Historical Posts | Main Site | Contact