Real estate ETFs don’t really diversify us from the stock market

Real estate is just a sub sector of the S&P 500

When we looked at an investment cheat sheet a while back, we broke out real estate as it’s own investment category. That definitely makes sense in the case where you buy physical property.

However, when it comes to funds that are meant to be real estate specific such as VGSLX, VNQ, or XLRE, are you really getting true diversification from stocks? XLRE is literally just a subset of real estate stocks that are in the S&P 500, so you’re not getting true diversification there.

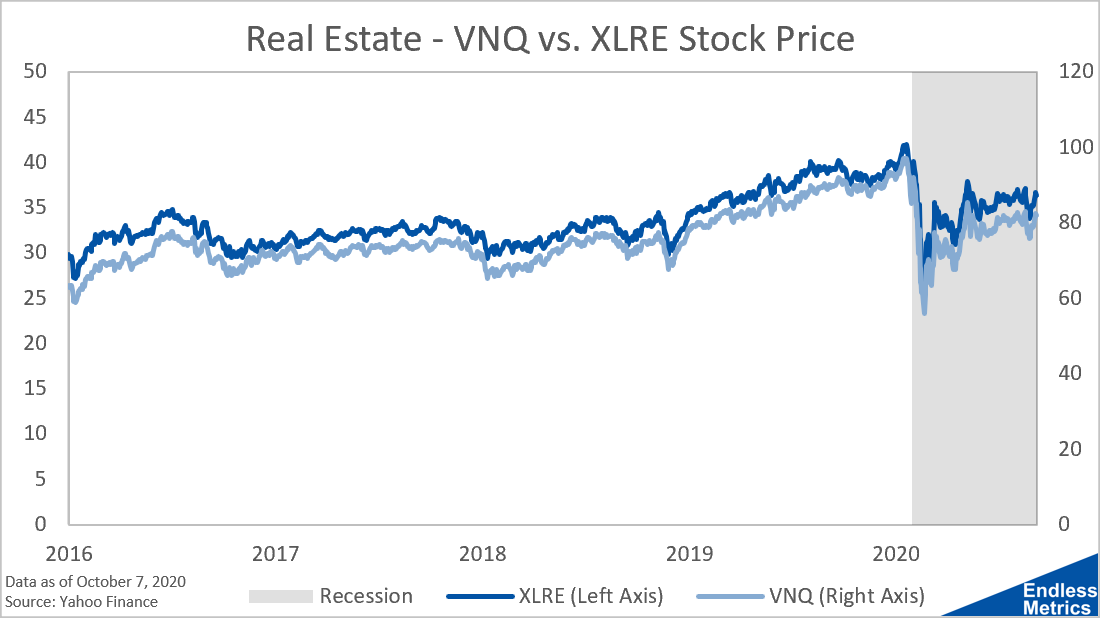

VGSLX and VNQ are highly correlated, so you could really pick one or the other to invest in even though there are two different funds. And, if we then analyze VNQ and XLRE, we see those two funds are highly correlated as well:

Whether you pick VGLSX, VNQ, or XLRE, you basically get the same investment in the grand scheme of things. XLRE is just S&P 500 stocks, so if you combined it with an investment in say SPY or VOO, you would just overweight your allocation to a set of stocks instead of providing true diversification.

Unfortunately, although real estate as an asset class helps with diversification, these funds won’t really do it. But, that’s okay. Those funds have severely underperformed from a return and risk perspective compared to stocks anyways. But that shouldn’t be a surprise now that we know those funds are really just a concentrated group of stocks in one particular industry that has done poorly the last decade!

More Metrics

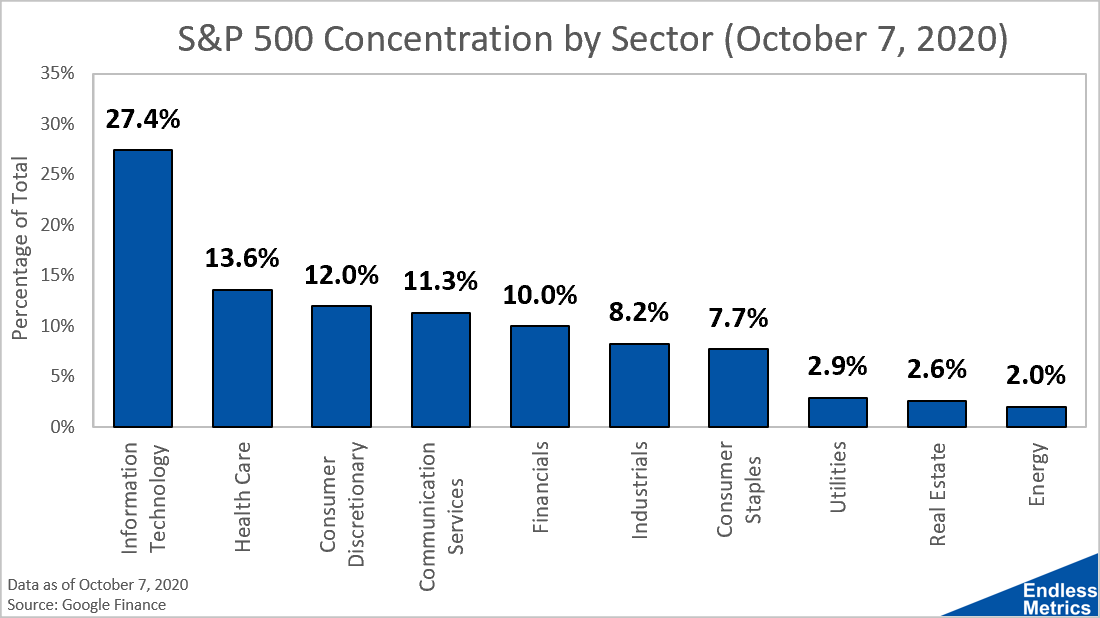

Over a quarter of the S&P 500 is concentrated in information technology

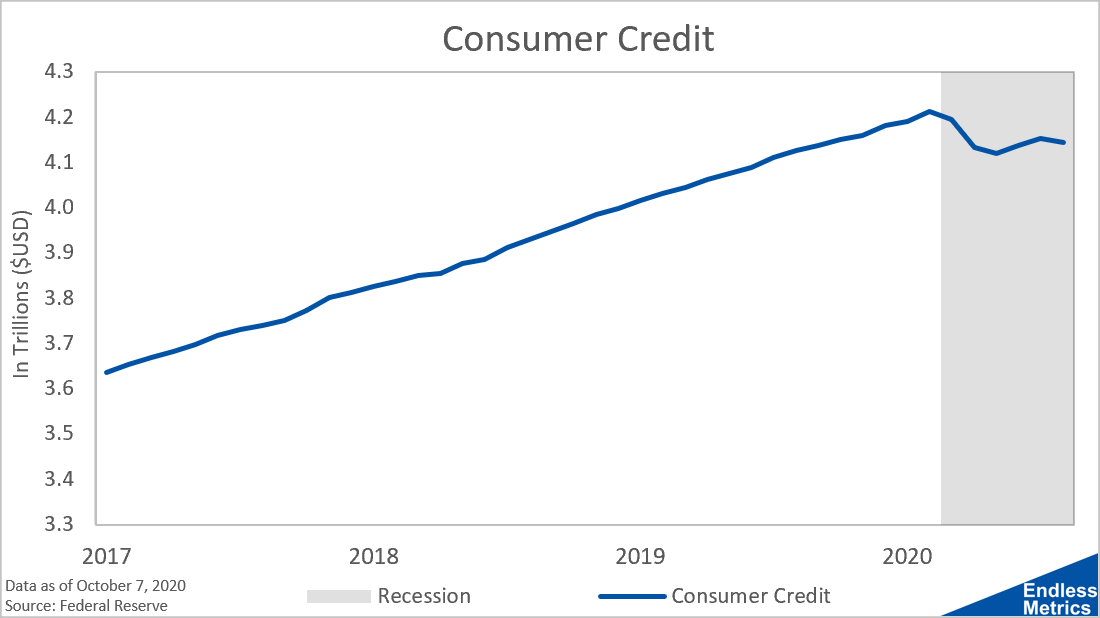

Consumer credit ticked down in August

Links

Yesterday’s Post | Most Popular Posts of All Time | All Historical Posts | Contact Me

Enjoying the content?

If you want to help support my crazy dream to one day write about the markets full time and produce even more endless metrics, maybe you could sign up for ongoing content (if you haven’t already) or sign up a friend. Don’t worry - you can cancel whenever you decide you’re bored or need an inbox cleanse. I don’t take it personally!