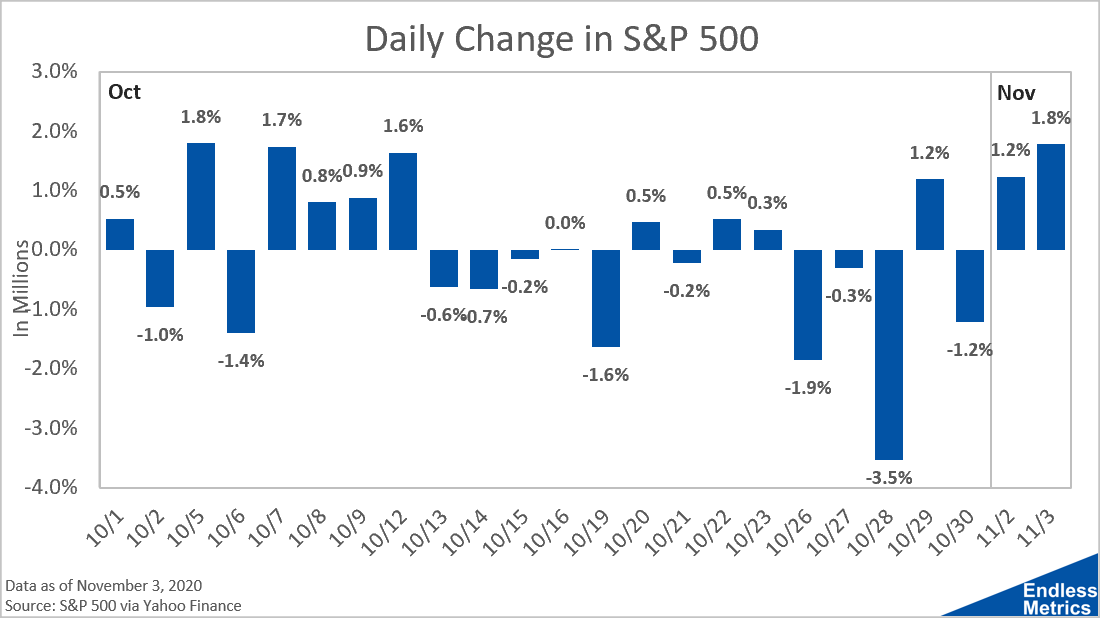

Uncertainty, as they say, is bad for markets. The election brings uncertainty. So, markets should be behaving badly…or, so goes the narrative. Well, the last two days have been pretty good for the market:

If you read some financial news the last two days, you might have seen something like, “stocks rise as the market shrugs off election worries.” The only thing markets are shrugging off is commentator’s attempts to apply a narrative to day-to-day volatility.

Narratives greater than a day are somewhat more plausible. I could get on board with the idea that markets tanked last week and now they are making back some of that sell off and that it is generally related to the election (and spiking coronavirus cases).

But, it’s also related to an endless number of other variables. It’s also got an element of randomness. Oh well, it won’t stop people (including myself) from trying to apply simple reasoning to the incredibly complicated system of financial markets.

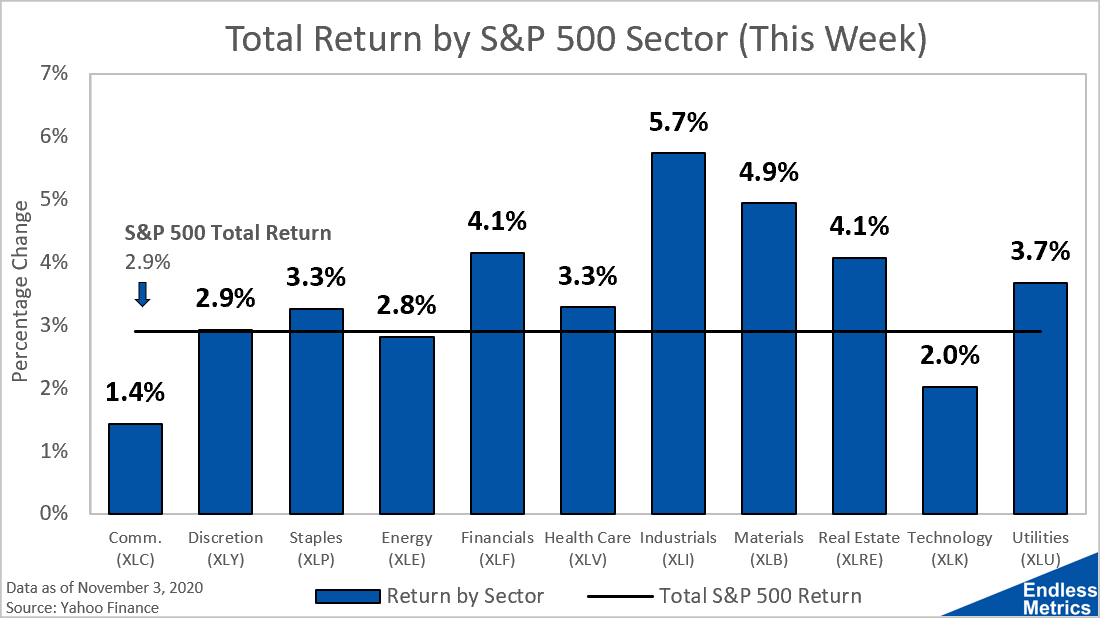

In terms of this week’s rally, I will say though, it has been pretty broad:

Surprisingly, tech has lagged a little bit. But, that could just be short-term noise. We all know how well tech has done the last year. So, I’m not going to overanalyze two days of data.

More Metrics

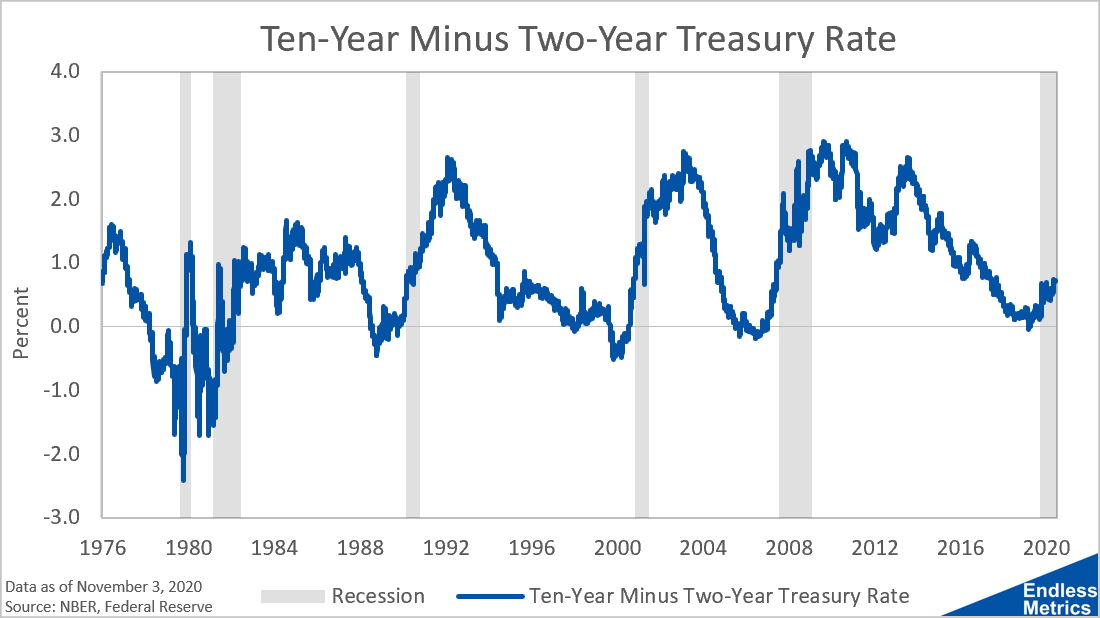

The yield curve continues steepen, consistent with prior post-recession recoveries:

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact