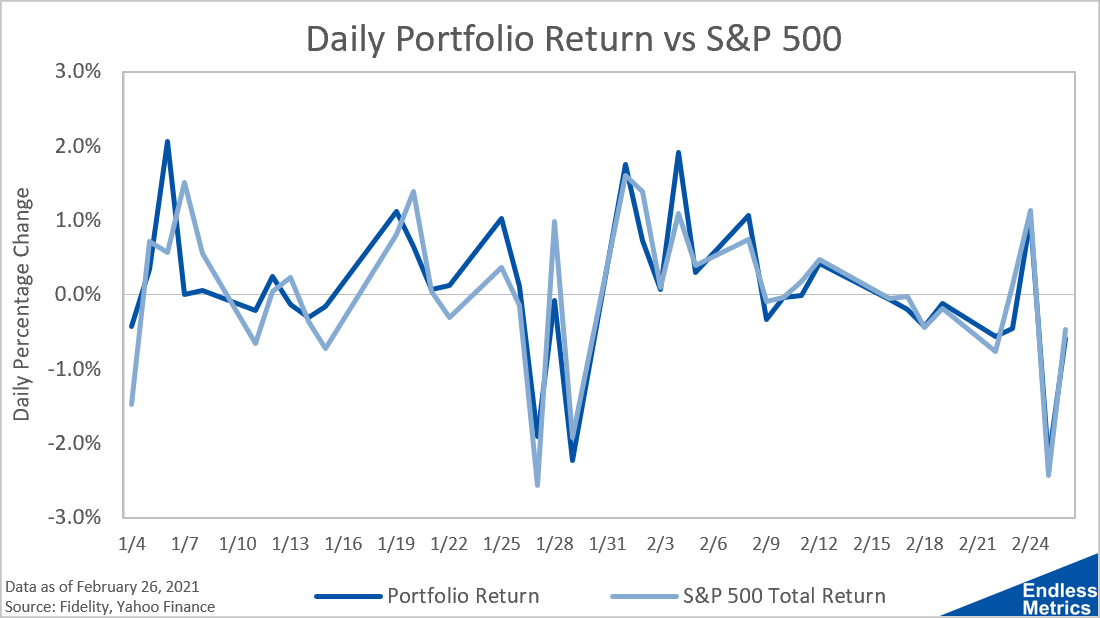

After four investment rounds, my daily returns are converging more and more to the S&P 500 overall:

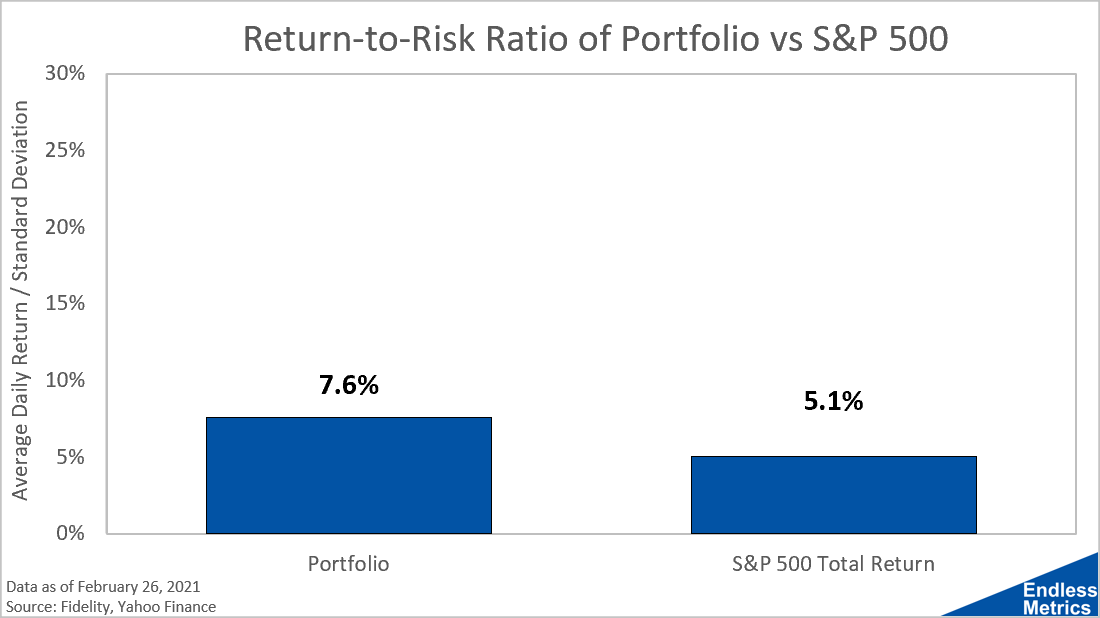

However, the small differences add up and I’m still ahead on a risk-return basis:

Going forward, I can either focus on trying to stay close to the S&P and eke out small advantages or place some bigger allocation bets on specific stocks or sectors to differentiate the portfolio. I haven’t made a conscious choice as to which path I’m going to go down just yet, so it will be interesting to see if my next picks bring me closer or further from market performance as a whole.

Fortunately, we won’t have to wait very long until the next investment round to find out which path it’s moving towards - Monday is investment round five! Looking forward to discussing the next moves then.

Links

Yesterday’s Post | Most Popular Posts | All Historical Posts | Contact

Portfolios

Main Portfolio | Wild Stuff | Shiny Stuff | Safe Stuff | Big Stuff | Random Stuff

Live Charts

Tracking Portfolio Performance | “Wild Stuff” Constituents | “Shiny Stuff” Constituents | “Safe Stuff” Constituents | Ten-Year Treasury Less Two-Year Treasury | Ten-Year Breakeven Inflation Rate | S&P 500 | S&P Rolling All-Time High | S&P 500 Drawdown | S&P 500 Rogue Wave Indicator | S&P Moving Averages | S&P 500 / 200-Day Moving Average | S&P 500 / 50-Day Moving Average | S&P 500 50-Day Moving Average / 200-Day Moving Average | S&P 500 Relative Strength Index | CBOE Volatility Index (VIX) | Three-Month USD LIBOR | Three-Month Treasury Bill (Secondary Rate) | TED Spread | Price of Bitcoin | Bitcoin Rolling All-Time High | Bitcoin Drawdown | Bitcoin Rogue Wave Indicator