Stock Overlap of the Major Indices

How many stocks are represented in the Dow, S&P 500, and Nasdaq 100?

When people talk about what the markets are doing, they typically refer to the three major stock indices represented by the Dow 30, S&P 500, and Nasdaq. These broad baskets of stocks generally tell the story about where the market is heading as a whole.

Sometimes, however, the indices tell different stories. Last week, there were a few notable days of big performance divergence between the three indices. This is unusual because there is quite a bit of overlap between each index:

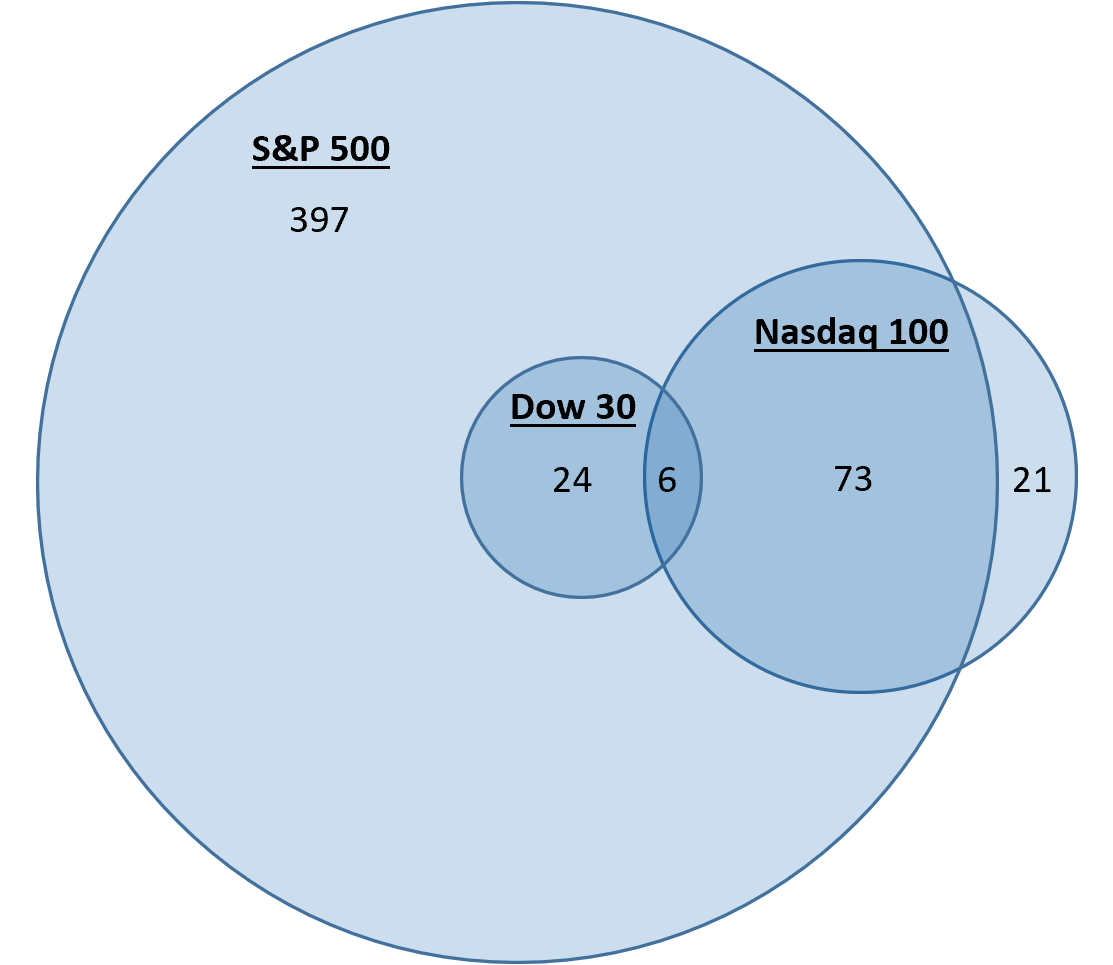

This Venn diagram shows how many stocks are part of each index. I do want to note that I used the Nasdaq 100 instead of the full Nasdaq (which has a lot more stocks) for simplicity.

Now, these indices change quite often, so this is just a snapshot of what stocks are in which index at the moment. But, we see a few things right away:

The Dow 30 is just a subset of the S&P 500. This is one reason people like the S&P 500, as it represents a broader basket of stocks for the total market.

The Nasdaq 100 has 79 stocks that overlap with the S&P 500! So, even though it’s a tech index, the S&P 500 covers it pretty well.

There are only 6 stocks that are a part of all three indices.

In total, these three indices represent 521 unique stocks.

So, now we have a starting point for a research list for investments. These 521 stocks are all well-known companies covered by the three indices most commonly used as a proxy for the whole market. And, over time, we can add to this by finding more good stocks outside of this group in our attempt to find outperforming companies that can help us “beat” the market.

I found your substack from Googling this very query!! [no Android support!!]

Can you please add percentage weightage overlap also ?