Reviewing Last Week’s Market Performance

Stocks, Bonds, Gold, Bitcoin, Industry Sectors, Value and Growth

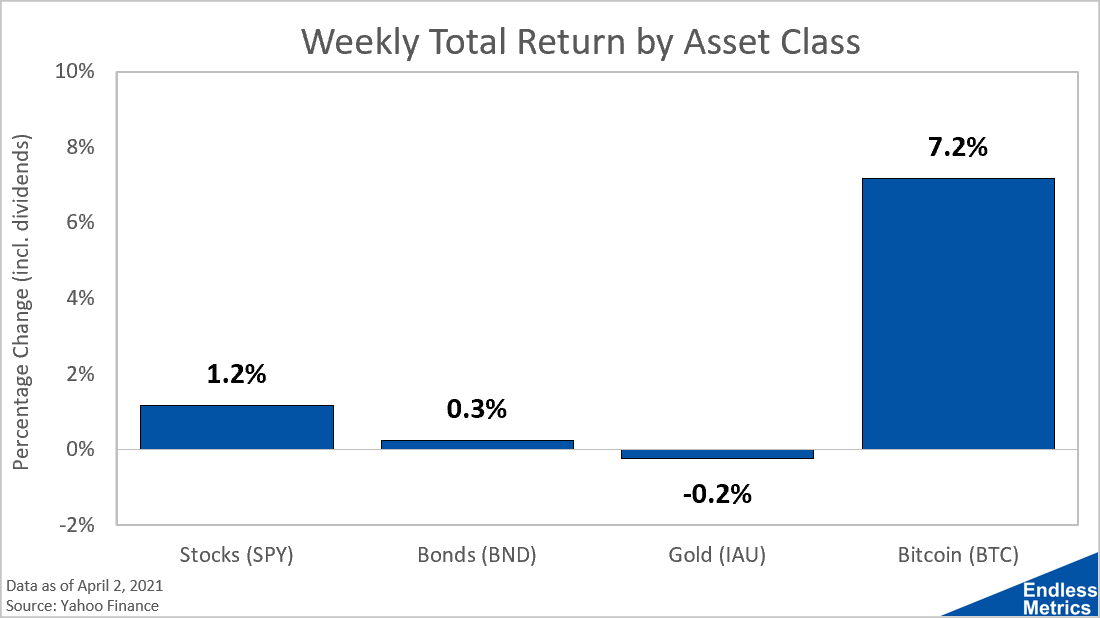

It was a pretty solid week across the board, though gold slipped a bit:

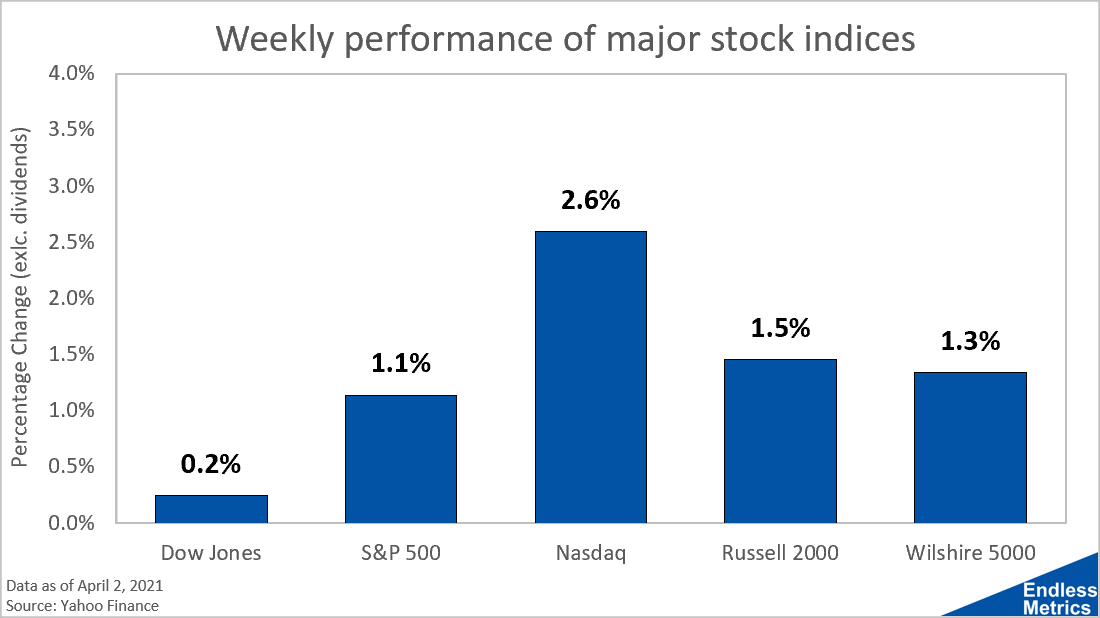

Tech looked really solid:

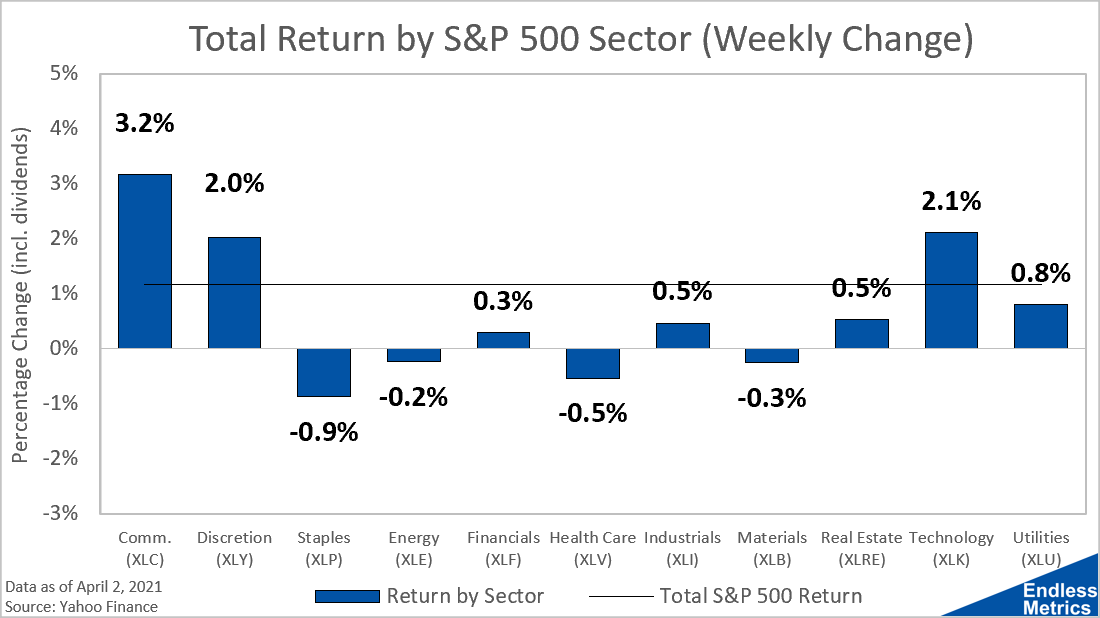

Communication did the best but…that’s also tech (e.g. Google, Facebook, Netflix):

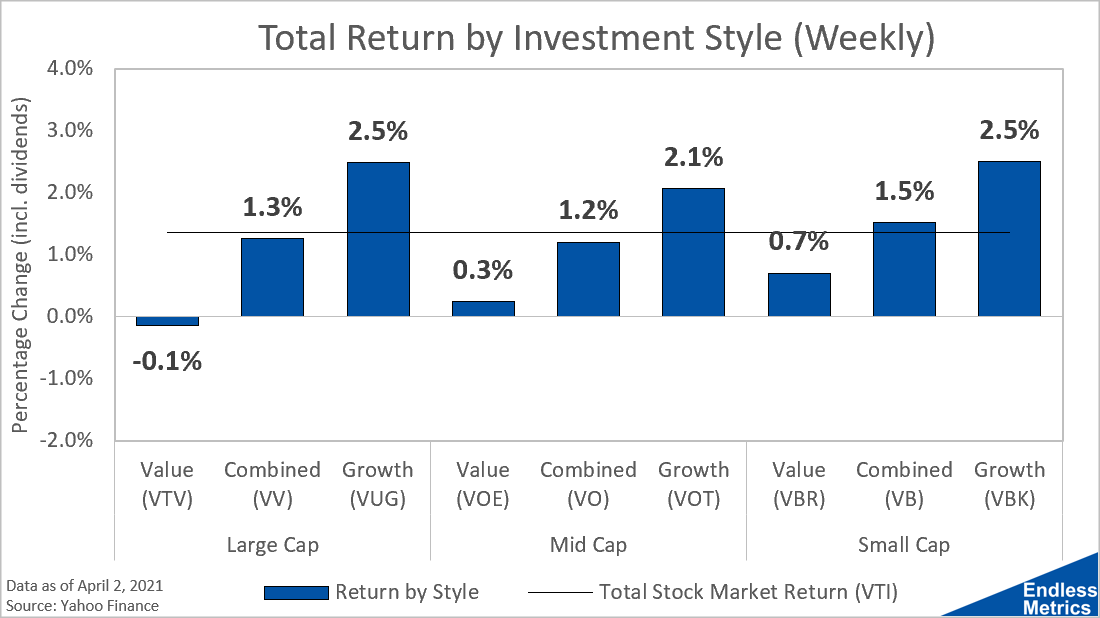

And, with the strong showing in tech, it’s not surprising to see growth do well:

A nice short week to end the month and quarter. I’ll run down performance by those time periods over the next two days to take a broader look at how the market’s been performing. Hard to believe 2021 is already a quarter done!

Links

Yesterday’s Post | Most Popular Posts | All Historical Posts | Contact

Tracking Portfolios

Overall Comparison | Wild Stuff - Chart | Shiny Stuff - Chart | Safe Stuff - Chart | Big Stuff - Chart | Random Stuff - Chart

Live Charts

Ten-Year Treasury Less Two-Year Treasury | Ten-Year Breakeven Inflation Rate | S&P 500 | S&P Rolling All-Time High | S&P 500 Drawdown | S&P 500 Rogue Wave Indicator | S&P 500 Moving Averages | S&P 500 / 200-Day Moving Average | S&P 500 / 50-Day Moving Average | S&P 500 50-Day Moving Average / 200-Day Moving Average | S&P 500 Relative Strength Index | CBOE Volatility Index (VIX) | Three-Month USD LIBOR | Three-Month Treasury Bill (Secondary Rate) | TED Spread | Price of Bitcoin | Bitcoin Rolling All-Time High | Bitcoin Drawdown | Bitcoin Rogue Wave Indicator | Nasdaq Composite Index | Nasdaq Composite All-Time High | Nasdaq Composite Drawdown | Nasdaq Composite Wave Indicator | Nasdaq Composite Moving Averages | Nasdaq Composite / 200-Day Moving Average | Nasdaq Composite / 50-Day Moving Average | Nasdaq Composite 50-Day Moving Average / 200-Day Moving Average | Nasdaq Composite Relative Strength Index | Moody's Seasoned Aaa Corporate Bond Yield | Moody's Seasoned Baa Corporate Bond Yield | Moody’s Aaa less Baa Corporate Bond Yield | Dow Jones Industrial Average | Dow Jones Transportation Average | Dow Jones Industrial Average / Transportation Average