Growth Grades

Rating Stocks A, B, C, D, or F

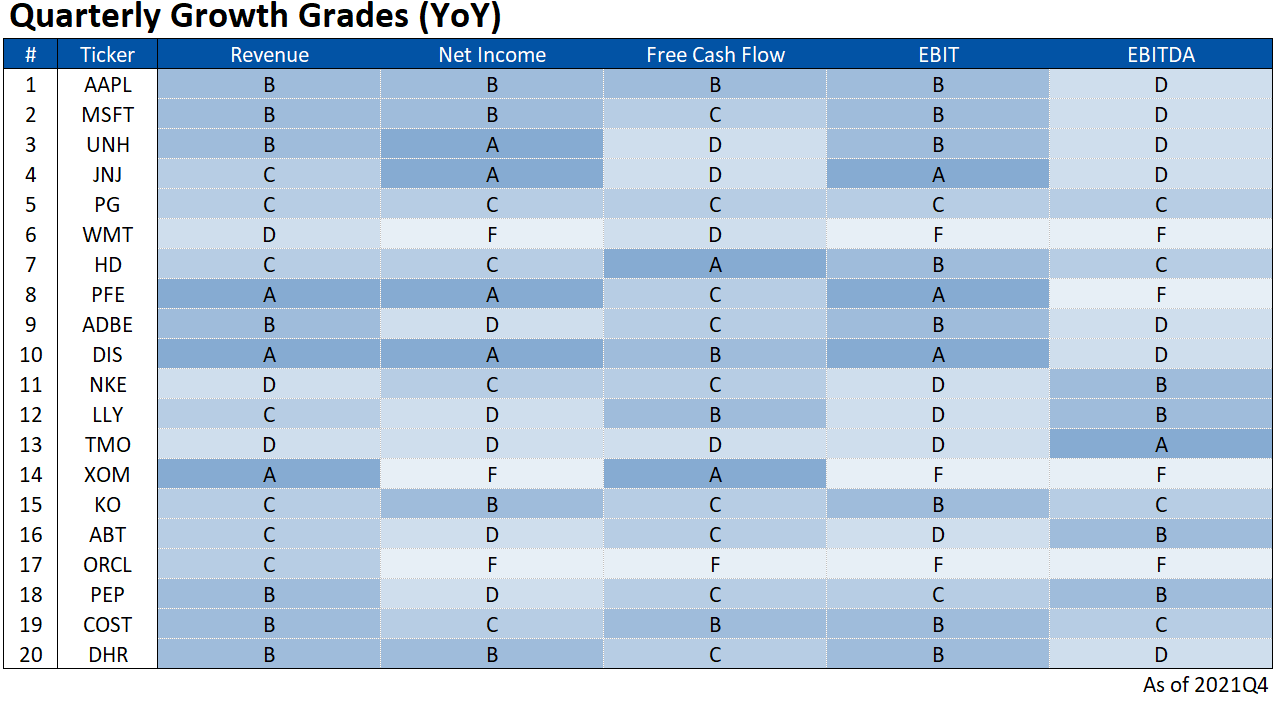

Let’s take a look at a growth report card for the twenty largest stocks in the EM100:

Unlike valuation, which was pretty bad across the board, we see that there are a lot of companies with solid growth. For example, look at Apple and Microsoft, which are doing amazing with their growth despite being massive companies.

And this is just one of the many stock domains we can look at when it comes to grading companies. While we have many metrics to go, we can already see that there is a lot more to consider than whether or not a company has a few good or bad ratios (like a high or low P/E ratio).

Even within a single domain, we can see variance, such as a good revenue grade but bad EBIT grade or some other permutation. Lot’s to consider when investing!

Have a question you want to ask or a topic you’d like to see covered? Let me know!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000