Let’s check out UnitedHealth Group today:

UNH is solid across the board with the most relative weakness in valuation. It honestly could be easy to mistake the growth of the company with something more akin to a tech stock than a healthcare stock:

That increase in valuation has been justified from a revenue perspective:

As the price-to-sales ratio has only grown modestly over the last ten years:

In terms of profit, things have been a little choppy lately:

Because of that, price-to-earnings has jumped in the last few quarters:

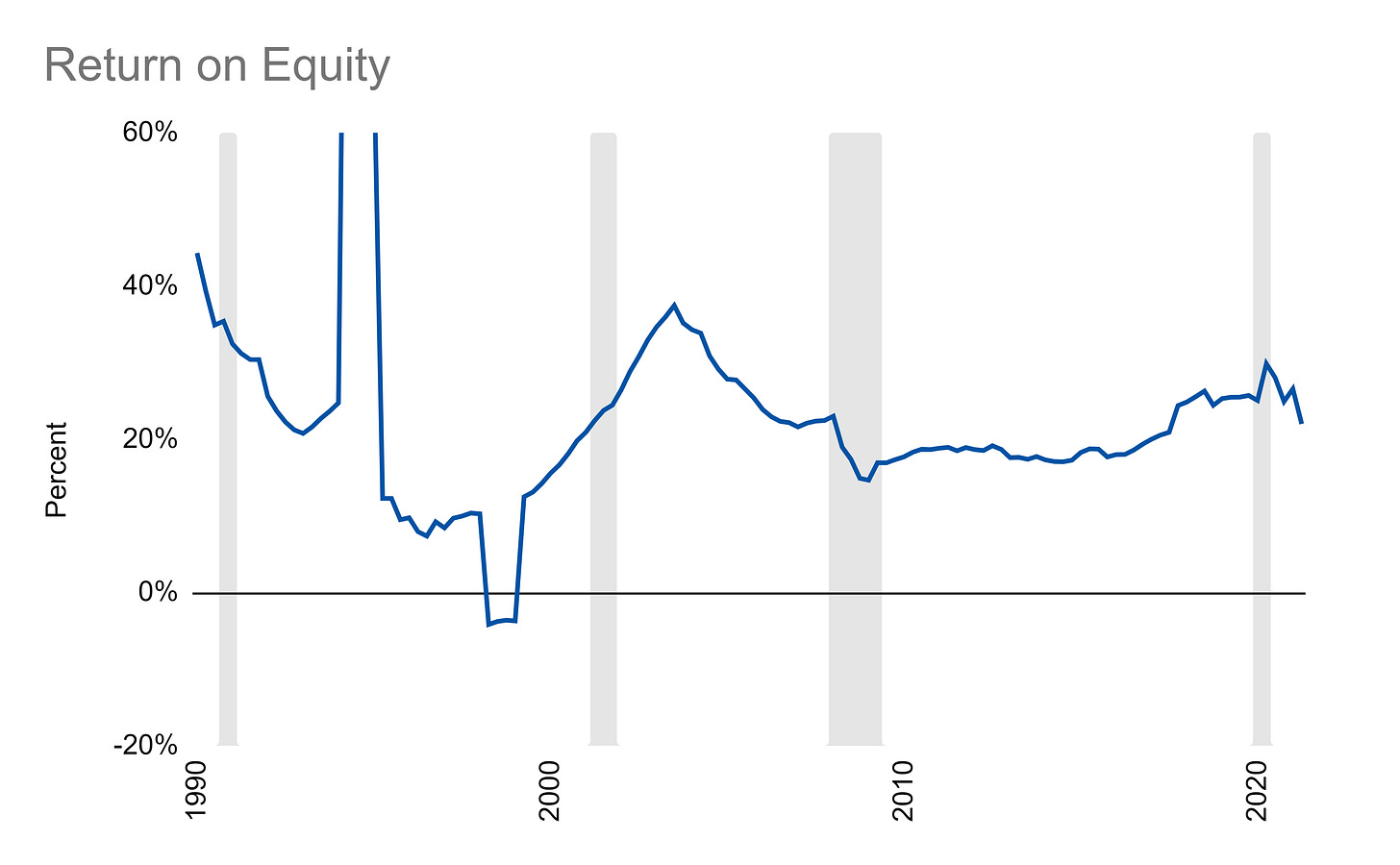

However, profitability has been fairly steady:

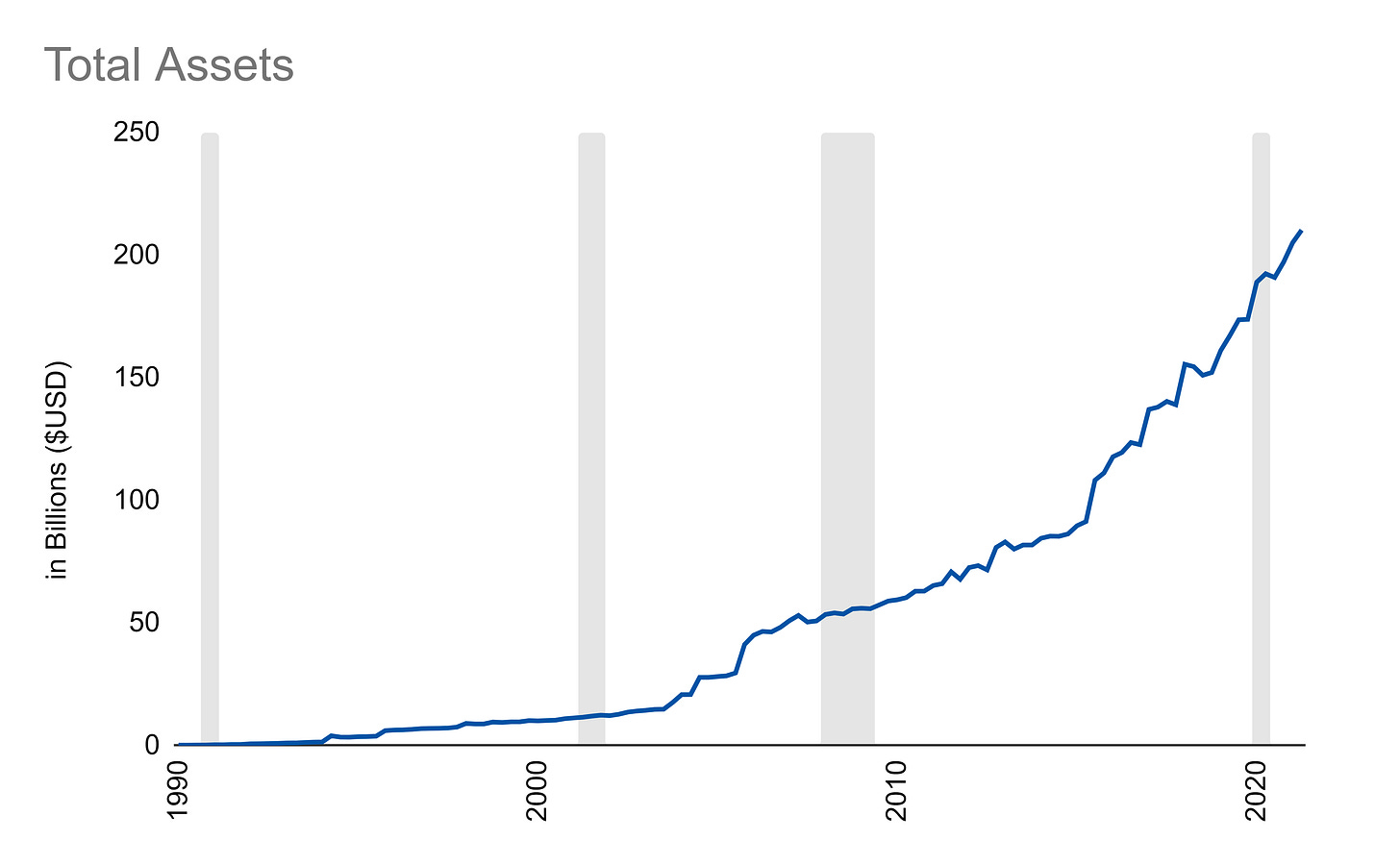

The balance sheet has grown along with market capitalization:

Unfortunately, asset growth has outpaced revenue growth to some extent:

Though the return on those assets has been fairly uneventful in terms of change:

Overall, these are solid numbers, especially for a stock that is so large but then rarely talked about when compared to the likes of big tech. UNH is definitely a company to analyze if one is looking to dig deeper in the healthcare sector.

Have a question you want to ask or a topic you’d like to see covered? Let me know!

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000

this is a great post. the market cap chart's almost vertical rise over the past couple of years definitely made me go "hmm"... and the PE definitely looks rich now considering I am not sure where the new high growth areas of revenue+profit would be for a company of this size going forward