Historical Context for the Current Market Downturn

Looking all the way back to 1929

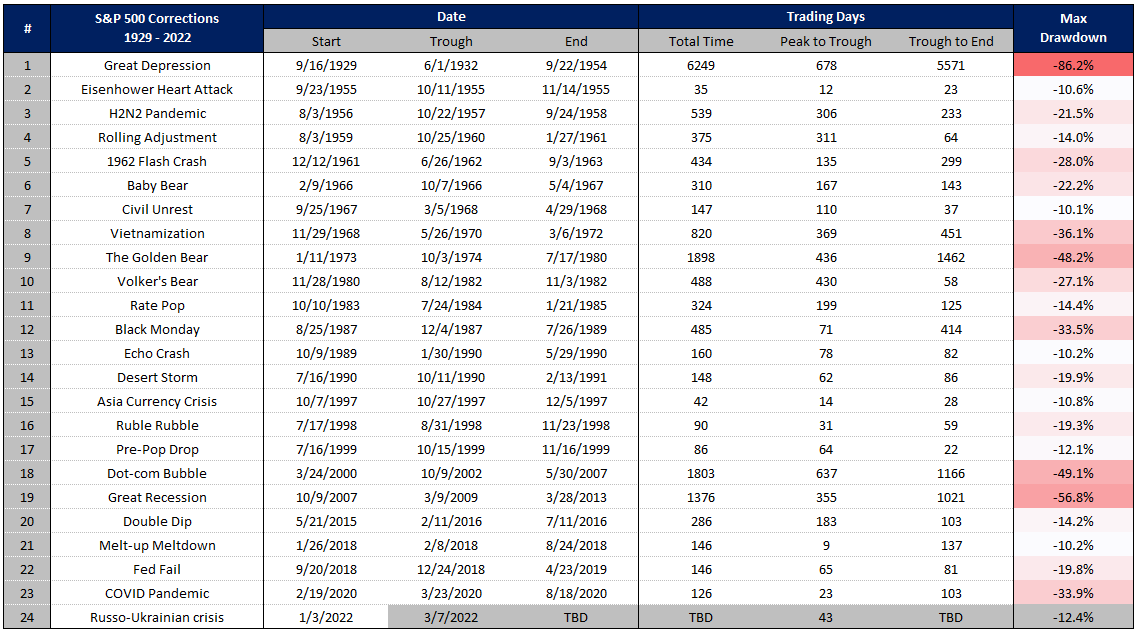

Yesterday, the S&P 500 set a new low point in the current downturn cycle, which is just the 24th downturn worse than -10% going back to 1929:

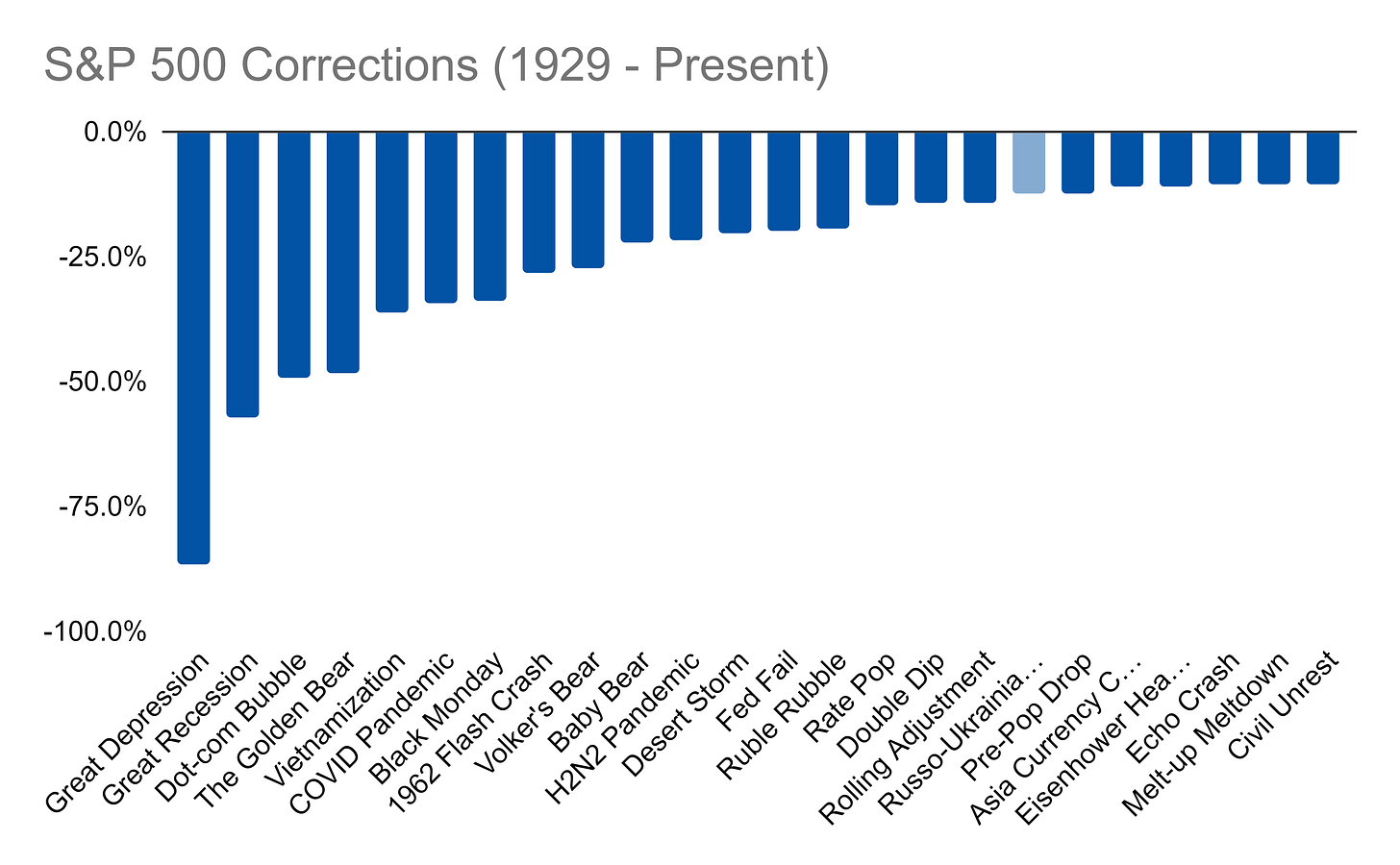

Now, there is a lot of doom and gloom out there at the moment. But, to put the current downturn into context, things could be a lot worse:

So far, the current market pullback is relatively benign even though it is in rare company. While I’m not saying that it will get worse, what I am saying is that the drop we have experienced so far isn’t really all that material.

You should know this though. After all, the COVID crash was only two years ago. But, the pain of history is no match for discomfort of the present. Time will tell if we have experienced the worst of it or if we will continue on down and join the ranks of more infamous downturns from the past.

Have a question you want to ask or a topic you’d like to see covered? Let me know!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000

great chart. seems like we are likely in for more pain without a positive catalyst (like Fed injecting liquidity during covid crisis, which they won't do soon again due to inflation), before some sort of recovery. or this pushes us into recession as paper stock gains turn into losses, consumers pull back (or have to spend significantly more on staples), and the financial system shakes out the excesses that the Fed put in to keep things afloat during 2020-2021