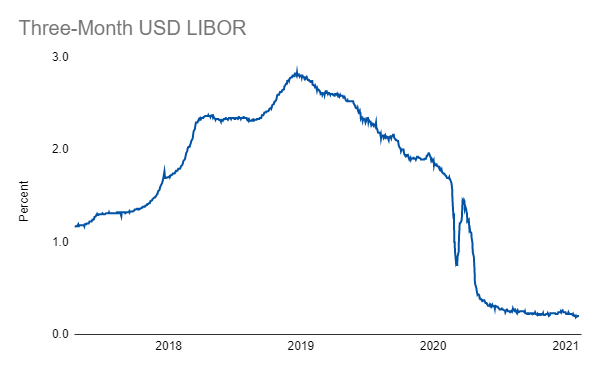

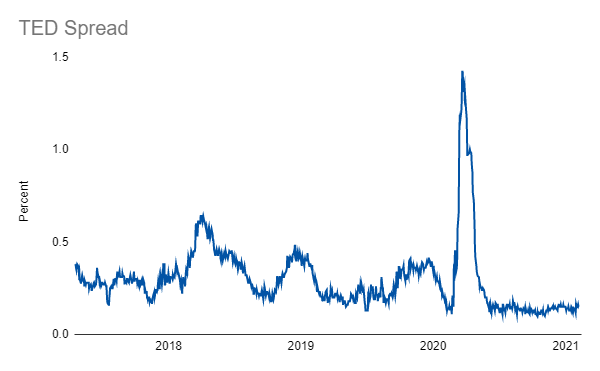

Continuing with the theme of building out live data from yesterday, I’ve got three more daily charts for rates. LIBOR, while soon to be phased out, is perhaps the most important rate out there. The three-month treasury bill captures the short-end of the yield curve. And the TED Spread, which is just the difference between the two, is a great indicator for stress.

Three-Month Treasury Bill (Secondary Rate)

You can find all three of these metrics in the links below and they will be updated automatically on a daily basis!

Links

Yesterday’s Post | Most Popular Posts | All Historical Posts | Contact

Portfolios

Main Portfolio | Wild Stuff | Shiny Stuff | Safe Stuff | Big Stuff | Random Stuff

Live Charts

Tracking Portfolio Performance | “Wild Stuff” Constituents | “Shiny Stuff” Constituents | “Safe Stuff” Constituents | Ten-Year Treasury Less Two-Year Treasury | Ten-Year Breakeven Inflation Rate | S&P 500 | Three-Month USD LIBOR | Three-Month Treasury Bill (Secondary Rate) | TED Spread