Tether is my biggest concern with crypto

A fundamental market mechanism with lots of question marks

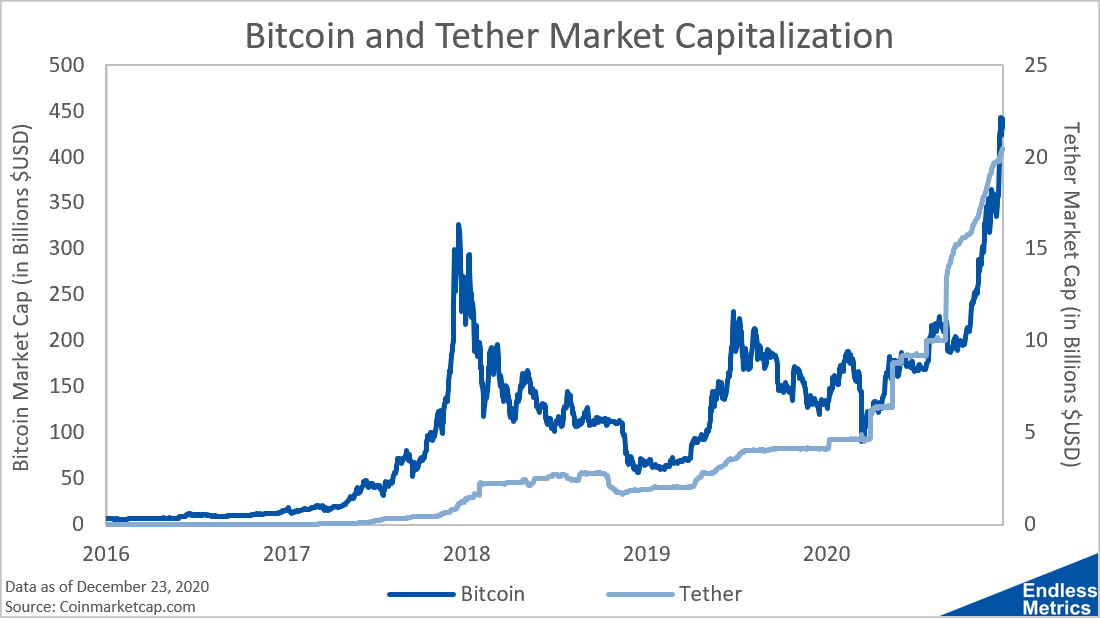

Tether (USDT) is a cryptocurrency known as a stablecoin, which means it is supposed to keep a value of one dollar. Over the years, Tether has made claims that each of these tether dollars is backed by one real US dollar sitting in a bank account somewhere. That was somewhat believable when there wasn’t much USDT in circulation years ago but a lot harder to fathom now:

Money for Nothing

There is over $20 billion USDT in existence at the moment, $15 billion of which was introduced to the market in the last nine months. That is an absurd amount of cash for anyone to have on hand, even a large company. Who gave it to them? Where did it come from?

One possibility is that there is no one-to-one backing of Tether to actual dollars. There is certainly no mechanism that forces this to be the case. New Tethers can be printed on demand. And, to produce $15 billion in nine months, you have to be chunking out huge prints of hundreds of millions of dollars quite often. Perhaps one or two massive deals like that is possible from some super rich connected guy giving them money but $15 billion worth?

Individuals in high finance or startup companies that raise capital will tell you how difficult it is to get even a few million for an idea. No one throws $15 billion at something. Especially when the value proposition makes no sense! A rich person is going to give cash to someone so they can put it in a bank account just to hold a claim that they are backed one-to-one? Doesn’t pass the smell test.

One-to-one?

So, if Tether isn’t backed by actual dollars, or even if it is, why does it matter so much to the market? Well, with the exception of a few exchanges, the vast majority of cryptocurrency is traded in USDT and not actual dollars. More simply, the majority of the market is linked not to dollars but to USDT.

As long as people think USDT has the value of a dollar and this one-to-one mechanism stays in place, then it’s all good. But, what if that didn’t work? Financial history is ripe with stories of hedges that were supposed to be one-to-one before correlation broke down and the hedge stopped working, which lead to (spoiler alert) significant unexpected losses.

What happens if people lose faith in USDT? Perhaps, the fact that it may not be backed one-to-one actually matters to people or becomes much more apparent due to scrutiny by authority.

Money Printers

Why would there be scrutiny? Well, for one, it’s kind of like that thought many of us have as a little kid - why don’t people just print more money if there are things in the world that we can’t afford or people don’t have enough? I mean, when I was a little kid, we got a top-of-the-line scanner and I showed my Dad a replica of a dollar bill I made for a school poster project. I didn’t understand at the time why he was so concerned!

Let’s be clear. There is only one institution that can print dollars. Anyone else who does that (including white-collar financial criminal mastermind children who scan and print single dollar bills for a school project) is in deep trouble. Even if the Tether organization is making USDT, which can hide behind the veil of “tech” and claim to not really be printing dollars, I think the spirit of the law will prevail.

Digital Lifeblood

Tether has become the lifeblood of the cryptocurrency world. While there are other stablecoins, they don’t have nearly the same clout. And, any problem with one would likely be a problem for them all.

Now, I don’t think that problems with Tether could destroy cryptocurrency as a whole. But, it could certainly hurt prices. Think of Mt. Gox or all the other hacks in the last few years. A bad thing happens and people lose confidence. Hacks of tens of millions are one thing. What if a $20 billion dollar market-wide base currency was rendered illegitimate?

Why even risk it, kid?

So, if Tether is questionable, why would the creators take on such risk? Well, imagine if you had the power to create hundreds of millions of dollars instantly? Obviously, this doesn’t show up in a bank account but as a trading pair benchmarked to cryptocurrency. What could you do with that?

You could create Tether when the market falls to buy low, then sell high. You could create a safety net to prop up prices and ensure the low you purchase at is the bottom.

But why stop there? You could also print and pump prices by creating buying pressure. Further, if cryptocurrency is paired with USDT and USDT has to equal one dollar but you increase the supply, then cryptocurrency should also rise (or fall) in value relative to that supply.

And what do we see in that chart? Tether printed steadily in the 2017 run up. Then, they mostly stopped printing and Bitcoin fell in price. Then, they sharply reduced the Tether supply and there was a big crash shortly after toward the end of 2018. Then, Tether rose again with the 2019 run up. Then, printing slowed down and the price fell. Then, at the bottom in March of this year, the Tether printer turned on like never before and it’s been straight up for the whole market.

If you can control the underlying trading pair and use that to manipulate the market, you can amass actual cryptocurrency like Bitcoin. What better mechanism to use for monetizing shady practices? Bitcoin has long had a reputation as the currency of choice for less-then-palatable financial transactions. There are many avenues to offload Bitcoin and get actual money. And, who wouldn’t want to trade real money for Bitcoin when it’s price is going up so much?

Neat thought experiment…but does it really matter?

Is all of this actually a problem? It’s possible that I’m severely misunderstanding this whole thing. After all, USDT has been around for years, why is it still operating if it’s not really allowed?

I think the first driver is prioritization. It’s possible the current administration and heads of authoritative institutions haven’t put cryptocurrency high on their to-do list. I think that’s changing as cryptocurrency continues to grow. You certainly see it with central banks around the world getting more interested.

I think the second driver is that these things take time. How many companies have broken the law for years before seeing consequences? It’s not easy to build a case against a foreign entity that is doing something that has never been done before with a new technology, even if the underlying phenomenon might be considered bad acting.

What I will say is that sometimes the music plays the loudest just before it gets cut off. No one expected to wake up and see major online poker sites shut down overnight on April 15, 2011 after years of skirting the rules. There was really no warning either. Everyone just thought online poker, which was supposed to not be allowed, was just the new normal.

I’m not the first to be skeptical of Tether. And, for me, it’s a concern that doesn’t reach the point of worrying that Bitcoin will cease to be or anything. But, I don’t think it’s outlandish to believe that crypto, with its history of insane price movements, could be susceptible to an immense and quick crash. Tether could just be one such driver. Or, maybe not. It’s been this long already so, I’ll say tongue in cheek that, “maybe this time it’s different.”

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact

Enjoying the content?

If you want to help support my crazy dream to one day write about the markets full time and produce even more endless metrics, maybe you could sign up for ongoing content (if you haven’t already) or sign up a friend. Don’t worry - you can cancel whenever you decide you’re bored or need an inbox cleanse. I don’t take it personally!