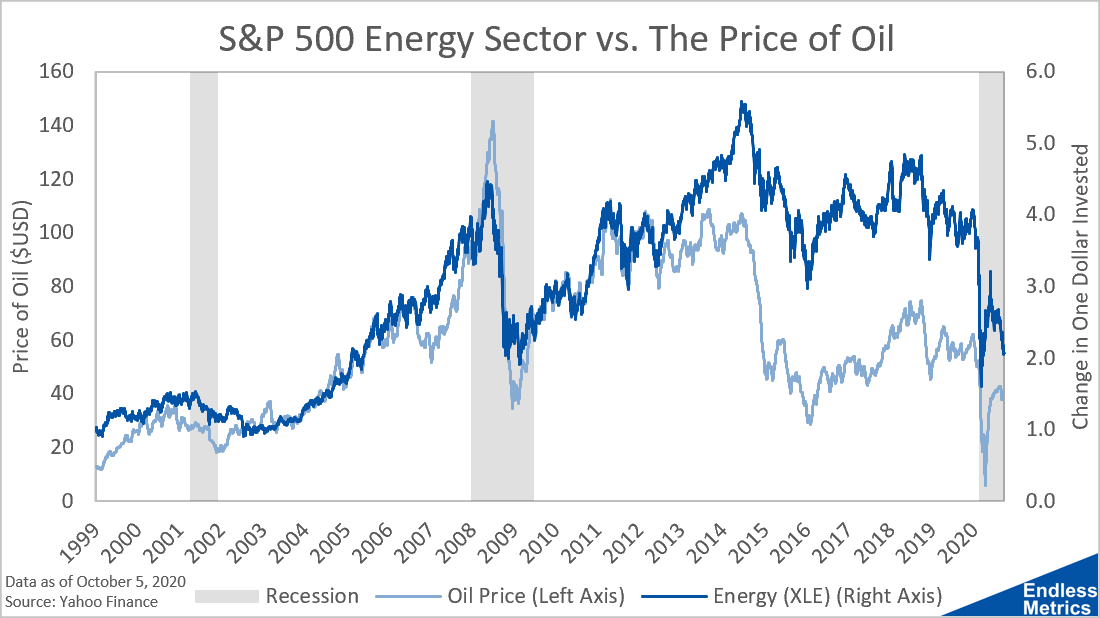

While renewables may be considered the future, the energy sector of the S&P 500 is still tied down to the price of oil:

In the finance world, where data can be noisy and strong relationships can be hard to find, that’s a pretty clear relationship!

One consequence of this chart is that average investors probably don’t need to allocate funds toward energy ETFs like USO. If you have exposure to the broader S&P 500, you essentially already have oil exposure. You don’t need a complicated ETF that will way you alive on fees.

More Metrics

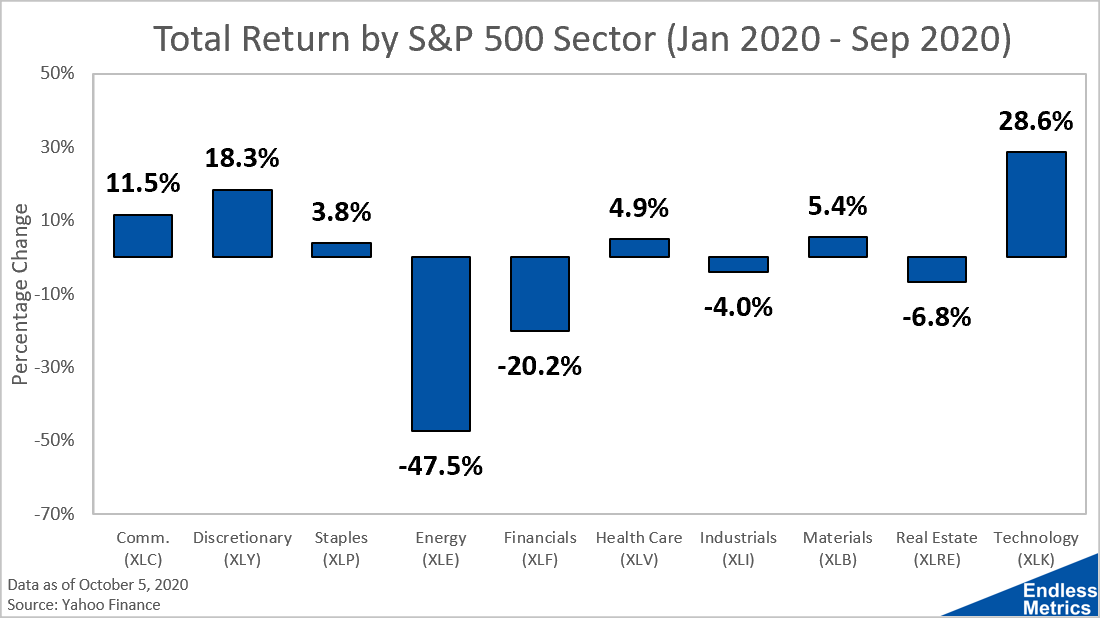

The energy sector has done terribly since the beginning of the year

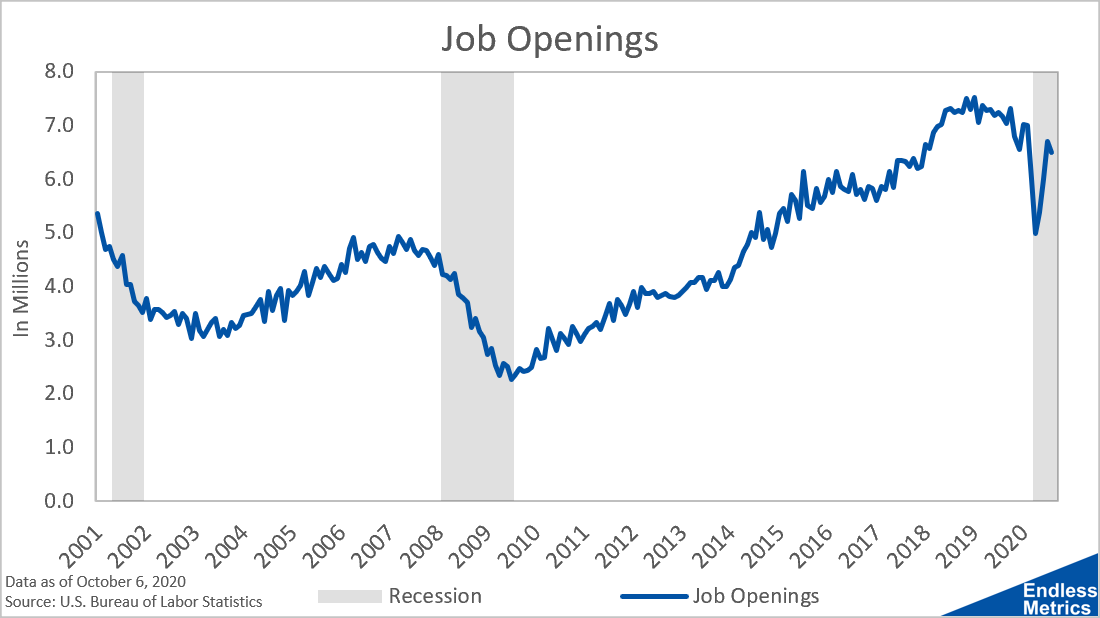

Job openings ticked down last month, suggesting a continuation of the downtrend

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact Me

Enjoying the content?

If you want to help support my crazy dream to one day write about the markets full time and produce even more endless metrics, maybe you could sign up for ongoing content (if you haven’t already) or sign up a friend. Don’t worry - you can cancel whenever you decide you’re bored or need an inbox cleanse. I don’t take it personally!