Stocks or Bitcoin?

A recent comparison

It’s no secret that stocks have been doing well the last few months. However, the rally goes beyond just stocks. It even includes everyone’s most love-it-or-hate-it investment, the infamous Bitcoin.

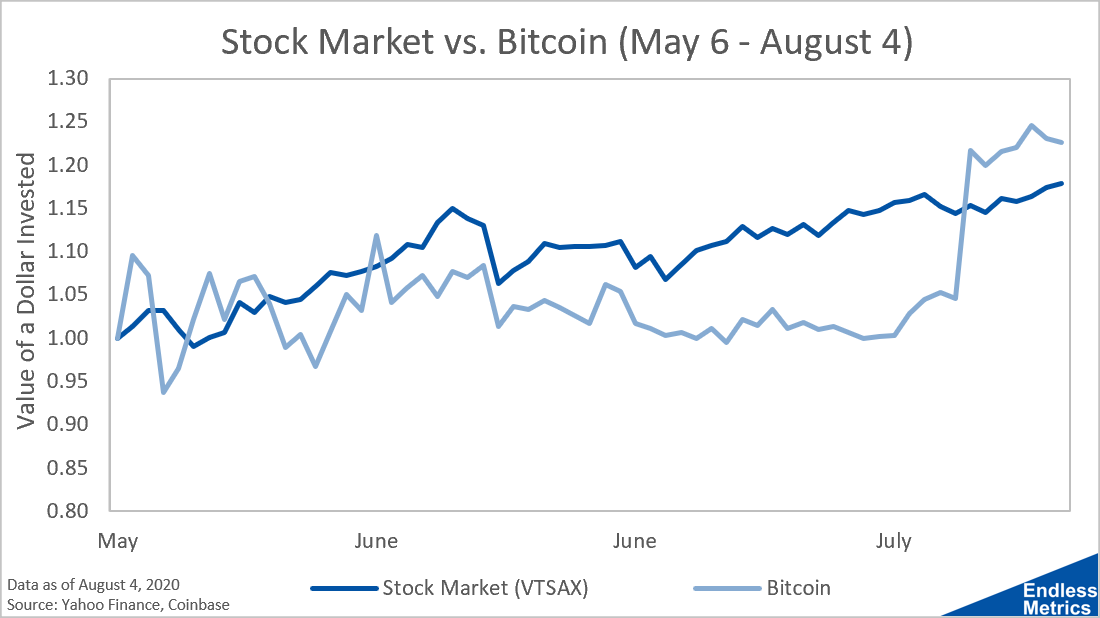

That’s right, the digital asset that can’t decide whether it’s a currency or a store of value or something else has been on a great run as well. Let’s see how the two stack up over the last two months:

If you thought the stock market was crazy lately just look at Bitcoin. That’s a lot of up and down, which is definitely expected given it’s incredibly volatile history.

It seemed like stocks were the better investment for a good while in this horse race but Bitcoin had a huge late surge to take the lead…for now.

The reason I wanted to show this example is to talk about return (or as I called it in my last post, offense). When it comes to stocks or other assets, everyone is focused on what the price is doing and how much gain there is. And, in terms of offense, Bitcoin definitely wins this little race.

The extreme focus on return in financial news is so pervasive that it almost makes it difficult to even think of what could be used for the defensive risk aspect of this analysis. So, we need some kind of measurement for defense - otherwise, we are only comparing one side of things. And, while return is good, the best offense doesn’t always win.

So, stay tuned for the next post if you are interested in the other half of the story. (That is, unless, you only care about flashy offenses. Then, by all means, go out and check out bitcoin because the crypto markets make the stock markets seem straight up boring in comparison!)