The New Normal

In early 2020, when the COVID-19 pandemic began to take hold, there probably weren’t that many people thinking, “Wow I can’t wait to see how well home prices do through all of this!” And yet, home prices went crazy, accelerating well beyond trend:

On a monthly change basis, the regime change was even more shocking, with home prices growing at a pace even greater than the most frenzied period leading up to the housing bubble and Great Recession of 2008:

But is it really a bubble?

The word bubble gets thrown around in the finance world a lot. I think it is warranted here for one specific reason - the relative valuation metrics of today’s housing market are on par with the height of the 2008 housing bubble. If people call that episode a bubble, I think we can call today’s market a bubble as well.

It’s not just that house prices have gone crazy (as seen in the last two charts) but that they have gone crazy in relative comparison to other metrics, like inflation (which is also going crazy!):

House prices are also extended relative to rent (which has gone up a lot too!):

And, relative to income:

Now, I will admit that not all of these metrics are as high as the peak prior to the 2008 housing crash. But, they are certainly close enough to raise concern, especially when we consider how bad 2008 was. It’s not good company.

Signs of Euphoria Breaking

If you look closely at the previous charts, you’ll notice something with the most recent month of data. A decline!

Home prices are still up compared to a year ago:

Even last month, every single tracked area was up:

But, this month, we finally see some declines on a month-over-month basis:

On the whole (remember the first chart), we are still up on a monthly basis. But, we can see, under the surface, a fever starting to break.

But Why? Rates and Supply

The first bubble-busting driver to look at is mortgage rates:

There has been an almost unprecedented jump in mortgage rates this year.

Even though rates have been elevated for a while, it takes time to work through the system. The housing market is like an oil tanker - just because you turn off the engine it doesn’t mean you stop the ship immediately. There is inertia. We are now seeing the slowdown from the change in rates and will continue to see it over the coming months.

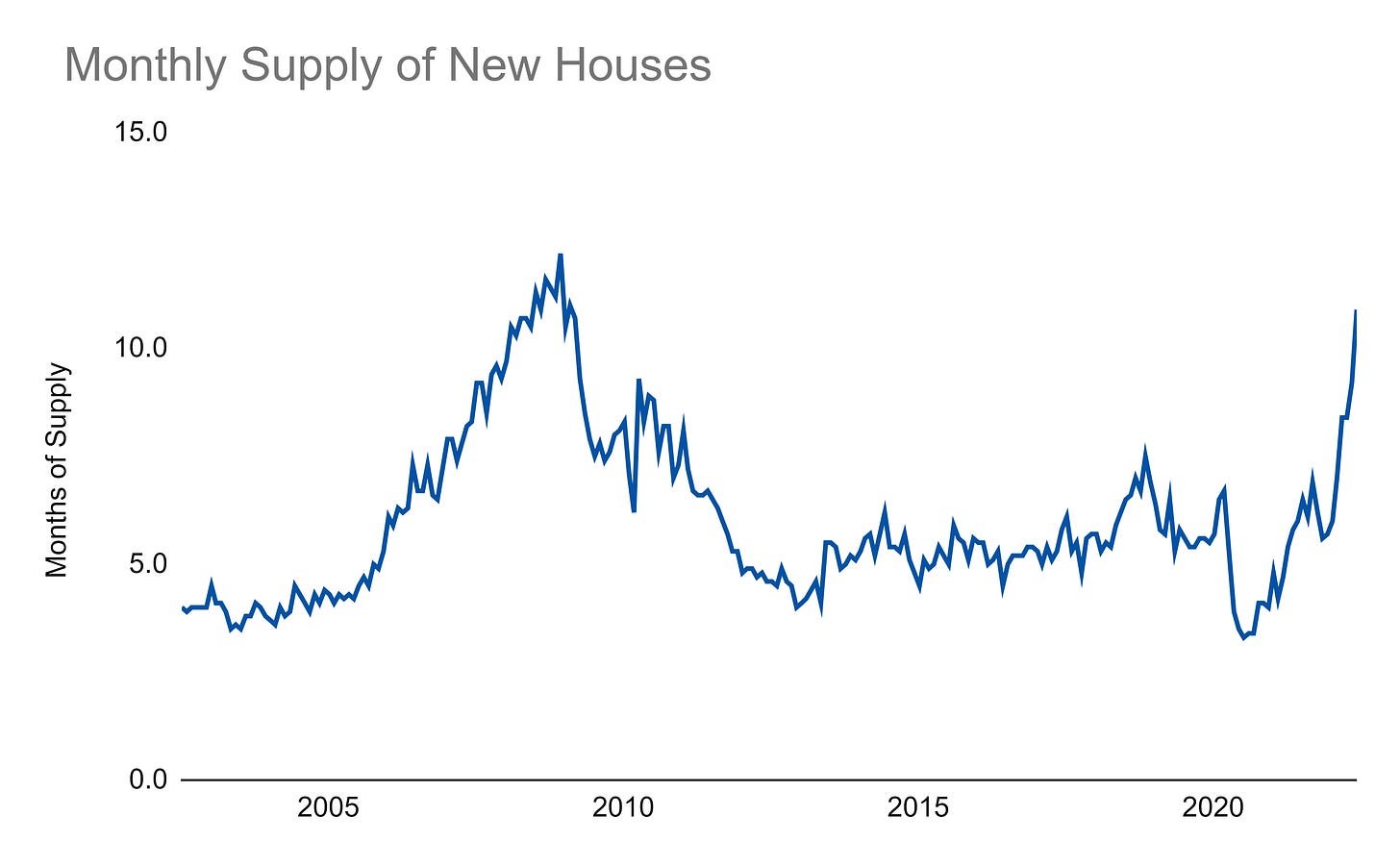

On the other related hand, you have supply. If we look at supply of new housing, it’s jumped rapidly:

It also jumped prior to the bursting of the 2008 housing bubble. So, there is some precedent for us to believe that this is another warning sign for home prices.

What next?

In mid-May, I wrote about what the housing market would look like if 2008 happened all over again. One chart from that article is particularly important when considering how things will play out:

Although we know that history won’t play out in the exact same way, the key takeaway is that the housing market will move slowly. This isn’t the stock market where things can crash in a matter of days. This will play out over months and, likely, as it did in 2008, over years.

In some ways, that is more painful than the quick gyration of a more volatile asset class like stocks. It will be a slow bleed and exhausting. Exhausting for sellers, buyers, and painful for the economy. Prices didn’t get out of hand over night and they won’t moderate back to normal quickly either.

I believe in the downside case because of the current status of the relative valuation metrics we looked at earlier. They either keep going up, stay flat, or go down. And, when there is a long-term average rate that is normal and they are stretched beyond that long-term average, I tend to believe in a regression to the mean. In this case, regression to the mean means a decline in prices.

How bad are we really talking though?

I don’t think I’m particularly bearish or by any means a doomsayer. I just look at the numbers and try to give my best guess as to what will happen next.

Since things aren’t as extreme as 2008, I don’t think we will have a 2008-level correction. But, I do believe there will be declines. We just saw the first of them in many markets and it would be surprising if this was the only month we ever saw them and it was all back to positive gains from here on out. It’s not impossible it just seems more unlikely than continued deterioration.

A lot of things mechanically in the market and financial systems are different than 2008, so I don’t think we will have a meltdown. But, just because things are different now doesn’t mean we can’t have trouble!

That is one argument I see a lot, “oh banks are safer or housing standards are tighter or people are smarter” for why 2008 won’t happen again. Sure. It’s not 2008. It’s 2022. But, just because there are different conditions today than then doesn’t mean we are immune to tough times. We are in our own scenario now and making our own history. The past is just a guide for contextualizing today.

So, what do we do? What should I do?

In the short-term, while there may be trouble, remember that there are positive forces at play in the grand scheme of things. Although home prices may fall, it won’t mean the end of the world. Things got bad in 2008. We recovered. Home prices are higher now. They will be higher in the future. Same for stocks. Same for almost everything else.

Until the overarching wheel of human progress stops, we can count on better economic days ahead of us. Setbacks are just a matter of asking how much will we lose and, more importantly, for how long. We will be alright in the long long run. And, if not, we will all be dead!

More pragmatically speaking, with the long-standing talk of a potential recession for many months, always consider downside scenarios in your own life. Have savings. Build savings if there isn’t enough there by spending less now. Consider the impact of losing a job. Think about uncomfortable financial situations and ask yourself what you would want to have done to prepare better. And, then, do it! Same as it always is. The doing is the hard part.

The Upside

The best part about building financial resilience by considering negative scenarios is that those negative scenarios may not play out. I’m just a guy writing an article about my opinions based on the data I’ve selected to show you. I could be totally wrong!

But, if you believe me, and prepare for trouble, and then it doesn’t occur, well then go spend the rainy day fund you set aside on something you want : )

It’s certainly better than being caught unprepared…

Don’t say I didn’t warn ya!