Let’s check out Johnson & Johnson today:

JNJ is stronger than average on profitability, a little below average on growth and valuation, and has a strong credit profile. They are a big company and definitely not going anywhere any time soon:

They’ve grown mostly in line with the market but have slowed a bit in recent years:

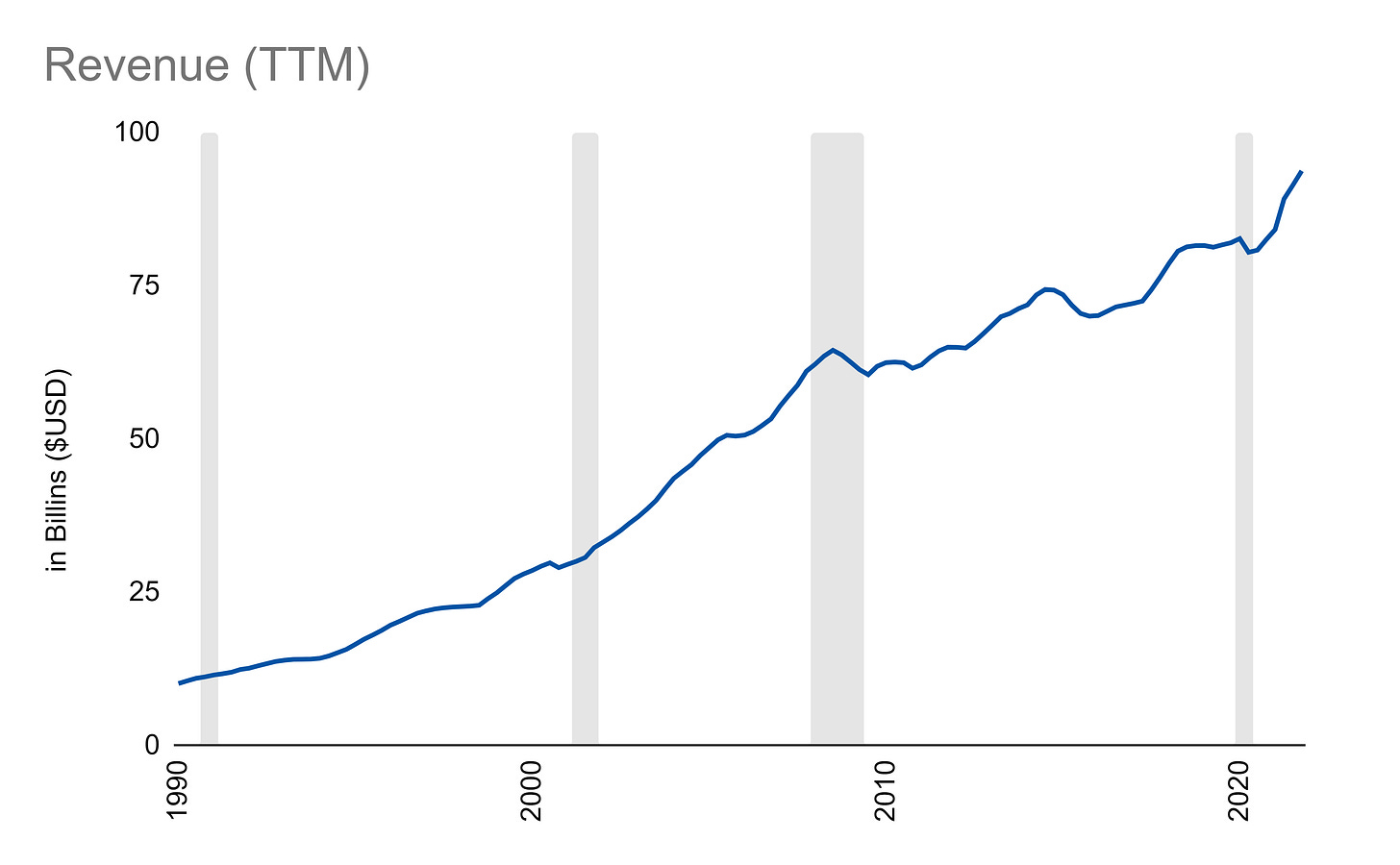

Revenue growth has been strong since the onset of COVID:

Price-to-sales has grown since the Financial Crisis to levels near the peak seen over the last thirty years:

Profit has grown alongside revenue but took a big hit due to a strategic response to the tax cut act a few years ago:

Price-to-earnings looks fairly steady, helping to justify valuation more than price-to-sales:

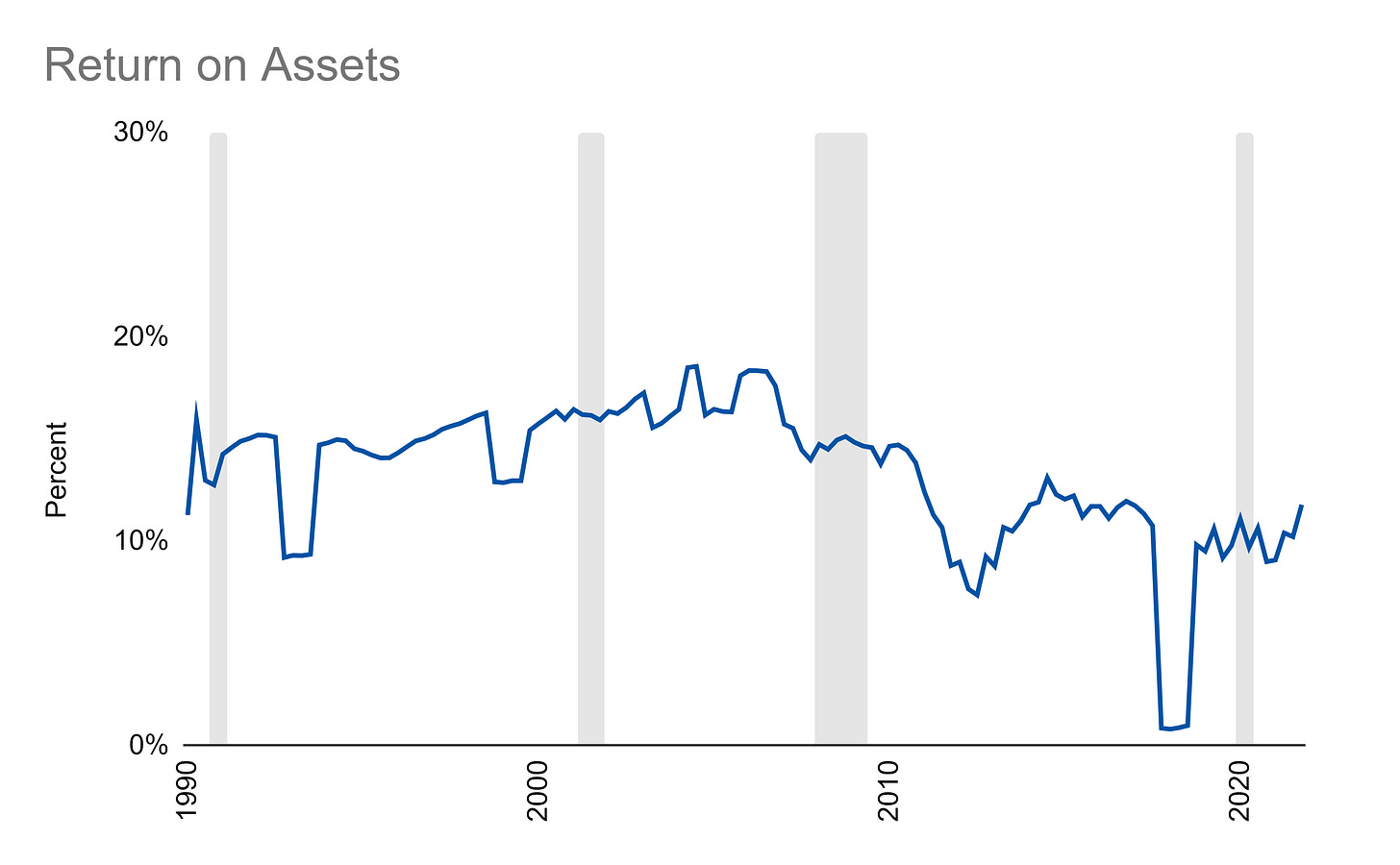

Profitability has been steady:

The balance sheet has grown at a reasonable rate over time:

Which means return on assets has been solid, though somewhat lower in the time since the Financial Crisis:

JNJ is a solid company. You may not see explosive gains but it’s a safer pick amidst volatile market development compared to other companies out there.

Have a stock you want to see me cover on the next deep dive? Let me know by leaving a comment!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000