Inflation

And me looking a bit dumb

Yesterday, I wrote that I was feeling confident in the market and that only really bad misses would cause upheaval. I also wrote at the end that the market will probably find a way to prove me wrong. And, it did!

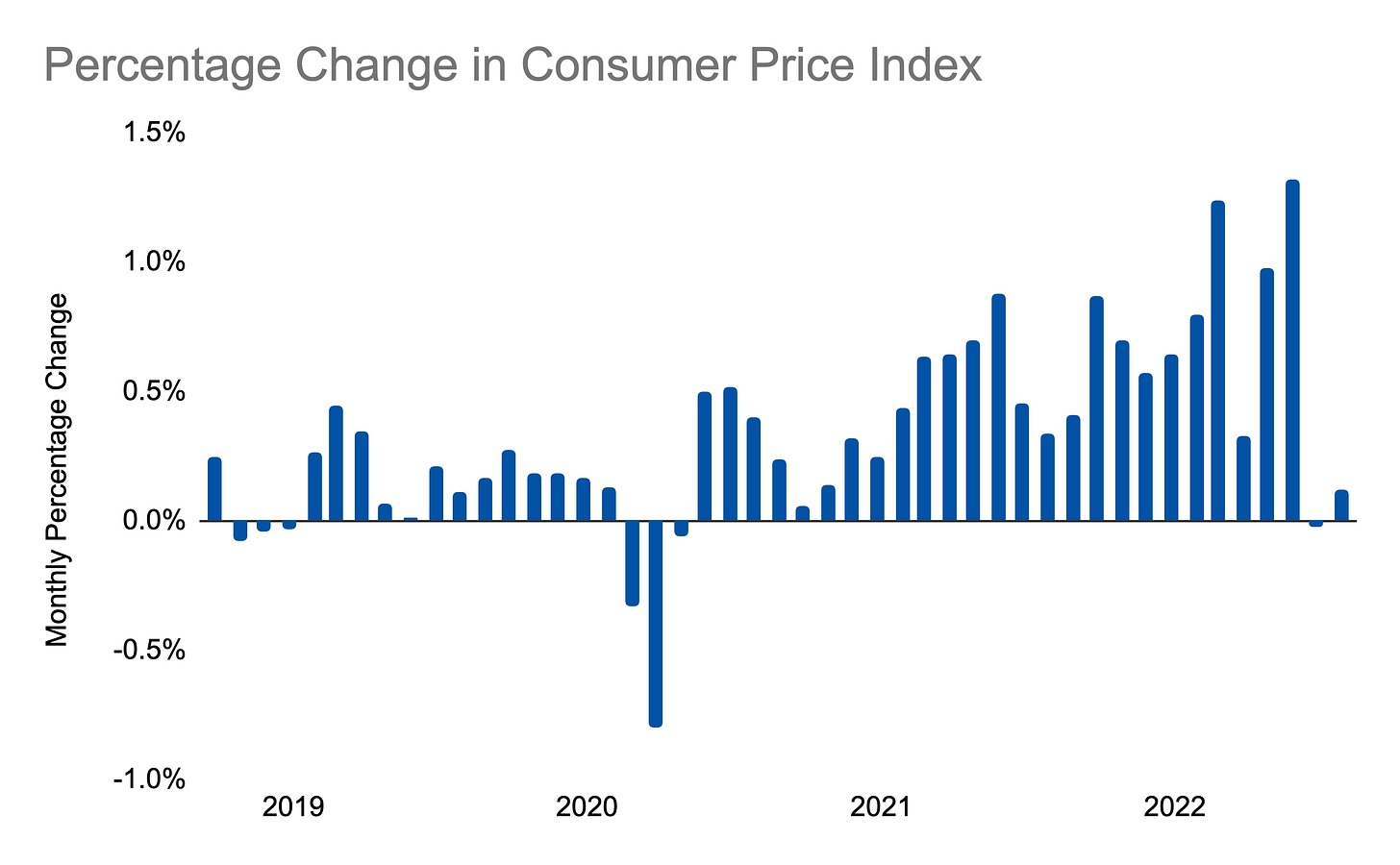

Inflation came in slightly above expectations:

Now, we can see that it is still low, which is good.

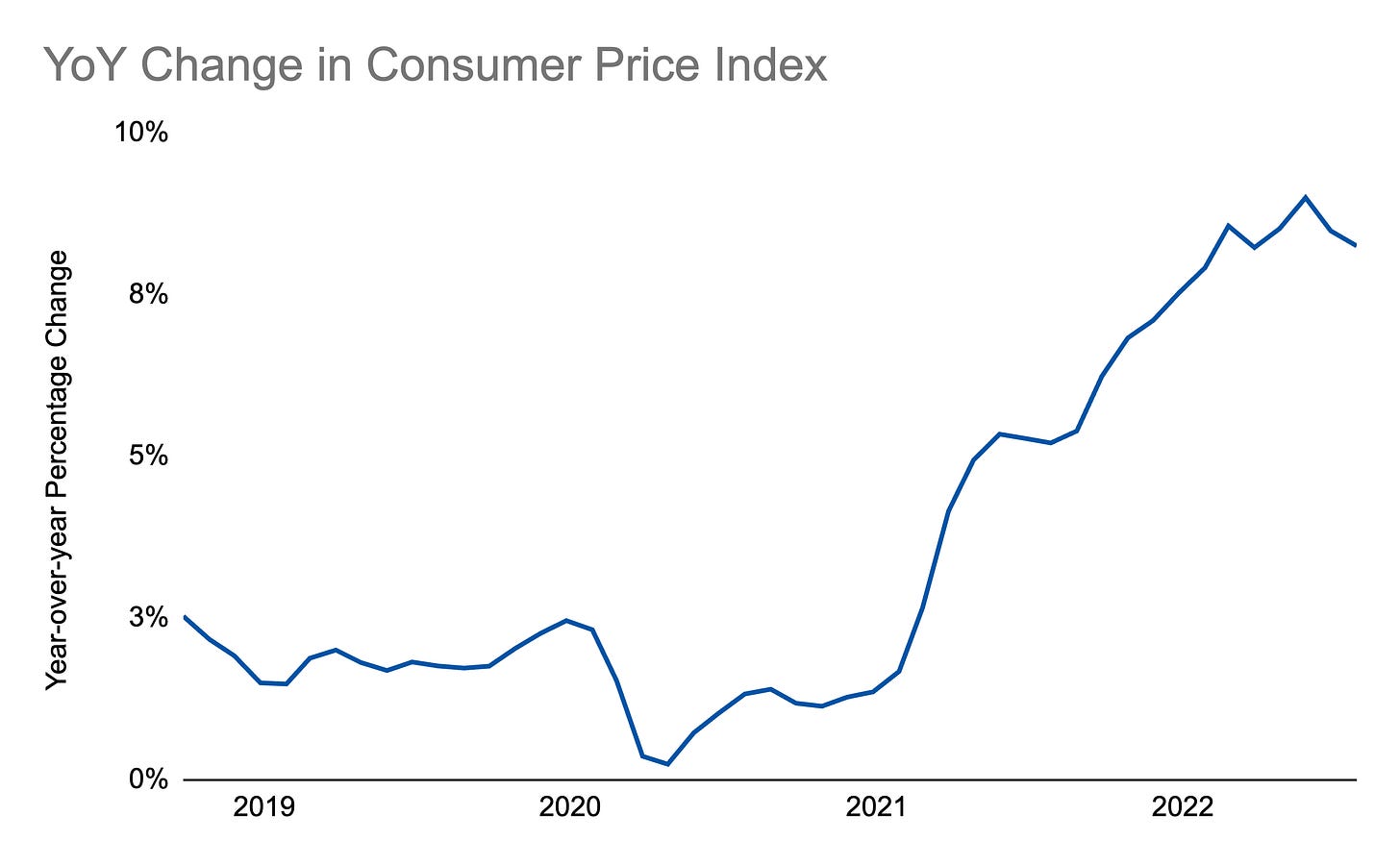

On a year-over-year basis, we continue to see a cresting trend:

Yet, markets had their worst day of the year, with the S&P 500 falling -4.32%! In fact, it’s the worst single day drop since June of 2020. Wow.

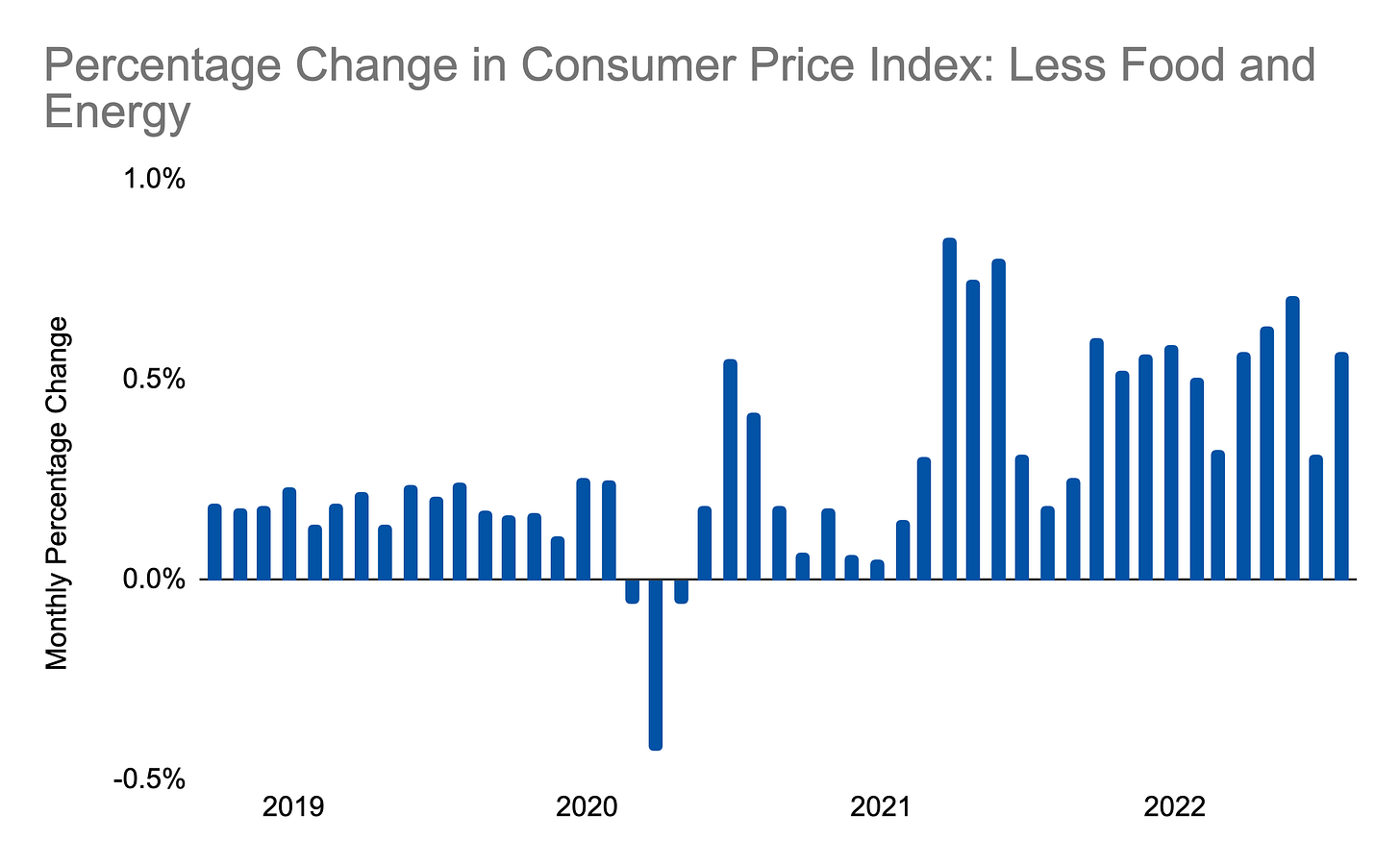

So, I was wrong that even somewhat bad data wouldn’t affect the market. (I’m happy to admit when I am wrong unlike some financial commentators who say one thing then say something the total opposite as soon as numbers come out and say they expected that all along.) Being wrong is good because we can learn from it. What did we learn? Well, that core inflation is the real kicker and continues to make some scary prints:

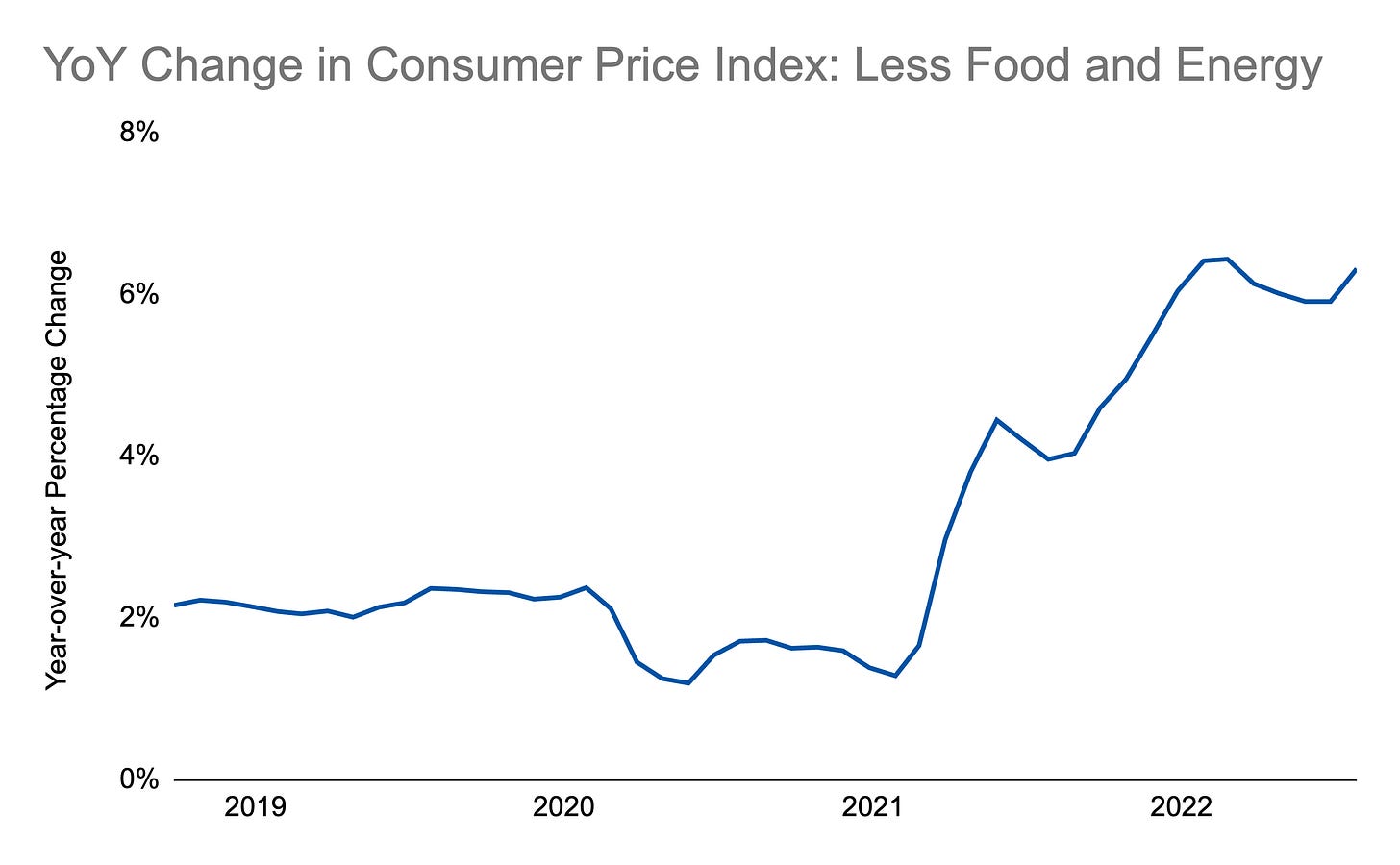

Now, I wouldn’t call that a catastrophic result but the year-over-year looks especially bad because it bucks the entire trend of cresting core inflation:

Definitely ominous. It more or less sets the Fed up to keep smashing investors on rates and that will continue to inflict pain.

We will likely need sustained lower inflation for a period of time before the Fed eases up. This result almost resets the counter and now we know the Fed will be mean to us for a few months longer even if the next print is quite good. Buckle up.