Another investment subcategory you can use for bonds is investment grade (IG) and non investment grade (non-IG). IG bonds are safer bonds that have lower yield but less risk because they are issued by entities with better creditworthiness. Non-IG bonds have better yield but more risk.

For example, Microsoft-issued debt would be IG based on the way they structure the offering and because everyone knows Microsoft is a big safe company that will pay its debt because it’s not going to go bankrupt and wants to maintain its reputation. If you think about a company with bad financials, a bad reputation, and high likelihood of bankruptcy, they would be issuing non-IG bonds because they would need to offer a super high yield as return for the risk investors would be assuming. The main risk being, the company ends up not being able to pay back the bond and an investor loses their money!

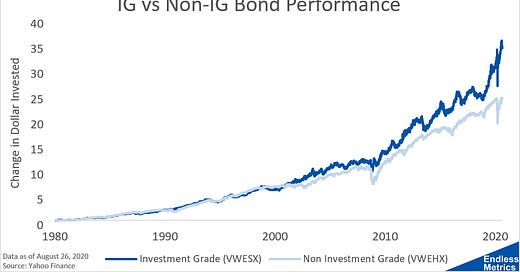

Despite the difference between safe companies and risky companies issuing these investments, the performance of the two categories has been somewhat similar over the long term:

While people tend to think of bonds as investments with weak returns, one dollar invested in 1980 would’ve become about 35 dollars in 40 years for IG and 25 dollars for non-IG. That’s really good! It’s certainly more than enough return to retire comfortably with a reasonable savings plan.

What we are starting to see with all these different investments is that there are many paths to success. People tend to choose just one investment category as their main focus (usually stocks) but there are other viable options. And, after we look at all of these categories we will see how diversification among them can be even better than any one category on its own.