Recently, I made a little investment cheat sheet with some different investment categories and subcategories. But, then I decided to make it even simpler and ditch the subcategories.

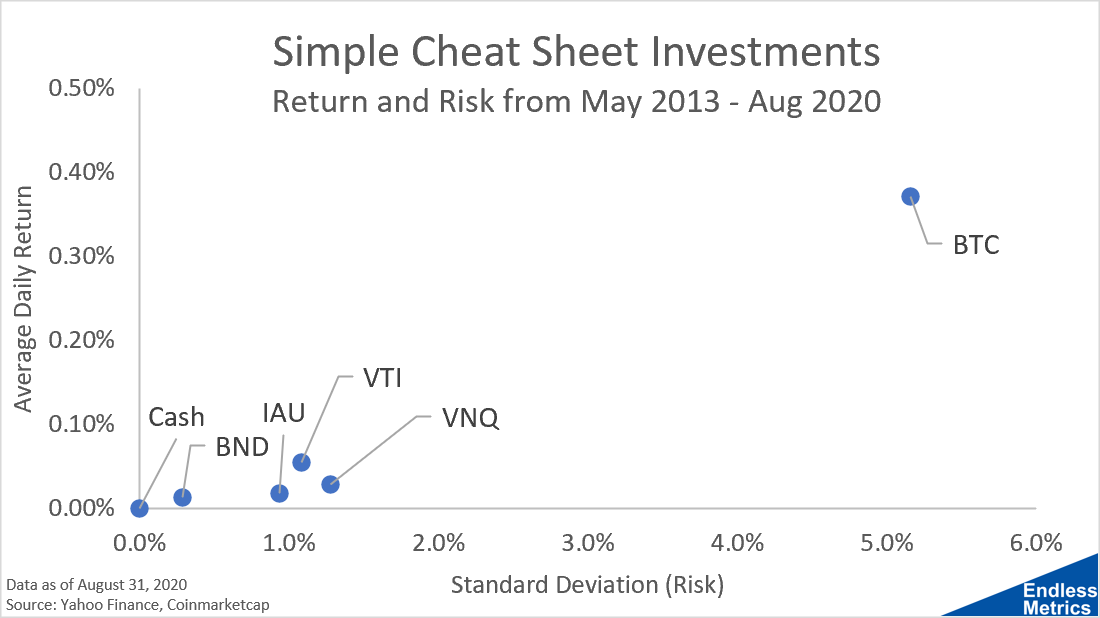

I figured it would make for better analysis to start with the most basic coverage possible, so the impact of those new categories can be more easily assessed. Let’s start by checking out the return and risk of the six main investment categories by using the suggested investment examples:

It’s pretty obvious that one investment is in a totally different ballpark. Yes, good old Bitcoin.

However, it’s not outlandishly advantageous from a combined return-to-risk perspective. It doesn’t have super high return for free or super low standard deviation with a super high relative return. It’s just out there.

Individual investments aren’t the real prize here though. What we really want are portfolios with allocations to each of these investments that will maximize the benefits of diversification. We want to be on the efficient frontier.

Trouble is, we saw how quickly the complexity of those portfolio allocation. options exploded. With just six investments and 1% allocation increments, we would need to calculate over 96 million portfolio options. If we want to add more options, we are going to run into trouble trying to brute force our way to a solution. Fortunately, there are some ways around this, which I will cover in the next few posts.