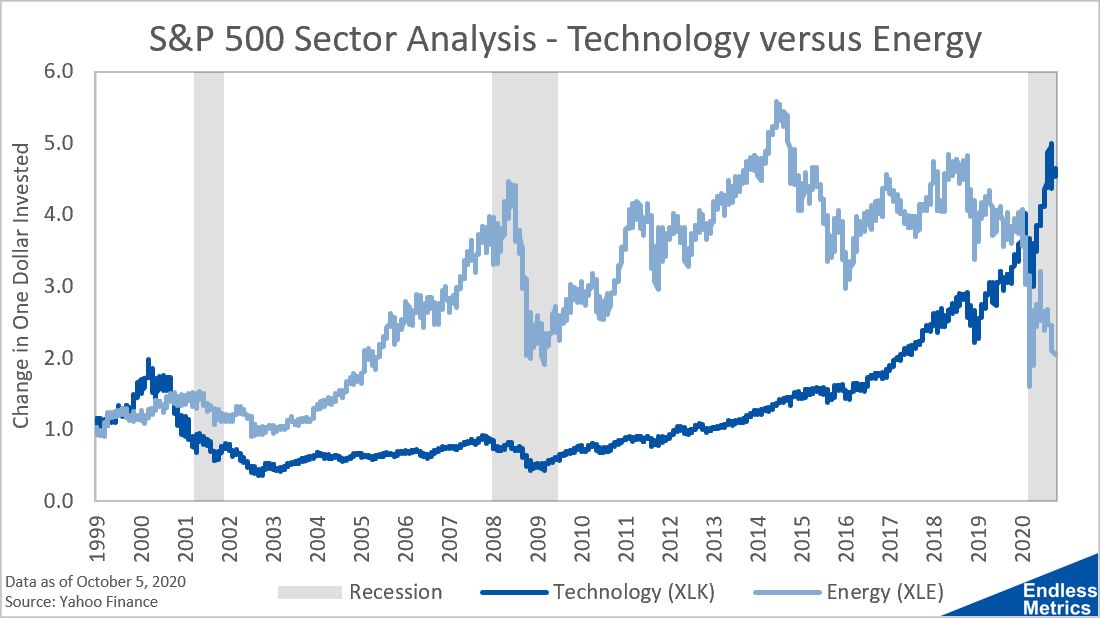

One of the biggest stories in the S&P 500 this year is the divergence of the technology and energy sectors. But as a long-term story, I think it looks even more interesting:

Imagine investing a dollar in energy and getting almost a 400% return in nine years. After that, there is a crash during the financial crisis but that’s true for almost every stock and sector. Just before 2015, you’re now up almost 500% on that original investment.

Then, it all went downhill. For fifteen years you had an amazing investment but from 2015-2020 it has been awful, down about 60% in a time when the overall stock market had an amazing rally. Imagine buying at the peak. Ouch.

Meanwhile, tech investors have had all the fun for the last ten years. Will it last another five? Another ten? It’s hard to see companies surpassing the likes of Apple, Microsoft, etc. but the tech sector already had a bubble and long-term unwinding in the first half of this chart. So, it’s not impossible to imagine underperformance.

The most important question about these things is always the hardest to answer - when will it happen? No one knows the answer to that but you don’t want to be stuck on the downtrend. The best thing to do is keep studying the historical trends and recent developments - every crash starts with a small dip.

More Metrics

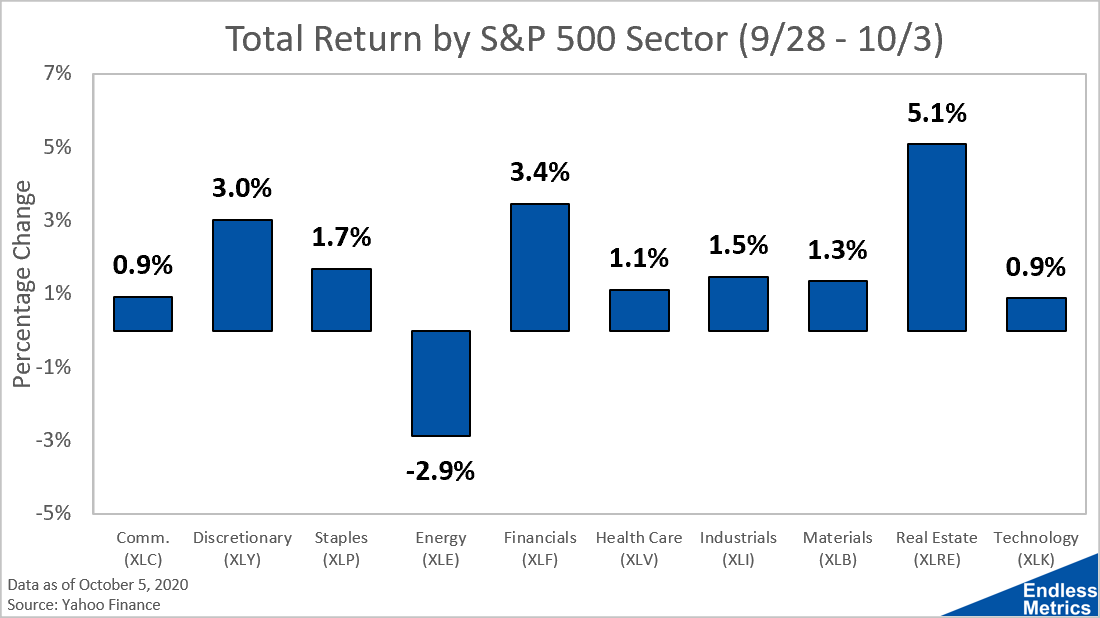

Consumer discretionary, financials and real estate did very well last week

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact Me

Enjoying the content?

If you want to help support my crazy dream to one day write about the markets full time and produce even more endless metrics, maybe you could sign up for ongoing content (if you haven’t already) or sign up a friend. Don’t worry - you can cancel whenever you decide you’re bored or need an inbox cleanse. I don’t take it personally!