The Nasdaq climbed almost 4% yesterday, which makes it the best day for the index since April 14:

Despite no winner being called in the election (i.e. uncertainty), the three-day market rally continues. If I had to make a narrative for this I would say a few things:

There will be no blue wave. So, no unified government, which means controversial market-unfriendly items like capital gains tax increases are unlikely to be passed. In fact, overall, very little action is likely to be done at all in the next few years without unified government branches.

Whoever wins, antitrust tech action is becoming increasingly unlikely. That’s good for tech stocks.

Tech stocks dominate the indices so, when they do well, the whole market does well.

Markets tend to do well after elections, so I think some investors are trying to get in early to capture the gains, creating a self-fulfilling prophecy.

The pandemic is worsening, increasing the chances of ongoing remote lifestyles. That’s good for tech stocks.

Infrastructure spending is unlikely to happen without a big blue wave. This ties into the deficit and inflation which means rates are likely to be lower for longer. That’s good for tech stocks.

The market took a big dip last week, so some of this is just a reversal.

A lot of the nightmare scenarios for the election (e.g. civil unrest, 2000-style outcome) have not occurred…yet.

Despite no official winner, there is a lot less election uncertainty right now as compared to Monday (though there remains a small chance that could still change if the final vote counts in deciding states finish within a few hundred votes). Further, there is increasing clarity on all the other races, which matter too for overall composition of the government. So, there is really more certainty overall for the future despite it maybe not seeming that way to a lot of people.

Obviously, the “real” reason this is all happening is much more complicated but this is a good starting point for ideas. It will be interesting to see how markets play out the rest of the month and revisit these narratives to see if they still fit the market story or if other major narratives take over (e.g. market drops because of exploding domestic coronavirus cases).

More Metrics

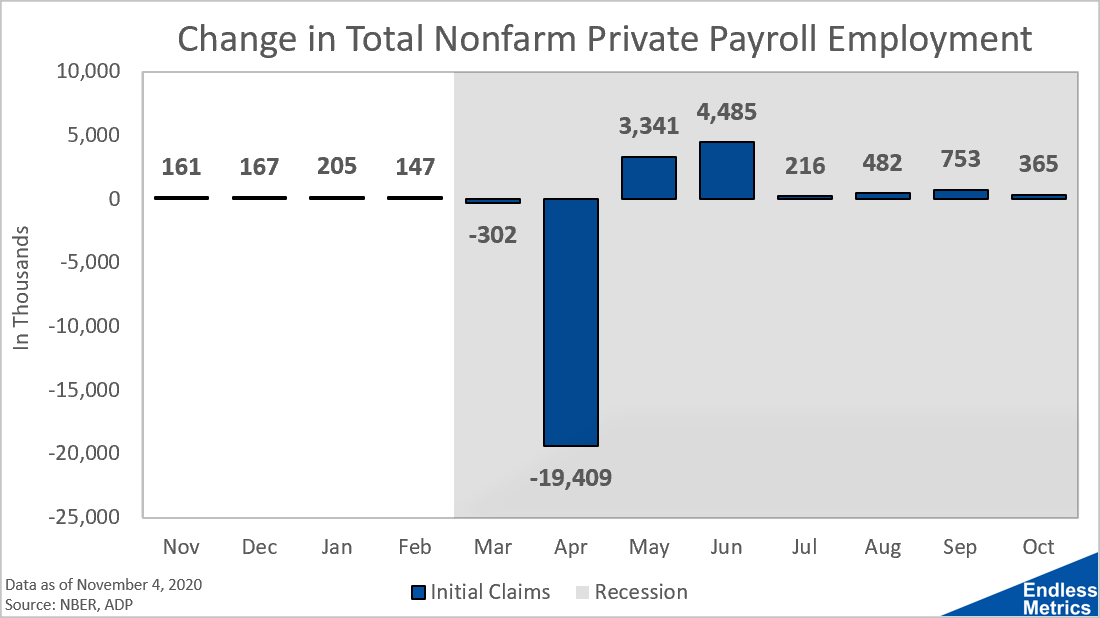

The job market continues to make gains but October wasn’t as good as September

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact

Enjoying the content?

If you want to help support my crazy dream to one day write about the markets full time and produce even more endless metrics, maybe you could sign up for ongoing content (if you haven’t already) or sign up a friend. Don’t worry - you can cancel whenever you decide you’re bored or need an inbox cleanse. I don’t take it personally!