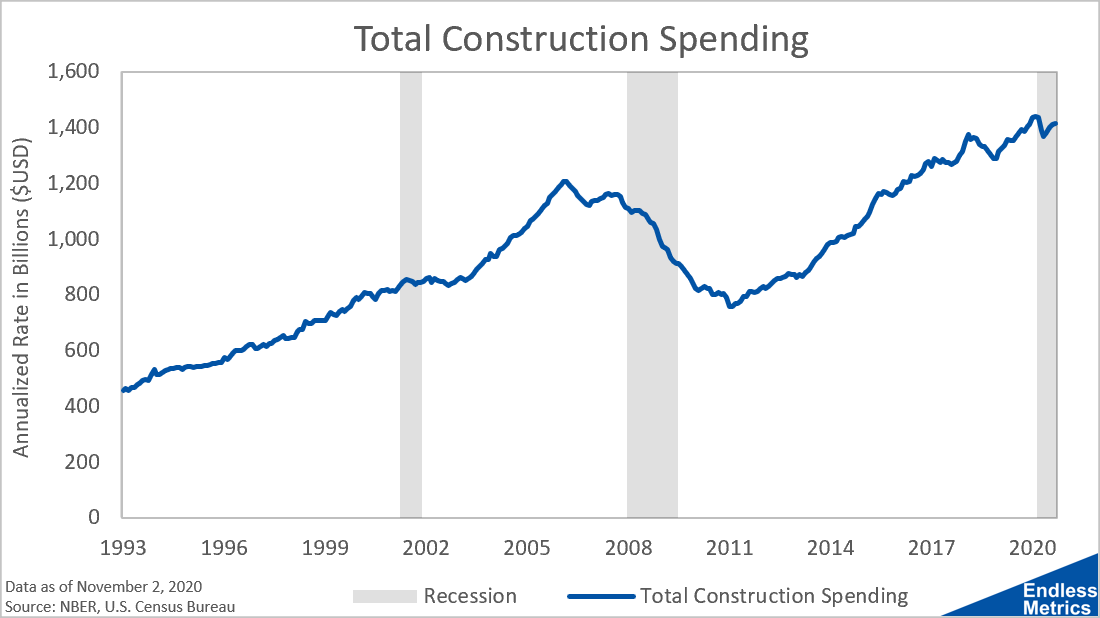

One of the hardest hit industries in the Great Recession was construction. In fact, it was actually a leading indicator, as construction spending peaked about two years before the recession really began:

It took almost a decade before construction spending got back to the previous peak. It was about five years of downturn and five years of recovery.

In the current recession, we had about one month of downturn and one month of recovery. We are back on track! Construction is doing well this time around.

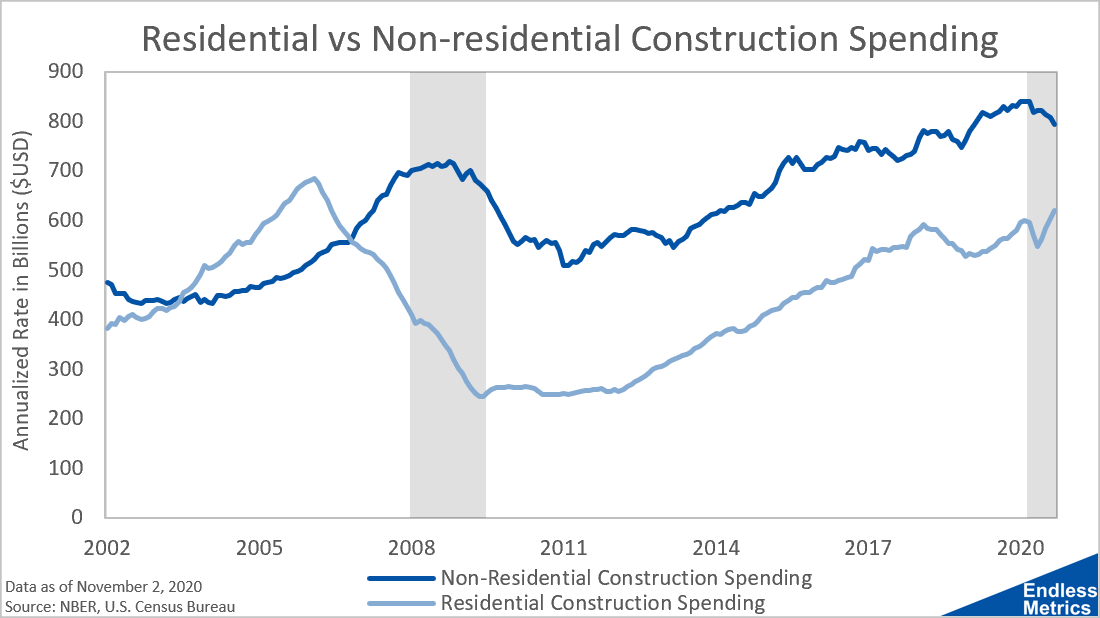

The story is a little more complicated if you dig beneath the surface between residential and non-residential construction (see the chart in “more metrics”) but construction feels kind of like the banking industry in terms of now versus then. What I mean is, banks and housing were super problematic in the last recession and, this time around, are a source of resilience. The bad guys became heroes. At least for now.

More Metrics

Going beneath the surface, the two main categories of spending are diverging slightly but offsetting each other overall

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact