Summary

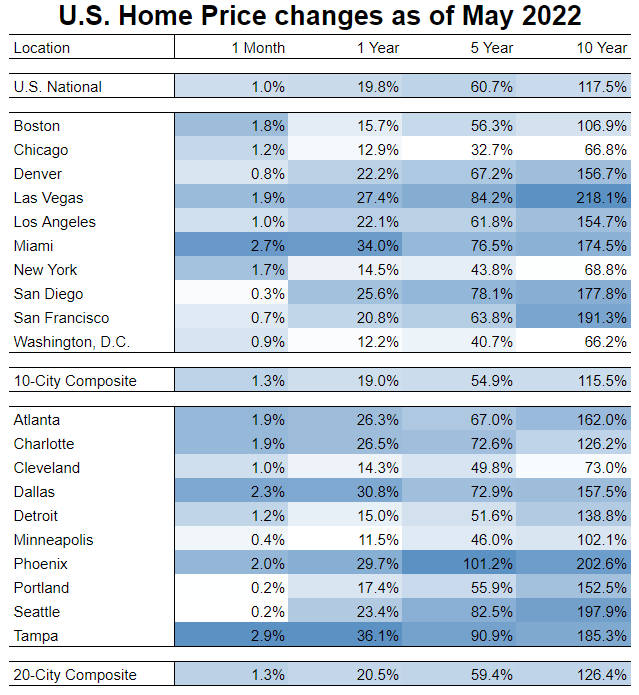

U.S. home prices rose 1.0% month over month in May, which is the slowest rate of change since July 2020 but still a fast rate historically

Tampa leads the way for cities in annual increases at 36.1% and Minneapolis saw the least growth with 11.5%

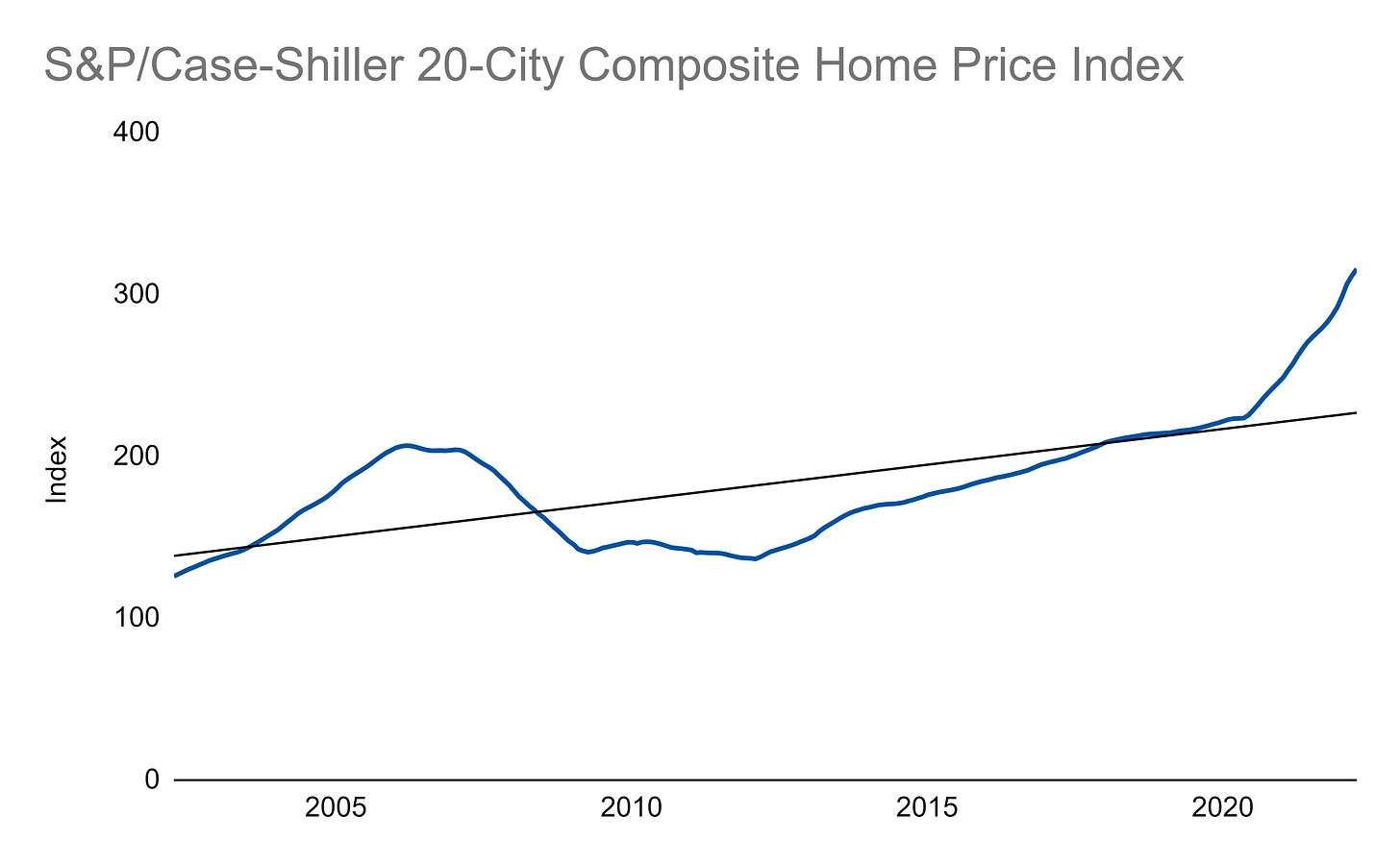

Nominal home prices are high compared to trend but remain slightly below levels seen prior to the 2008 Financial Crisis for some relative metrics (though that gap continues to close each month)

Trend and Change

National home prices, in aggregate, have seen a sharp acceleration above trend since the onset of the pandemic:

While we saw some moderation in the pace of increase a few months ago, it recently re-accelerated significantly with but has since reversal the last two months:

City-by-city Details

Miami, Dallas, and Tampa saw big monthly gains in May:

San Diego, Portland, and Seattle saw very low growth this past month:

On an annual basis, Miami and Tampa have outpaced the pack:

On a five-year basis Phoenix and Seattle also stand out:

On a ten-year basis, there are some notable laggards including Chicago, New York, Washington, D.C., and Cleveland:

Rates and Supply

Mortgage rates have seen a nearly unprecedented jump in recent months:

Supply of new housing has jumped significantly lately:

Relative Valuation

The price-to-rent ratio continues to rise but is below twenty-year highs:

Price relative to income continues to climb:

And inflation-adjusted home prices are rising quickly even though inflation is running extremely hot:

However, homes relative to the market continue to look reasonable (for now):

The first five months of the year continued to be huge for price increases. It will be interesting to see what the rest of 2022 has in store for us, especially now that we have seen a slowdown in the rate of price increases.

Have a question you want to ask or a topic you’d like to see covered? Let me know!