What characteristics make a good stock?

A new series on fundamentals

Now that we know that picking ETFs at random is worse than picking random individual stocks, we want some systematic way to bucket “good” stocks versus “bad” stocks so we can see if there are any characteristics that make them “better” from a fundamental perspective. This will take a few posts, so let’s just start with what our buckets look like:

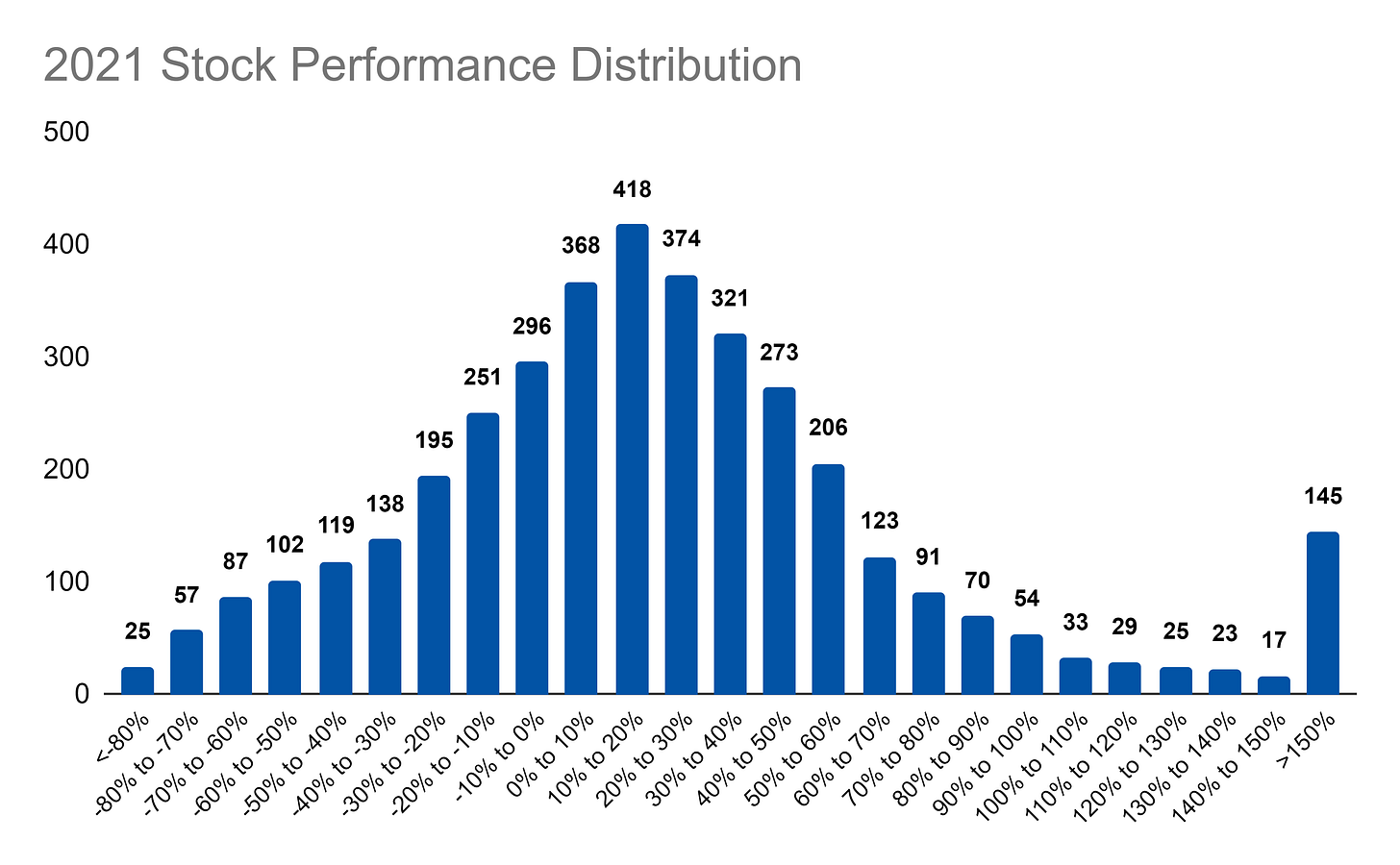

There’s a really interesting distribution for returns in 2021 and it’s tempting to want to analyze at this granularity (particularly for the stocks that outperformed with >150% return). However, in some initial analysis, this many buckets of performance was detrimental to analysis as it introduced some noise. Ten buckets is a more reasonable approach to grouping performers:

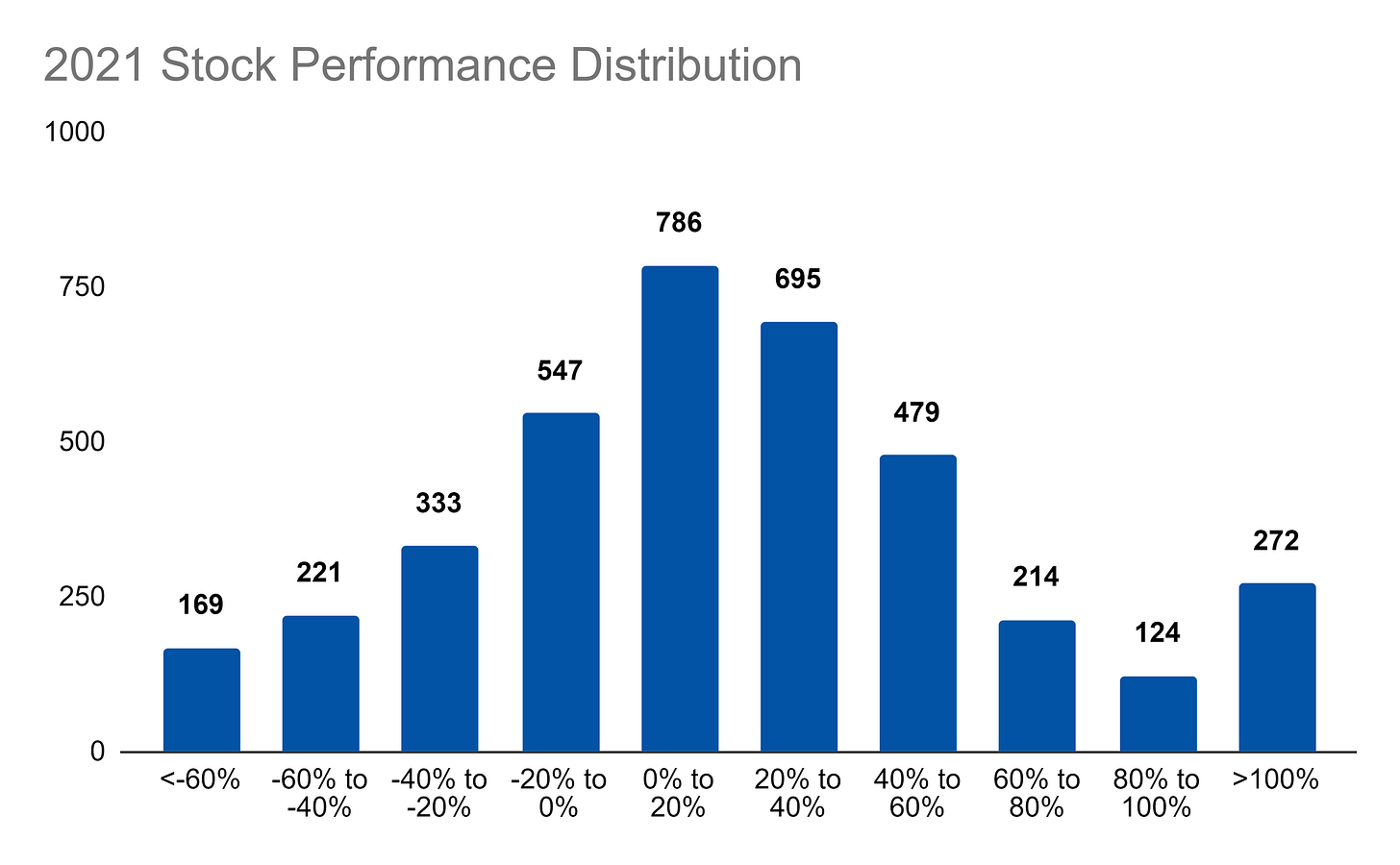

We still see the skew of stocks that did well (>100%) here and that will be interesting to assess. We also have a nice shape for our distribution of returns. In the next few posts, we will look at some financial ratios for these buckets to see if we can see any patterns emerge about the companies that did well or not in 2021.

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000