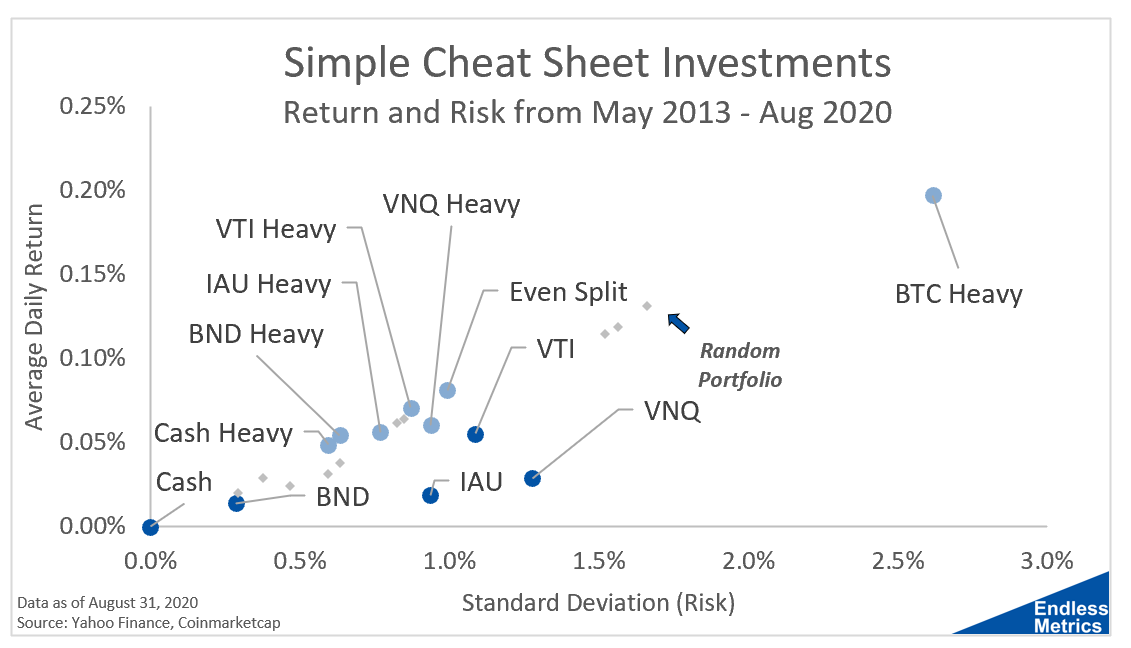

When we made some simple portfolios using our investment cheat sheet, we saw that we did quite a bit better than any investment on a stand-alone basis. To pick those portfolios, we made one that was equal weighted and six that had a heavy allocation toward one investment.

But, what if we didn’t care about using our brains? What if we just blindly threw darts at the return and risk scatter plot and picked feasible portfolio allocations at random? That kind of feels like gambling at a casino, which is why that method is named after the famous casino - Monte Carlo Simulation. Let’s generate ten random portfolios using this approach and see what happens:

I didn’t make those small grey dots hard to see just to be evil - there is a purpose that we will see in the next post. But, for now, just squint really hard and look at where the ten random dots landed.

Even though we just randomly picked ten portfolios, they actually look quite good! They all pretty much dominate the single investment portfolios. That’s how powerful diversification can be. You can be a total idiot and just invest randomly, as long as it’s in different diversified investments, and get a really nice portfolio. So, even people like me can succeed!

The problem with gambling though, is knowing when to stop. With this analysis, I can’t help but wonder what would happen if we gambled on more than just ten portfolios. So, we will do some more Monte Carlo in the next post!