Honestly, I thought we would get 50bps. But, it turns out, the story the other day about the leaked 75bps decision was either legit or prescient.

The Fed is clearly trying to step their game up and deal with this problem they thought was transitory. But, like a growing fire or a festering wound, the lack of proactiveness has put us in a situation of catch up.

Let that be a lesson to take all comments seriously - there were plenty of people even early last year saying that inflation could be a big issue. Even a small one off hike a little bit sooner could have made a huge difference and signaled serious consideration of the potential problem for fairly minimal downside.

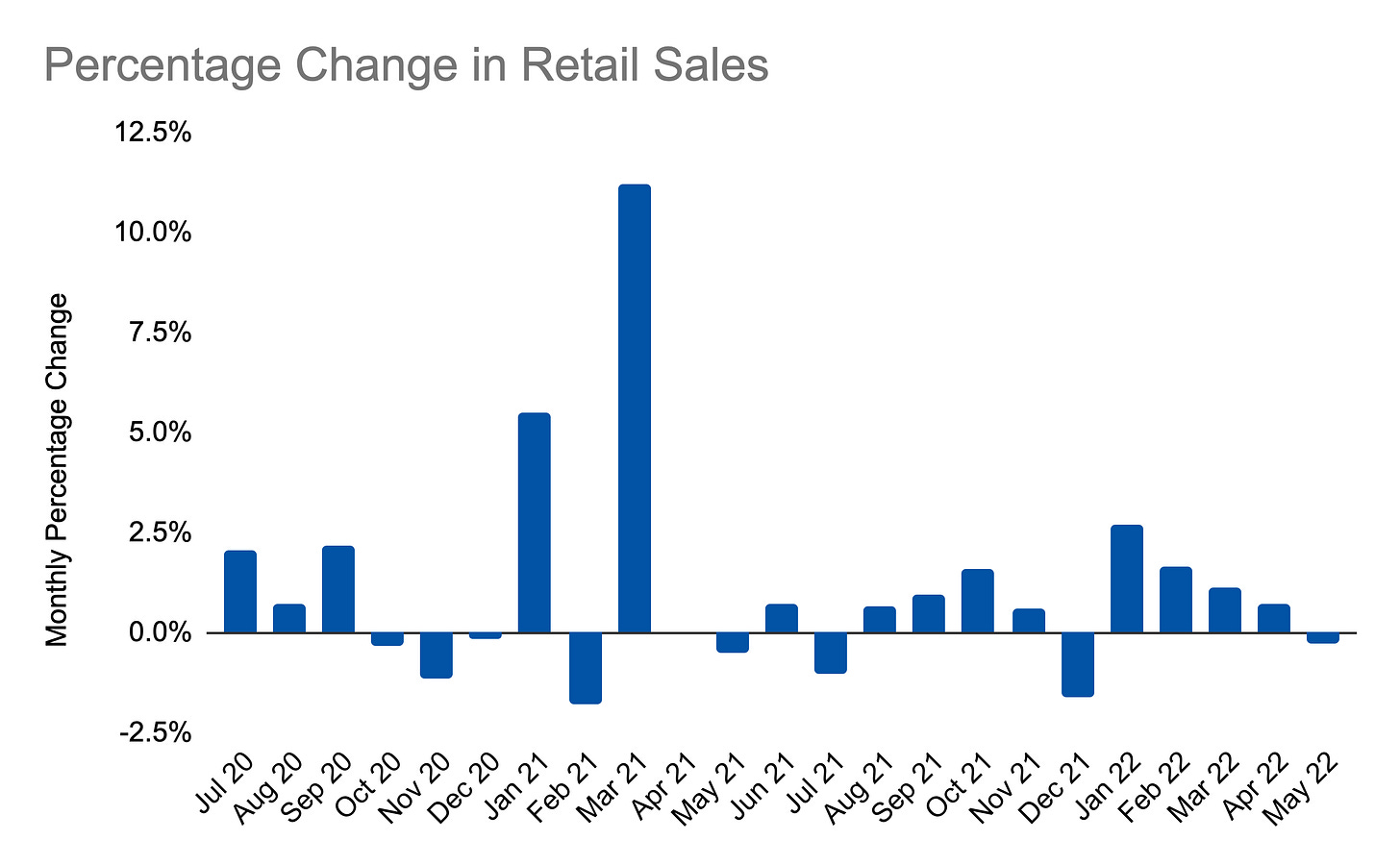

In other economic news, someone highlighted the last five months of retail sales in a chart to show the consistent decline. That’s nice for narrative building but the longer-term picture is a bit more complex:

Yes, retail sales have been consistently falling and are now negative but we will need another month to really jump to a conclusion.