If you’ve got savings in stocks or something like 401(k), you have probably dealt with feelings lately like “oh god I’m never going to be able to retire” and “oh god I’m going to die in a global pandemic.”

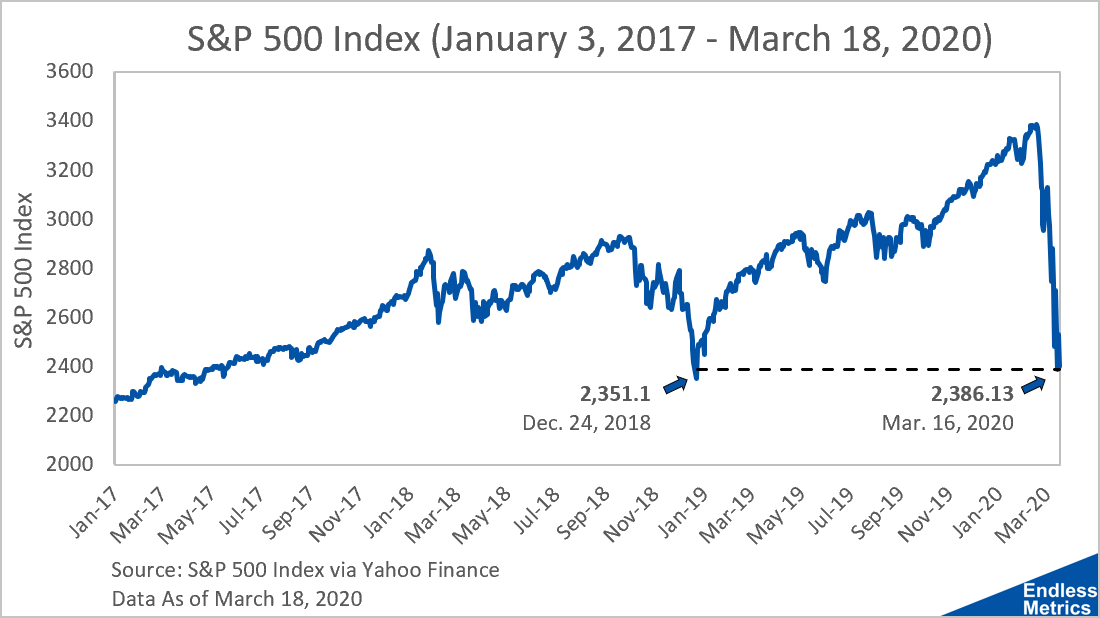

One silver lining is that these problems are mutually exclusive! Another silver lining is that stock market drops are opportunities to invest at index levels that haven’t been seen in a long time. It’s kind of like going back in time and getting a chance for a do over. Let’s see what that looks like visually:

On Monday, the S&P 500 hit levels that haven’t been seen since the day before Christmas 2018. While the index is down a huge amount from the peak, we are only back to levels from a little over a year ago. Kind of surprising when you consider just how painful the market crash has felt.

While I can’t speculate on if we have hit the bottom or not, what I can say is that a few months ago I would’ve loved for a chance to have invested in that December 24, 2018 low. And now, I have that chance again!

Yet, the psychology of the market and the nature of a crash makes that decision tough. It’s important to take a step back and ask why an investment opportunity that would’ve been an obvious choice a month or two ago seems so scary now. The simple answer is - we are afraid the market is going to fall even more!

That was probably the same fear that prevented us from buying on December 24, 2018. “Oh it’s so low but if I invest now it could go down further.” Well, it didn’t. That was as good as it got. And now there is a chance to try for it again.

At some point, there will be a bottom to the market. We will never know it’s the bottom at the time but after the recovery we will say the same thing we always do, “if only I could have invested then!”

Here is another chance. Don’t forget, the stock market time machine only takes so many trips back.