Picking Random S&P 500 Stocks

How do the results of a random strategy change if we limit our scope of selection?

Yesterday, we looked at the return we would have gotten in 2021 if we picked a portfolio of random stocks. Trouble is, there are a lot of not-so-good stocks out there to pick from. How would the results of our analysis change if we confined our pick to a smaller selection of more robust companies as defined by their inclusion in the S&P 500 index?

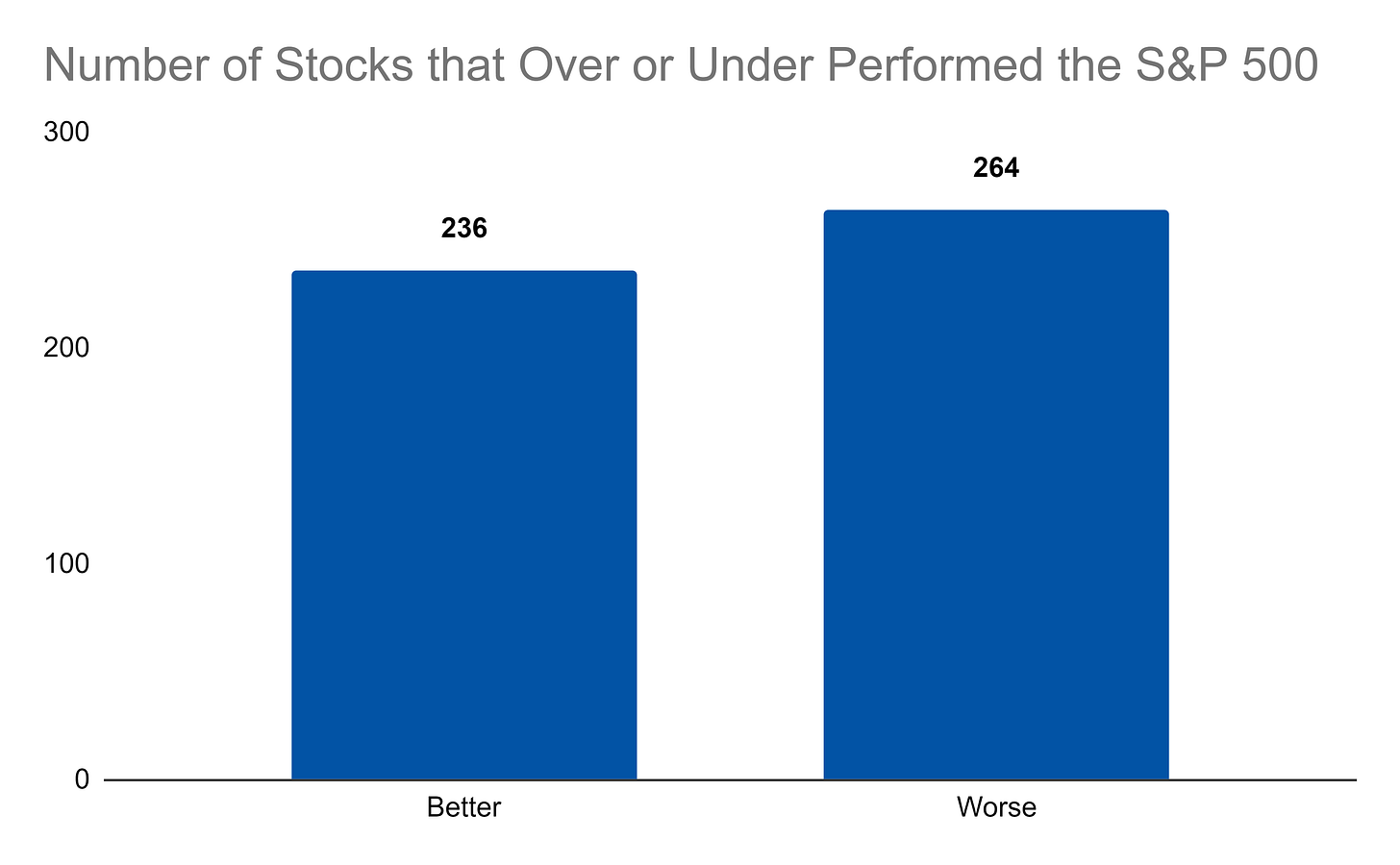

Well, to start, the performance of those companies is more balanced from an over and under performance perspective:

This means, if you picked a stock from the index at random, you’d almost get a coinflip odds of choosing a company that would outperform the entire index:

Also, your downside in the 10th percentile isn’t even that bad (a relatively minor -6%) and your upside is solid:

Now, if we made a bunch of portfolios with different numbers of randomly chosen S&P 500 companies, our average performance doesn’t change:

However, the chance of outperforming the S&P 500 goes up:

How is this possible, when we saw yesterday that the odds of outperforming for the total stock universe was so much lower? Well, first the odds of picking an outperforming stock are closer to 50/50 but also the average excess return of outperformers is much larger and the average loss from an underperformer isn’t as detrimental. In 2021, then, you would’ve been better off picking more stocks to equally invest in for a portfolio.

The potential downside mitigation of even just a few stocks is also huge:

And, you don’t even pay that big of a price in terms of upside dampening:

What these results show us is that it is possible to pick from a basket of better stocks to improve the odds and statistical outcome composition of our performance. “Better” is a nebulous word at the moment but right now just means a stock that is in the S&P 500. We will do more analysis on what these outperforming companies look like from a metric perspective but, before that, we will look at some ETF performance.

Links

Most Popular Posts | All Historical Posts | Main Site | EM100 | EM1000