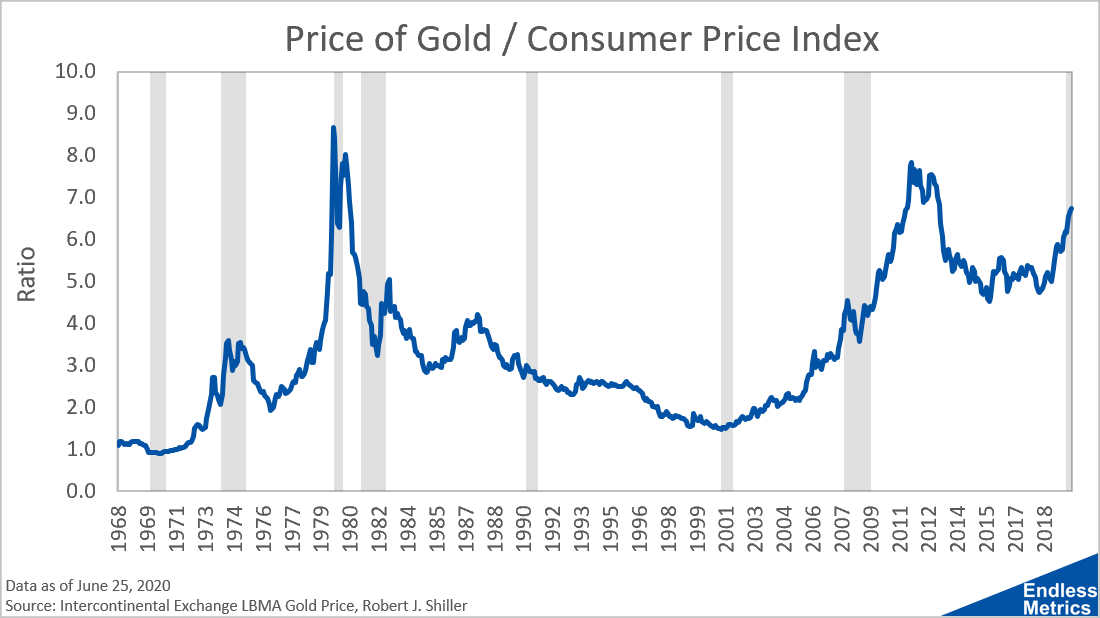

The last metric I talked about was the S&P 500 over the Consumer Price Index. The verdict of that one was that, in general, stocks outperform inflation. Gold, on the other hand, has a more complicated relationship:

Gold is interesting because it is often considered one of the most well-known hedge against inflation even though it does (almost) nothing. The Federal Reserve can print endless amounts of money but gold is a finite resource.

Gold as an inflation hedge worked really well in the 1970s and also after the dot-com bubble and a little bit in the last year or so. But for twenty years in the middle it was a terrible investment!

So, when it comes to gold, just try to catch it on the upswing - some people think it might be starting another long-term rally now! With all the money being printed for stimulus, it just might be one of the better hedges available.