Portfolio Performance Review

Good stuff so far

The 2021 investment plan for the main investment portfolio has been off to a good start. The regular investment purchases have gone according to plan and there has been some noticeable return on top:

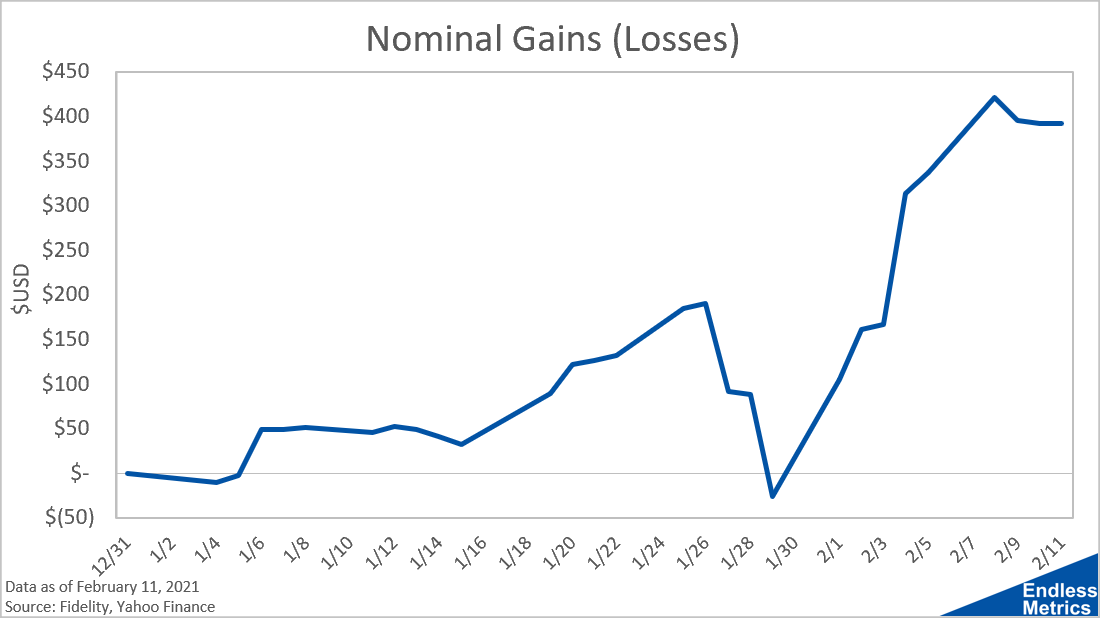

Subtracting cash invested from portfolio value gives a clearer picture of the profit and loss over time:

While gains are nice on an absolute sense, they are more important to analyze on a relative basis against the S&P 500 benchmark. So far, there has been slight but steady outperformance:

On a daily return basis, the performance looks much closer:

However, taking an average of those daily returns and dividing it by the standard deviation of those returns (to get the risk/volatility), we see that the Endless Metrics portfolio is solidly beating the S&P 500 in terms of risk-adjusted return:

It’s been a good start to the year but there is a long way (and a lot of investing) to go. Fingers crossed the decision making continues to turn out for the best!

Links

Yesterday’s Post | Most Popular Posts | All Historical Posts | Contact

Portfolios

Main Portfolio | Wild Stuff | Shiny Stuff | Safe Stuff | Big Stuff | Random Stuff