The 10-2 Spread Plummets

The clock ticks closer to midnight

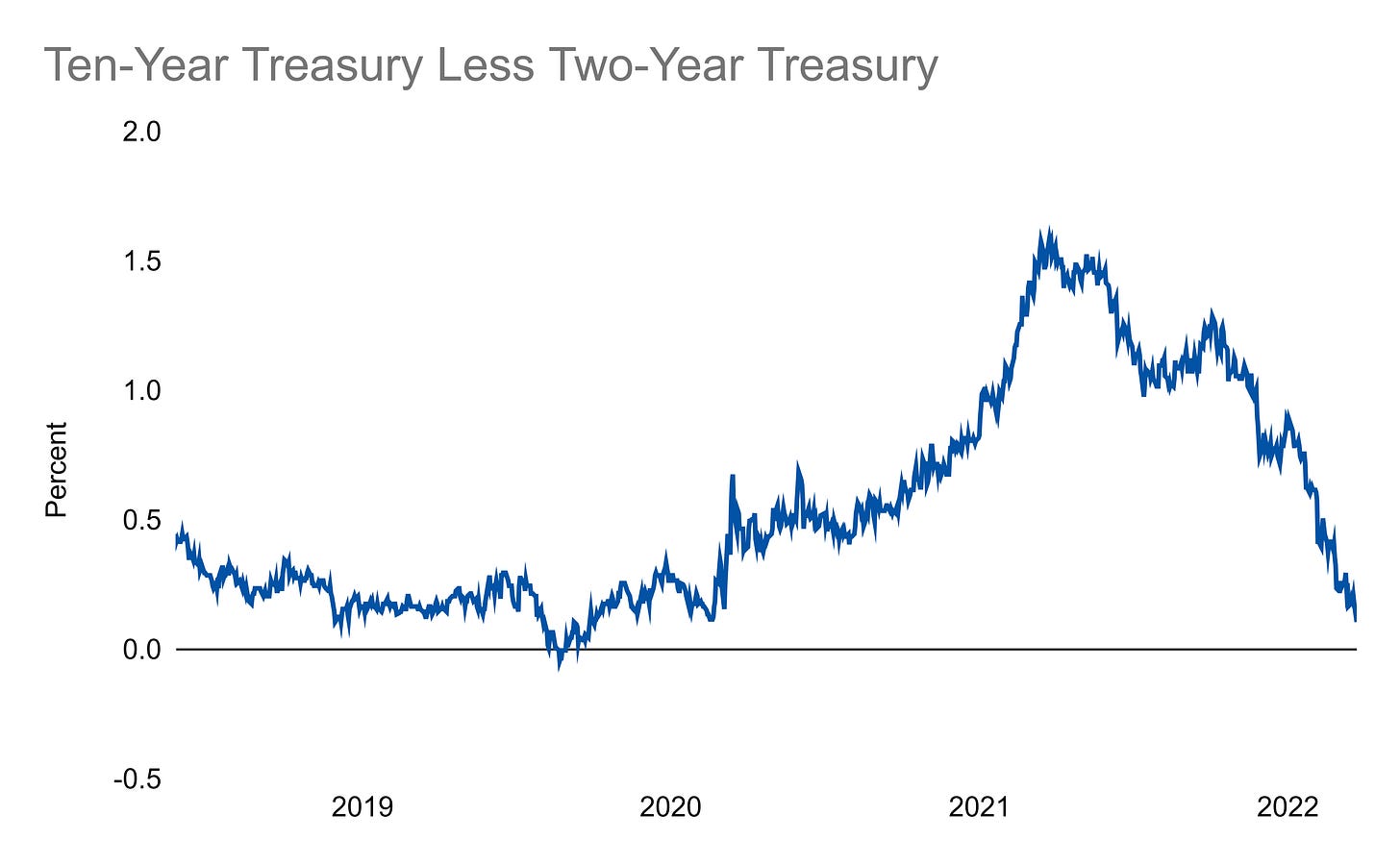

The 10-2 spread is one of the most well known early warning indicators out there for recessions. It has gone negative prior to every recession over more than forty years of recent history. Here’s where it currently stands:

It’s getting awfully close to zero there! However, since it’s an early warning indicator, even if it goes negative, there have historically been a few quarters before a recession actually hits. And, of course, it could also be that case that this time is somehow different and a recession doesn’t materialize in a reasonable amount of time. But, take that chance of being unprepared for a recession at your own risk!

Good Stuff I’m Reading

Recession Signals Light Up as Section of US 'Yield Curve' Inverts

“An inverted yield curve is widely read as a sign of impending economic recession, a significant decline in economic activity that lasts for months or even years. According to the Federal Reserve Bank of San Francisco, the yield curve has inverted before each recession since 1955, with the economy taking a hit between six and 24 months following the inversion.”

The bond market is flashing a warning sign a recession may be coming. Here’s why

“An inversion in the yield curve doesn’t trigger a recession. Instead, it suggests bond investors are worried about the economy’s long-term prospects, Roth said. Investors pay most attention to the spread between the two-year U.S. Treasury and the 10-year U.S. Treasury. That curve isn’t yet flashing a warning sign.”

Calm Before the Storm?

“This is called "the credit cycle" or "the business cycle" but it's really a cycle of human nature: when gains are effortless, we want to increase our gains, so we increase our borrowing, leverage and risk to buy more assets. "Investment" becomes pure speculation unmoored from fundamentals. Eventually valuations, leverage and debt all reach extremes and so valuations, debt and leverage all start to contract.”

Have a question you want to ask or a topic you’d like to see covered? Let me know!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000

I've been following your posts for only a few months now, but they are so informative, interesting, and free of bloviation. Bravo!