Microsoft Deep Dive

Single-stock Sunday

Let’s check out Microsoft today:

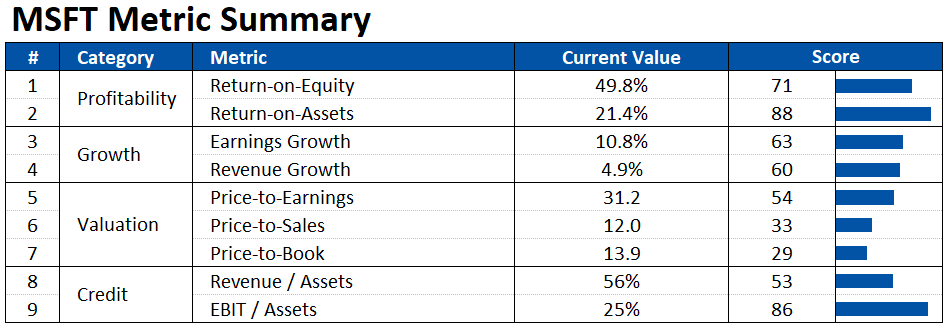

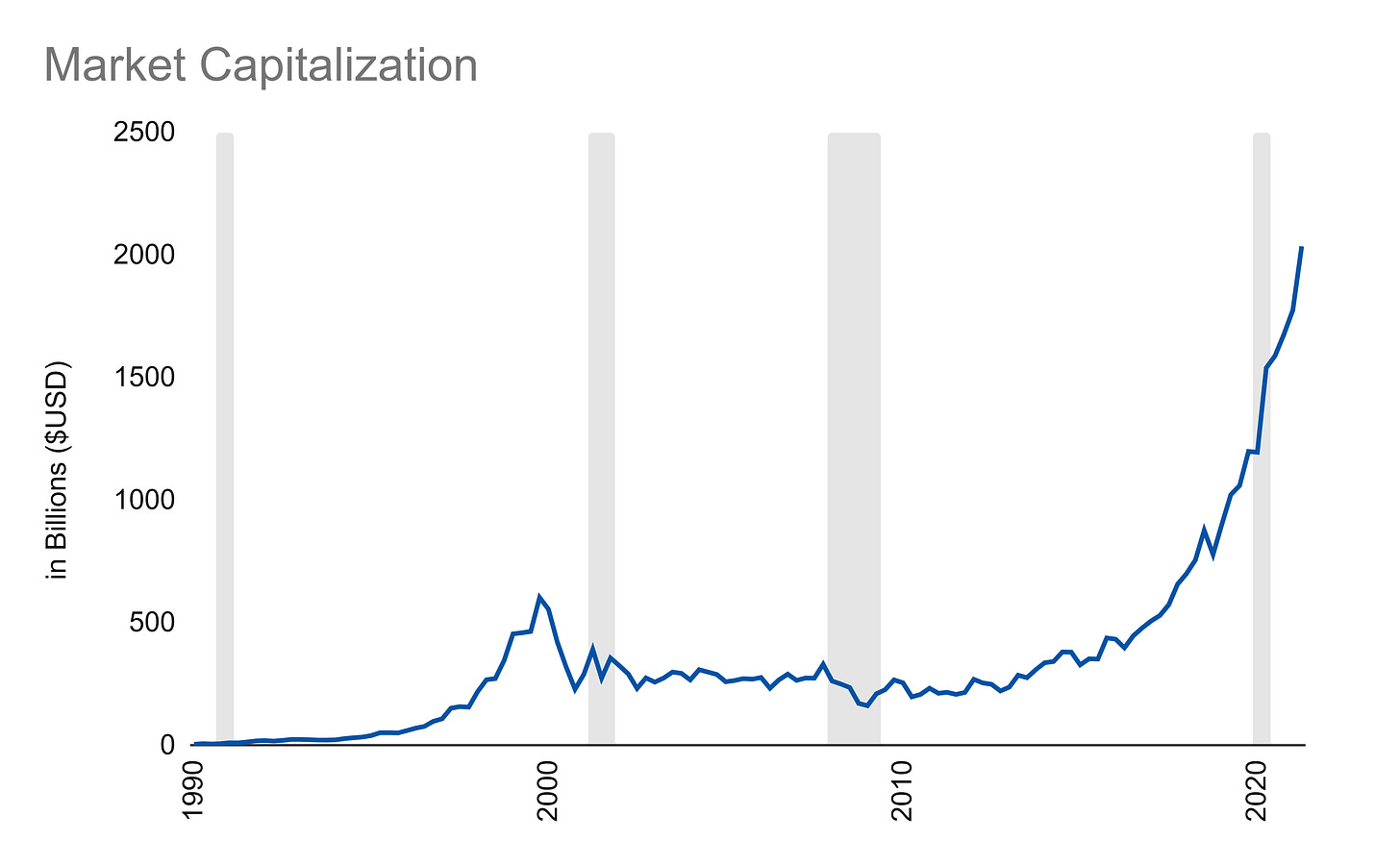

Microsoft is incredibly profitable, has solid growth (which is all the more impressive considering size), good creditworthiness, and only shows weakness in terms of valuation (which isn’t even that weak). The stock is in a great position considering how much it has grown:

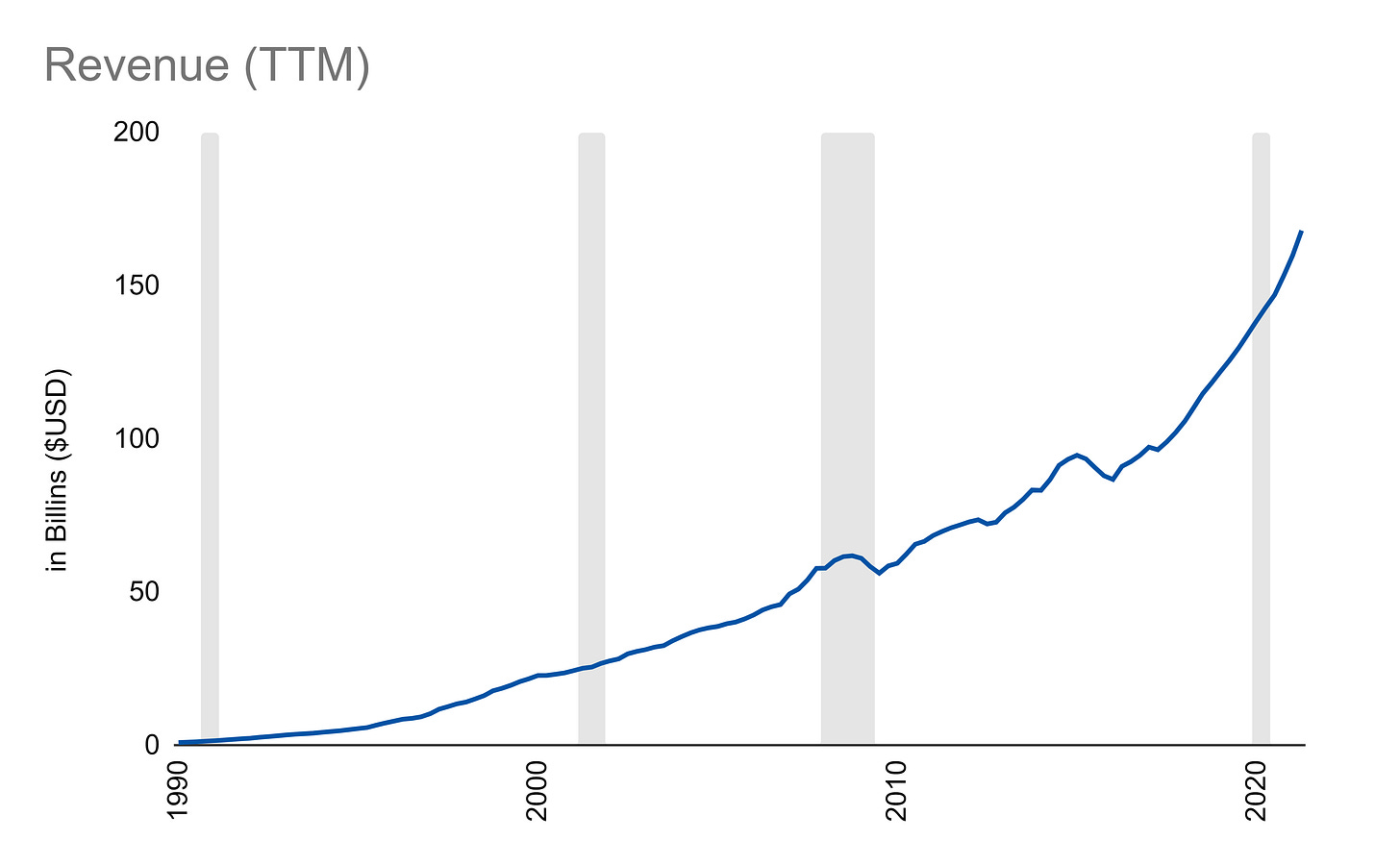

But, that increase in valuation has been justified from a revenue perspective:

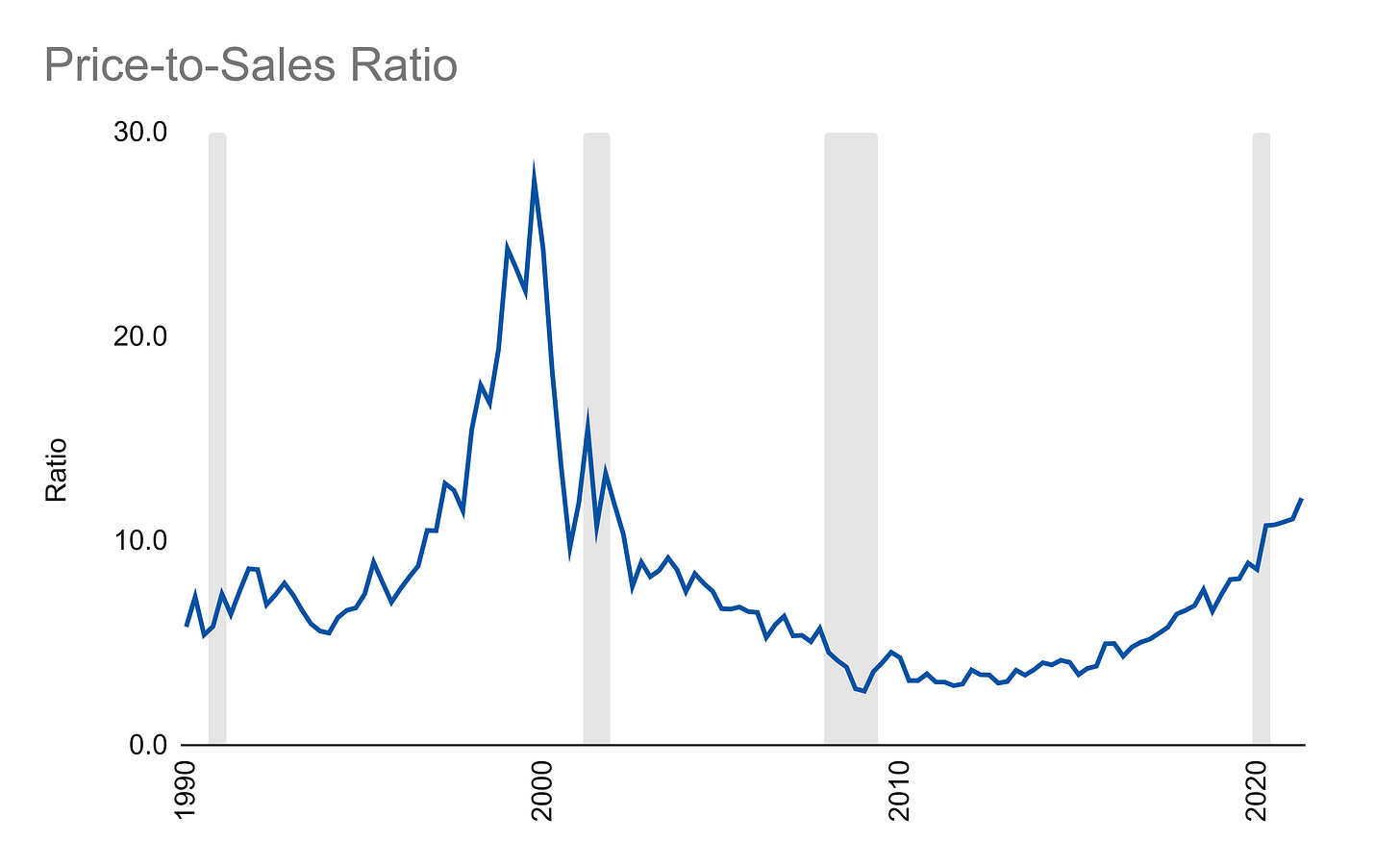

And price-to-sales is nowhere near tech bubble levels:

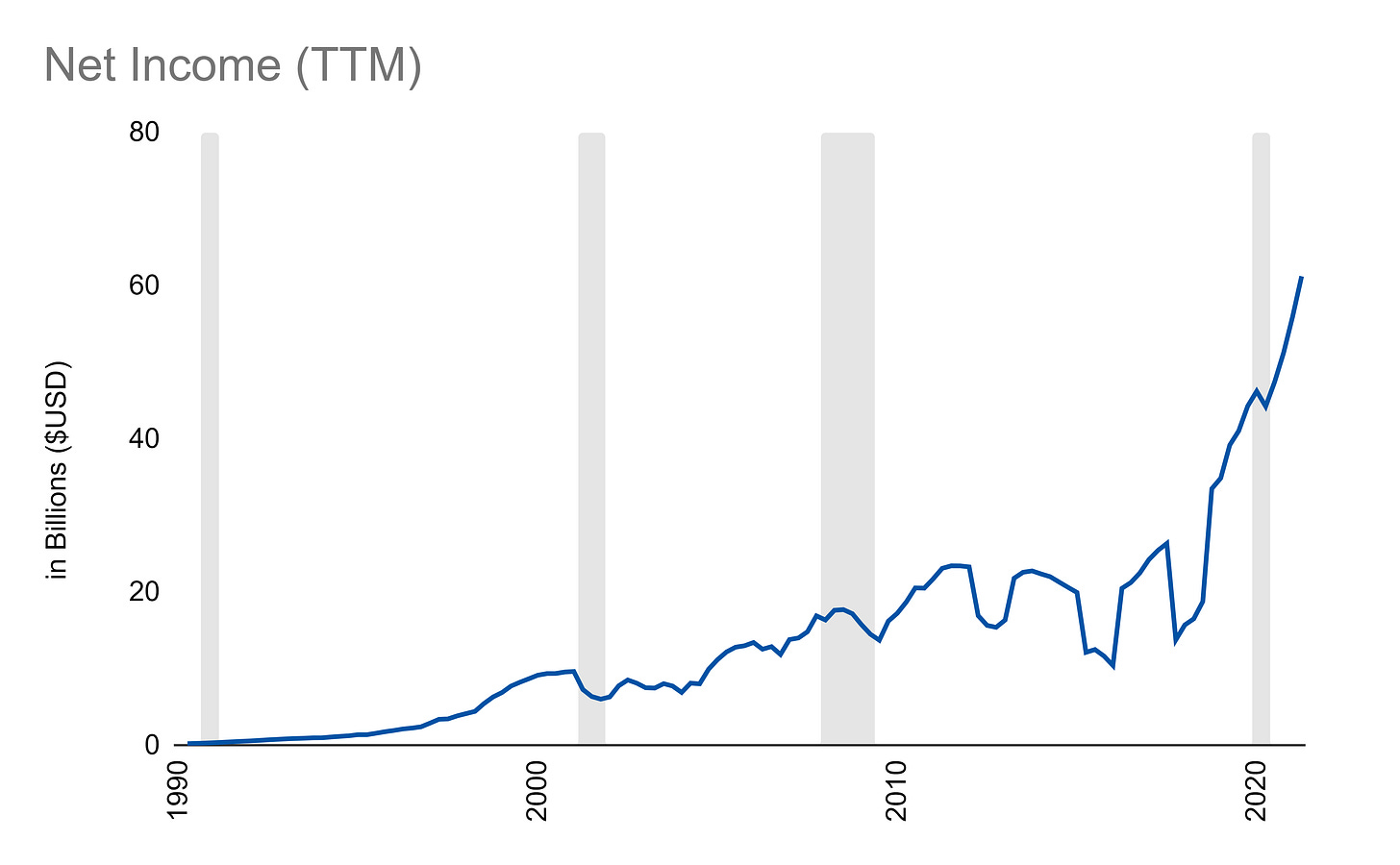

In terms of profit, things have really taken off in the last few years:

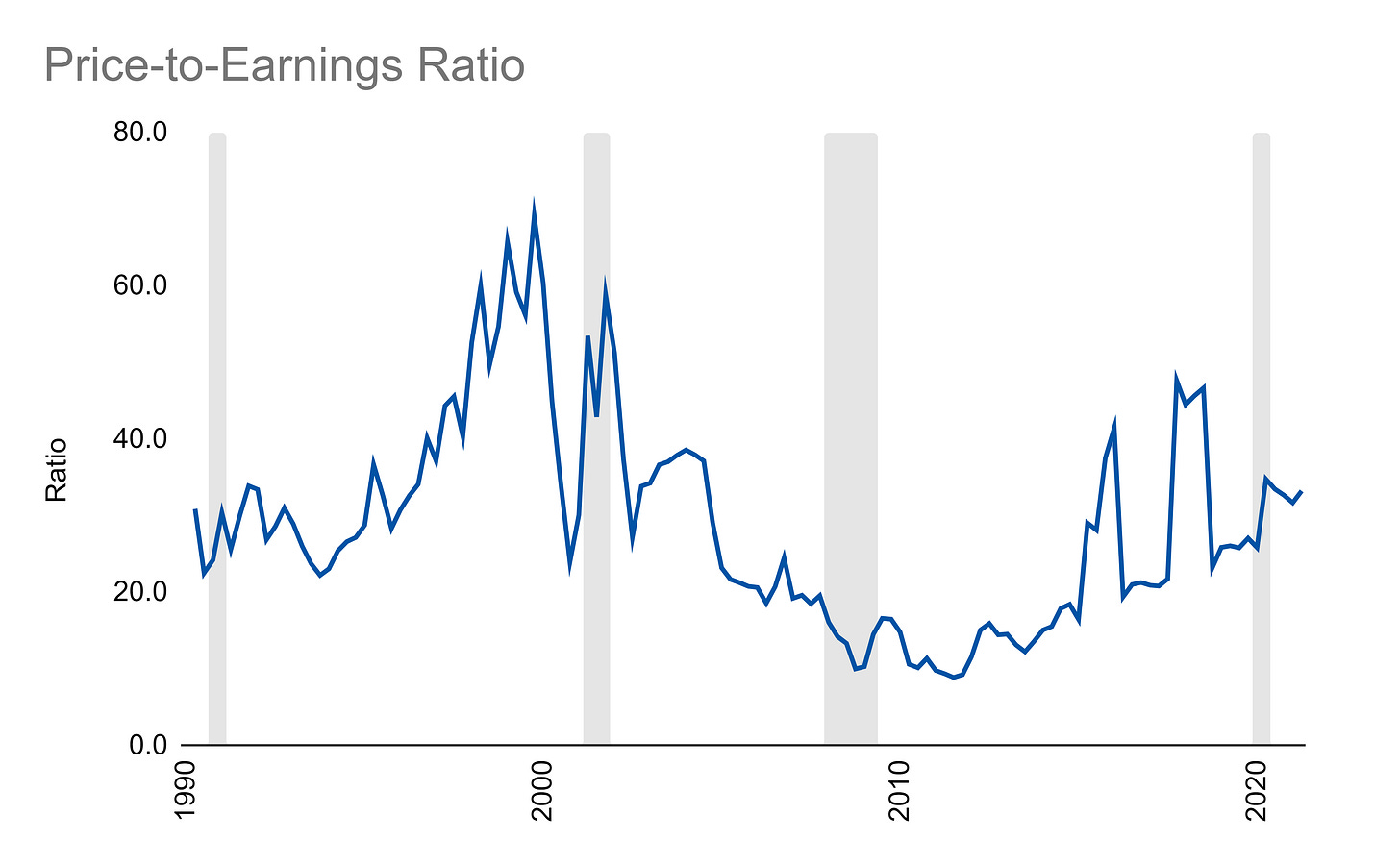

Because of that, price-to-earnings remains reasonable:

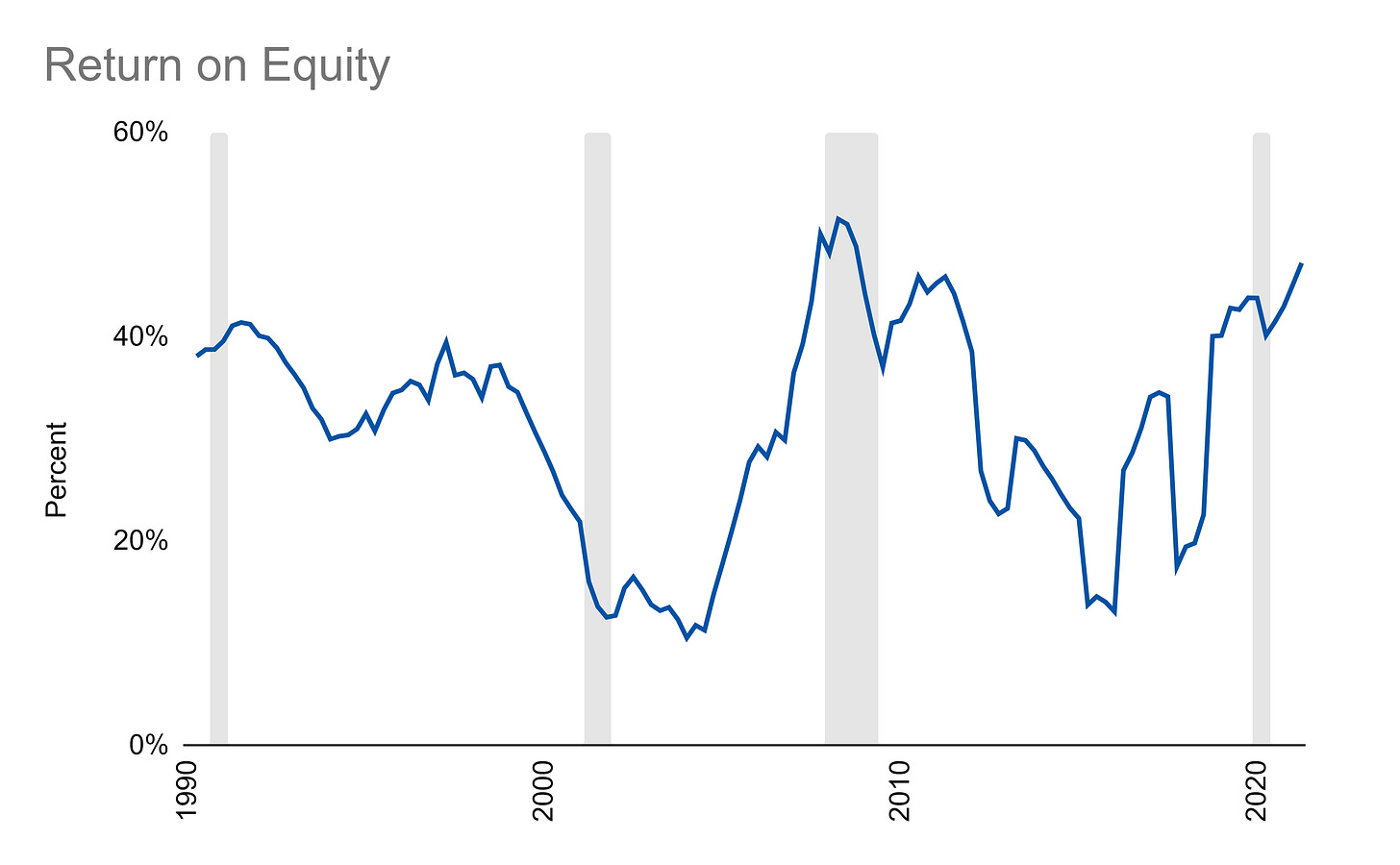

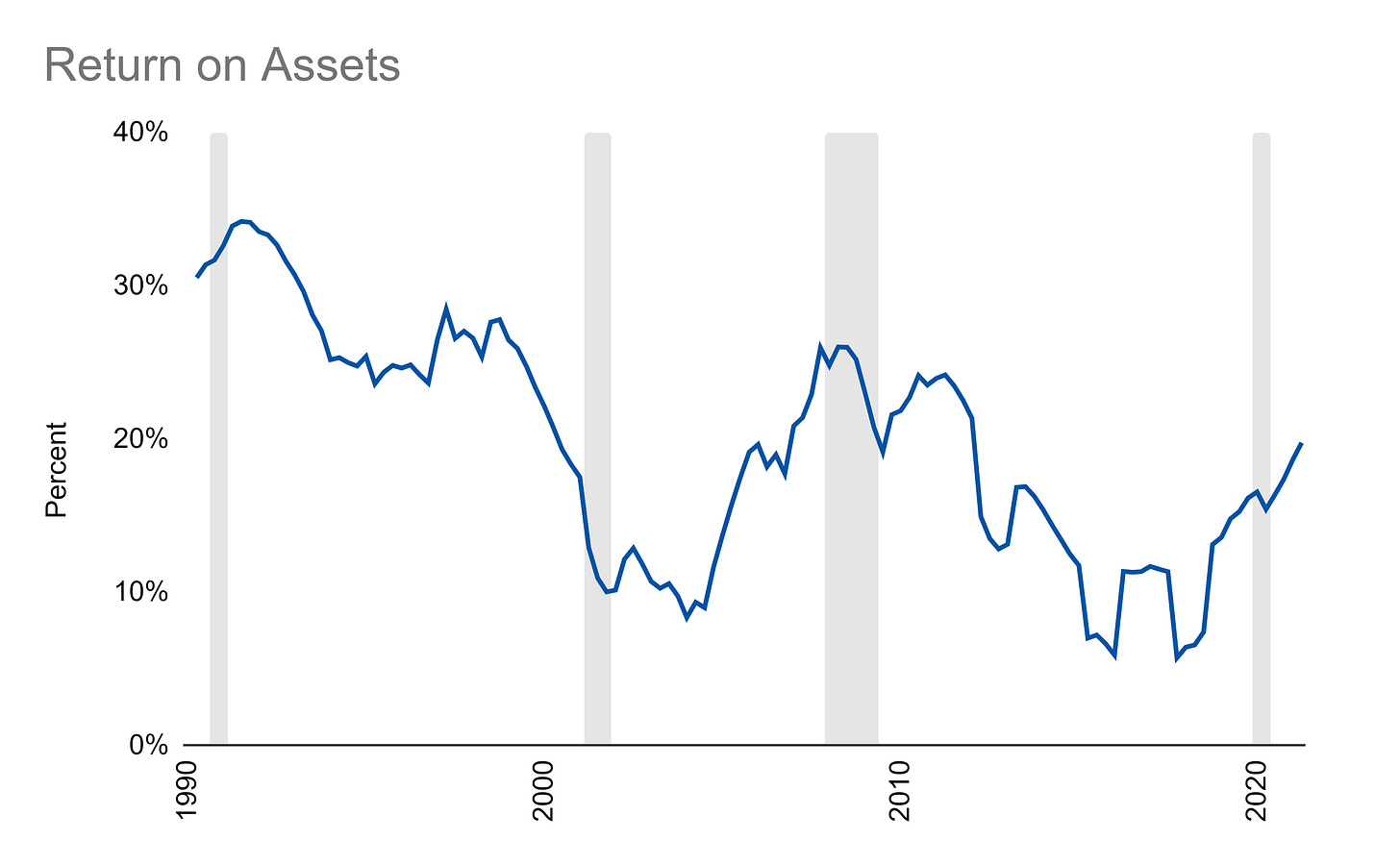

And profitability is nearly at its highest point over the last thirty years:

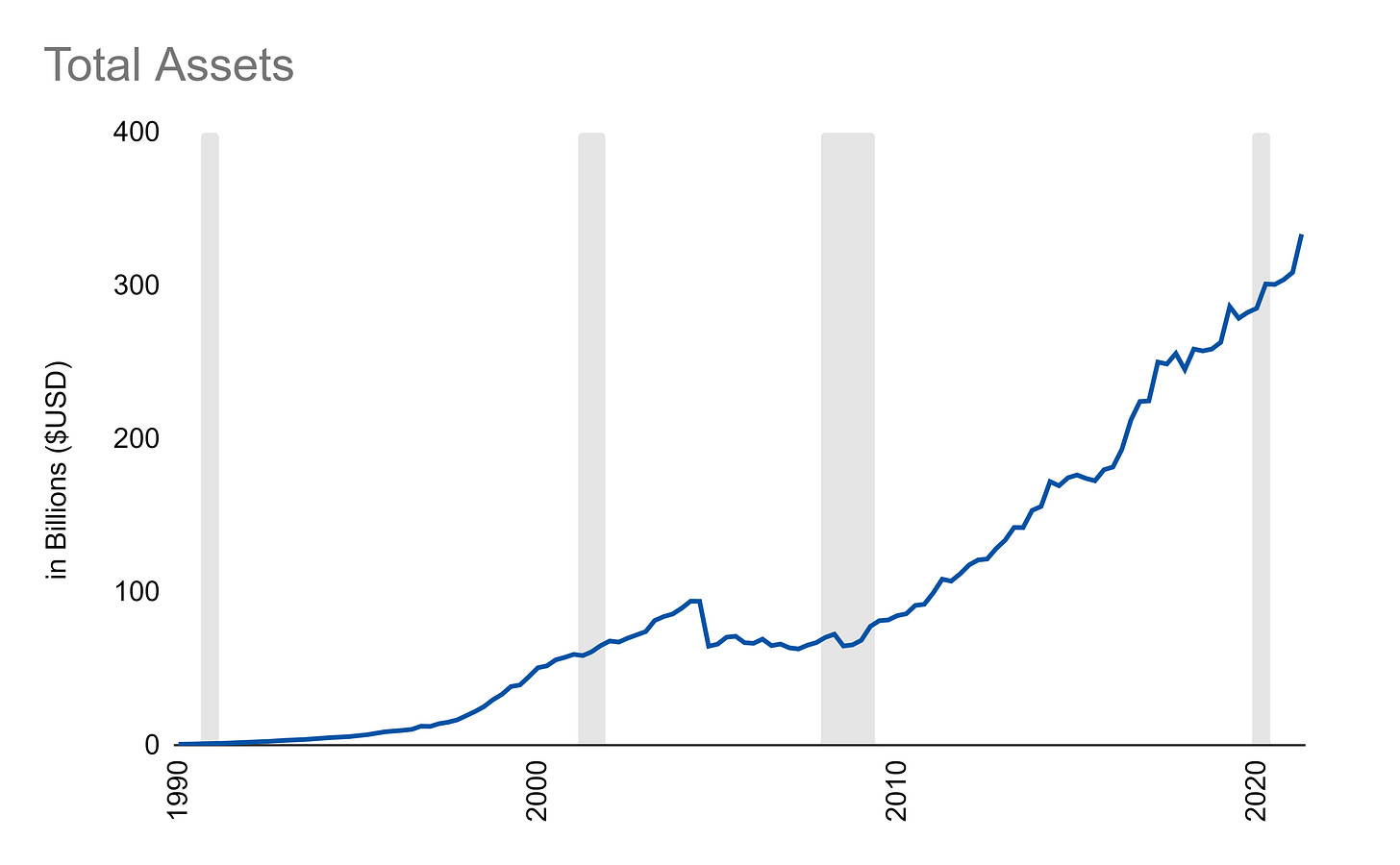

The balance sheet has been growing steadily:

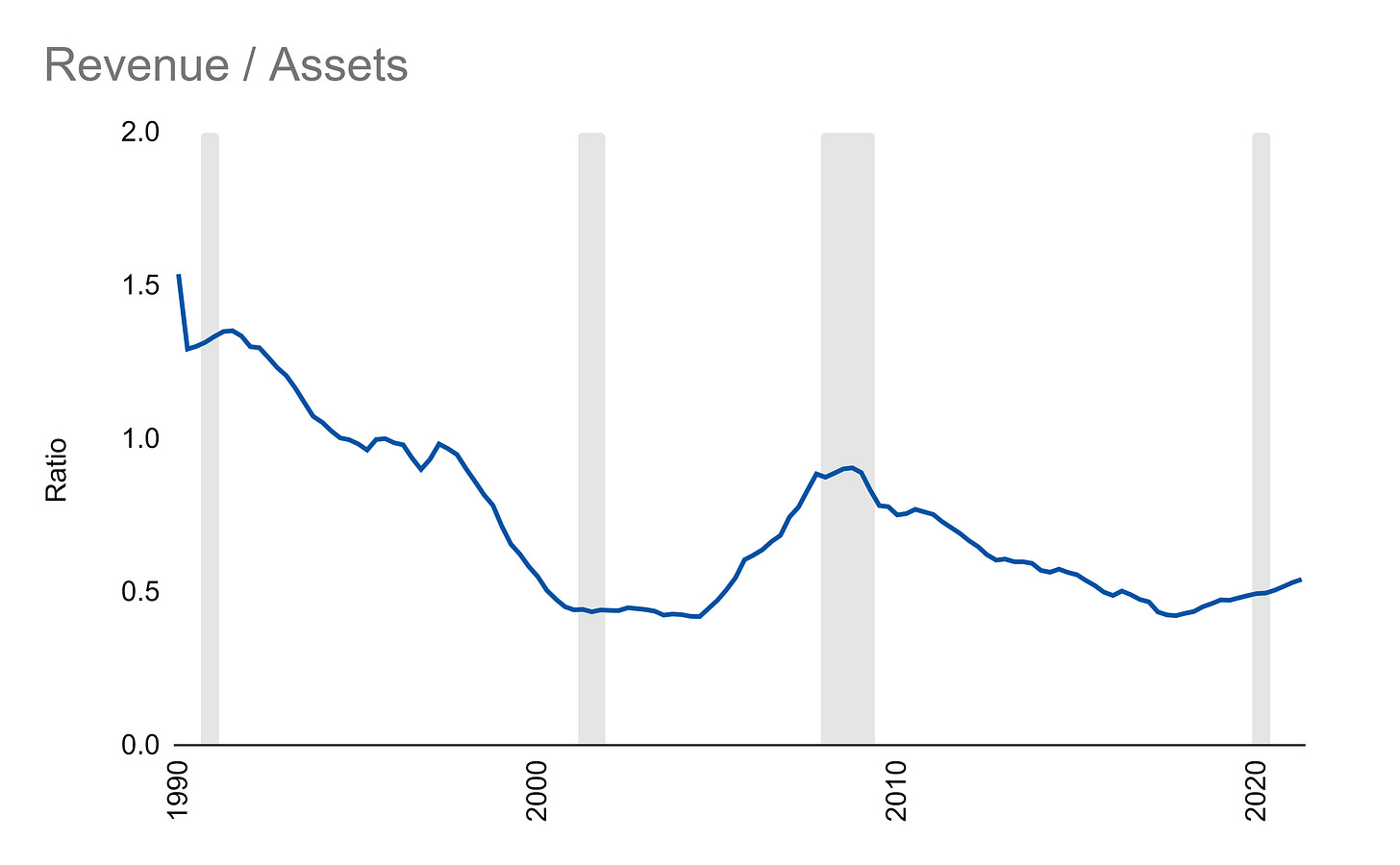

Recently, the growth in revenue has started to outpace asset growth (a good thing):

Though, return on those assets remains not as high as return on equity:

Overall, these are good numbers for Microsoft. Then again, what else would you expect from second-largest stock out there? It’s got a big market cap for a reason!

Have a question you want to ask or a topic you’d like to see covered? Let me know!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000