There are a few ways to determine a recession. One is to wait until a bunch of smart economists officially say it’s a recession (this is done by the NBER and can take months from the actual start of a recession to be announced). The second is to use a heuristic, such as two consecutive quarters of negative real GDP. A third way is to use your gut, “well it just feels like a recession don’t it?”

Using your gut is quick but isn’t very accurate. Using a heuristic is easy but not robust. Waiting for economists to get their act together is accurate but not timely.

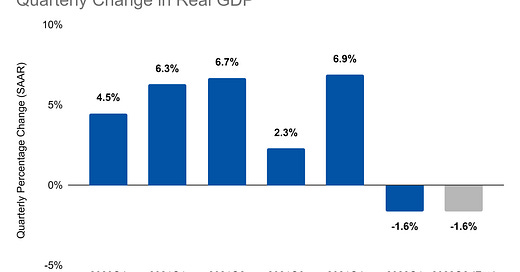

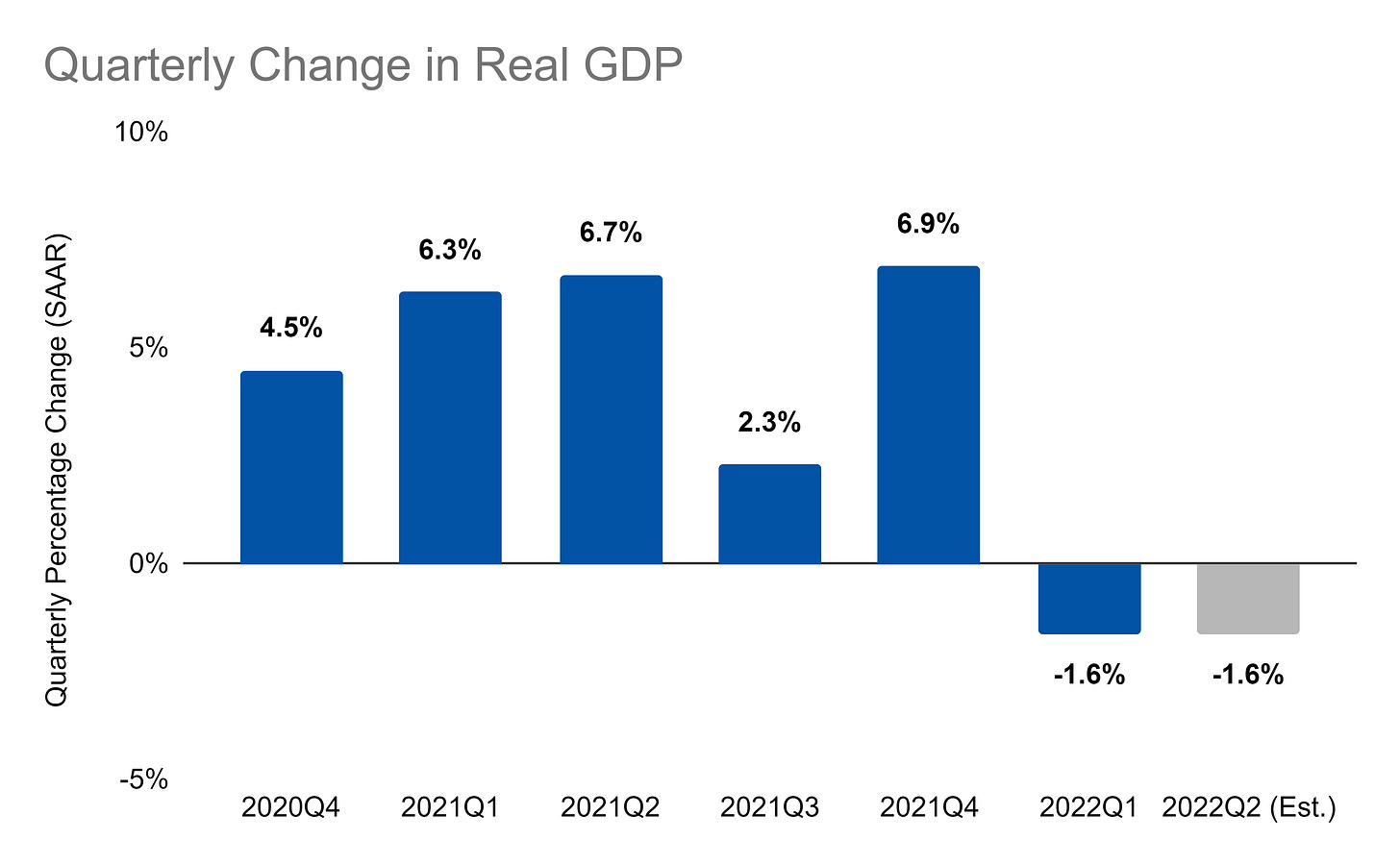

Plenty of people would say we are in a recession right now. And, we may just get confirmation from a heuristic perspective as well:

Official GDP numbers don’t come out for a bit but my most trusted early estimate comes from GDPNow and is decidedly negative.

Now, just because real growth is negative for two quarters it doesn’t mean the NBER will look back on this time and call it a recession. We have to consider other factors like unemployment.

But, at the end of the day, does it really matter? All three methods have their strengths and weaknesses. Perhaps the answer of whether we are in a recession or not is merely a collective figment of our economic imagination and up to the interpretation of the beholder!

Does a binary yes or no truly matter or does it distract us from more important questions, like why growth is negative in the first place, what impact does that have, and what does it mean going forward? These are harder questions to ask but are a lot more valuable to investigate than working ourselves up over whether or not we are in a recession.

IMO its not a real recession until you start seeing unemployment over 6-7%. The current "recession" is merely an artifact of us printing less money and raising interest rates, not a true contraction of the economy.

This is an excellent explanation of the dreaded GDP/recession obsession that keeps the talking heads on TV occupied. I was listening to an NPR Planet Money podcast where an ex-NBER analyst was on and he went as far as saying that it could be several years after a recession that it would be declared a recession. The reason being that it is not within their remit to provide time-sensitive info.

And as you elude to, with unemployment (in the US) a such a low level (statistically zero), how could you "declare" a recession?

I'm definitely in the camp that if it feels like a recession, then it is a recession!