WHAT

The fourth worst single-day Dow drop...ever

We are witnessing history.

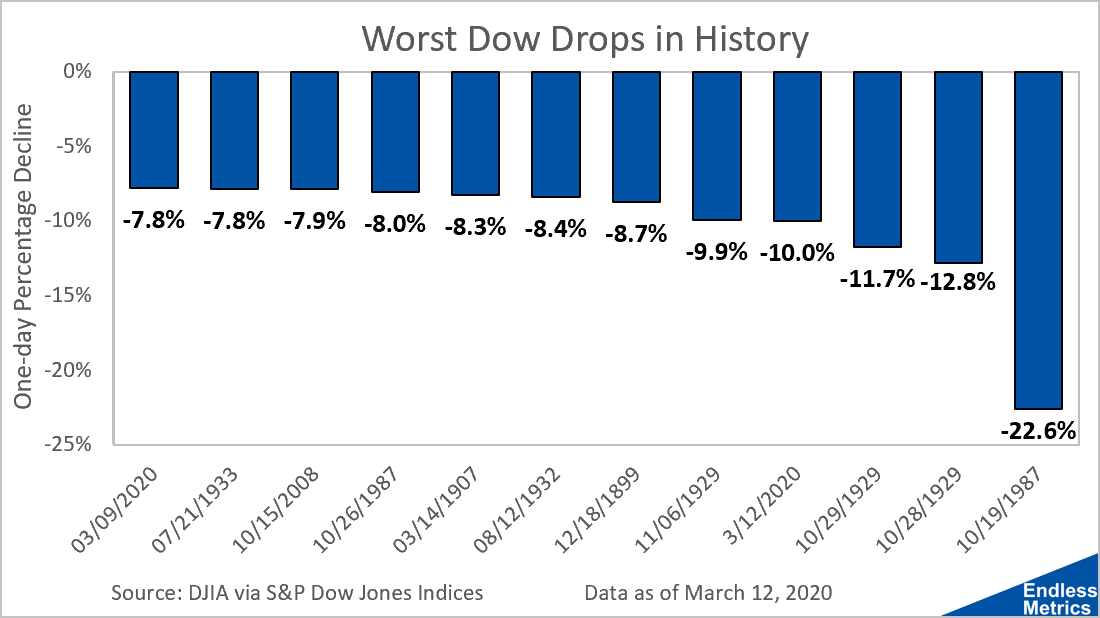

The market closed down -9.99% yesterday. That makes it the fourth worst single-day drop ever for the Dow. This comes just three days after the -7.8% drop on Monday. Since I just wrote about some of these losses just a few days ago, I’ll keep my thoughts brief.

What we are seeing in the market is almost a hybrid of 2008, 1987, and…yes, even 1929. The way markets are seizing up and demanding monetary and fiscal intervention is becoming more and more similar to 2008. The speed of the collapse is similar to 1987. And, in the same way we have had massive almost back-to-back drops is reminiscent of the two infamous days in late October 1929.

Unlike those events however, I’m not sure anyone saw this coming. With the other events, there were at least a few voices of caution prior to the event. Although, in a few years, I am sure some people will try to claim credit for having predicted this event ahead of time as well. (And maybe that’s how it kind of is in reality for those other events too.)

Really, the closest thing anyone could claim to have seen was a small pullback of maybe 5-10%. Not unusual stuff. But this collapse is unreal. And, it seems especially bad as the market has collapsed through technical floors that people were pointing to as support just a few days ago.

We can’t predict the future and this is a moment of great uncertainty. This is truly a historic time in the market, with few parallels and comparisons that are harder to make by the day. Since, 1896 we have seen some unbelievable events. 2020 has earned its own spot on the list and continues to climb.